Easterly Investment Partners LLC raised its stake in F.N.B. Co. (NYSE:FNB - Free Report) by 11.5% during the third quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 905,662 shares of the bank's stock after buying an additional 93,447 shares during the period. F.N.B. comprises about 1.0% of Easterly Investment Partners LLC's investment portfolio, making the stock its 28th biggest position. Easterly Investment Partners LLC owned 0.25% of F.N.B. worth $12,779,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

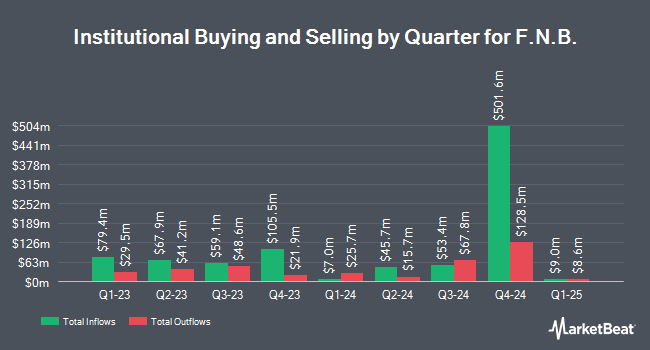

A number of other institutional investors have also recently made changes to their positions in FNB. BNP Paribas Financial Markets increased its holdings in shares of F.N.B. by 25.2% in the 1st quarter. BNP Paribas Financial Markets now owns 36,509 shares of the bank's stock worth $515,000 after buying an additional 7,344 shares during the last quarter. Janney Montgomery Scott LLC increased its holdings in shares of F.N.B. by 5.1% in the 1st quarter. Janney Montgomery Scott LLC now owns 60,472 shares of the bank's stock worth $853,000 after buying an additional 2,914 shares during the last quarter. Texas Permanent School Fund Corp increased its holdings in shares of F.N.B. by 1.3% in the 1st quarter. Texas Permanent School Fund Corp now owns 314,043 shares of the bank's stock worth $4,428,000 after buying an additional 4,066 shares during the last quarter. Susquehanna Fundamental Investments LLC bought a new position in shares of F.N.B. in the 1st quarter worth $600,000. Finally, Sei Investments Co. grew its holdings in shares of F.N.B. by 5.8% during the 1st quarter. Sei Investments Co. now owns 1,341,044 shares of the bank's stock valued at $18,909,000 after purchasing an additional 73,016 shares during the last quarter. Institutional investors own 79.25% of the company's stock.

Analysts Set New Price Targets

Several equities analysts recently commented on FNB shares. StockNews.com raised shares of F.N.B. from a "sell" rating to a "hold" rating in a report on Monday, October 21st. Stephens increased their target price on shares of F.N.B. from $16.00 to $18.00 and gave the company an "overweight" rating in a report on Monday, October 21st. Finally, Piper Sandler reaffirmed an "overweight" rating on shares of F.N.B. in a report on Friday, October 18th. Two investment analysts have rated the stock with a hold rating and five have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Moderate Buy" and a consensus target price of $16.33.

View Our Latest Analysis on F.N.B.

F.N.B. Trading Up 0.5 %

F.N.B. stock traded up $0.08 during trading hours on Friday, reaching $16.14. The stock had a trading volume of 1,787,613 shares, compared to its average volume of 2,236,248. The stock has a market cap of $5.80 billion, a PE ratio of 14.73 and a beta of 0.95. F.N.B. Co. has a 52 week low of $10.98 and a 52 week high of $16.76. The company has a debt-to-equity ratio of 0.40, a current ratio of 0.93 and a quick ratio of 0.92. The company has a fifty day simple moving average of $14.31 and a 200-day simple moving average of $14.04.

F.N.B. Company Profile

(

Free Report)

F.N.B. Corporation, a bank and financial holding company, provides a range of financial products and services primarily to consumers, corporations, governments, and small- to medium-sized businesses in the United States. The company operates through three segments: Community Banking, Wealth Management, and Insurance.

Read More

Before you consider F.N.B., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and F.N.B. wasn't on the list.

While F.N.B. currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.