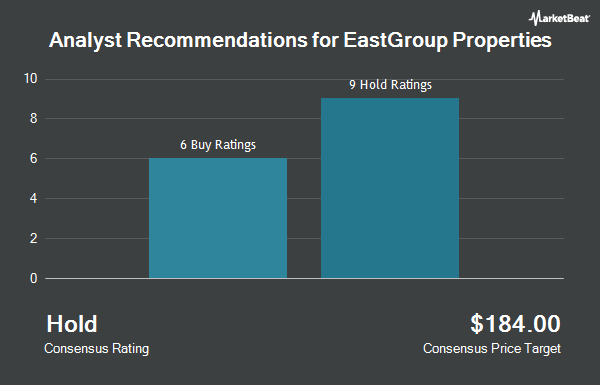

Shares of EastGroup Properties, Inc. (NYSE:EGP - Get Free Report) have been given an average rating of "Moderate Buy" by the fifteen research firms that are presently covering the stock, MarketBeat Ratings reports. Seven research analysts have rated the stock with a hold recommendation, seven have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12 month target price among analysts that have issued ratings on the stock in the last year is $191.80.

EGP has been the subject of a number of recent analyst reports. Morgan Stanley raised their price objective on shares of EastGroup Properties from $158.00 to $186.00 and gave the company an "equal weight" rating in a research report on Thursday, August 22nd. Wells Fargo & Company reduced their price target on EastGroup Properties from $214.00 to $199.00 and set an "overweight" rating for the company in a report on Monday, November 4th. Evercore ISI upped their price objective on EastGroup Properties from $204.00 to $205.00 and gave the stock an "outperform" rating in a report on Monday, October 7th. Mizuho upgraded shares of EastGroup Properties from a "neutral" rating to an "outperform" rating and boosted their target price for the stock from $175.00 to $200.00 in a research report on Thursday, September 5th. Finally, Wedbush reiterated an "outperform" rating and issued a $209.00 price target on shares of EastGroup Properties in a report on Friday, October 25th.

View Our Latest Analysis on EastGroup Properties

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the company. V Square Quantitative Management LLC boosted its holdings in shares of EastGroup Properties by 47.7% during the third quarter. V Square Quantitative Management LLC now owns 189 shares of the real estate investment trust's stock worth $35,000 after purchasing an additional 61 shares during the last quarter. Wealth Enhancement Advisory Services LLC boosted its stake in EastGroup Properties by 7.1% in the 3rd quarter. Wealth Enhancement Advisory Services LLC now owns 1,350 shares of the real estate investment trust's stock worth $252,000 after buying an additional 90 shares during the last quarter. Azzad Asset Management Inc. ADV grew its holdings in EastGroup Properties by 4.9% in the 3rd quarter. Azzad Asset Management Inc. ADV now owns 2,085 shares of the real estate investment trust's stock valued at $389,000 after buying an additional 98 shares during the period. UMB Bank n.a. lifted its holdings in shares of EastGroup Properties by 7.7% during the 3rd quarter. UMB Bank n.a. now owns 1,598 shares of the real estate investment trust's stock worth $299,000 after acquiring an additional 114 shares during the period. Finally, Creative Planning lifted its holdings in shares of EastGroup Properties by 4.8% during the 3rd quarter. Creative Planning now owns 2,555 shares of the real estate investment trust's stock worth $477,000 after acquiring an additional 117 shares during the period. Institutional investors and hedge funds own 92.14% of the company's stock.

EastGroup Properties Stock Performance

Shares of EGP stock traded down $2.46 during midday trading on Thursday, hitting $158.74. The company had a trading volume of 434,242 shares, compared to its average volume of 302,501. EastGroup Properties has a 52-week low of $155.23 and a 52-week high of $192.61. The company has a debt-to-equity ratio of 0.57, a current ratio of 0.08 and a quick ratio of 0.08. The company's 50 day simple moving average is $173.40 and its 200 day simple moving average is $177.72. The stock has a market cap of $7.86 billion, a price-to-earnings ratio of 32.80, a PEG ratio of 2.22 and a beta of 0.99.

EastGroup Properties (NYSE:EGP - Get Free Report) last announced its quarterly earnings data on Wednesday, October 23rd. The real estate investment trust reported $1.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.10 by ($0.97). EastGroup Properties had a net margin of 37.19% and a return on equity of 8.56%. The firm had revenue of $162.88 million during the quarter, compared to analyst estimates of $161.52 million. During the same period in the prior year, the firm posted $1.95 earnings per share. The business's quarterly revenue was up 11.2% compared to the same quarter last year. Research analysts anticipate that EastGroup Properties will post 8.36 earnings per share for the current fiscal year.

EastGroup Properties Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be issued a $1.40 dividend. The ex-dividend date of this dividend is Tuesday, December 31st. This represents a $5.60 dividend on an annualized basis and a dividend yield of 3.53%. EastGroup Properties's dividend payout ratio (DPR) is 115.70%.

About EastGroup Properties

(

Get Free ReportEastGroup Properties, Inc NYSE: EGP, a member of the S&P Mid-Cap 400 and Russell 1000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in major Sunbelt markets throughout the United States with an emphasis in the states of Florida, Texas, Arizona, California and North Carolina.

See Also

Before you consider EastGroup Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EastGroup Properties wasn't on the list.

While EastGroup Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.