Quinn Opportunity Partners LLC decreased its holdings in shares of Eastman Kodak (NYSE:KODK - Free Report) by 39.6% in the 4th quarter, according to the company in its most recent disclosure with the Securities and Exchange Commission (SEC). The fund owned 872,935 shares of the technology company's stock after selling 572,021 shares during the period. Quinn Opportunity Partners LLC owned about 1.09% of Eastman Kodak worth $5,735,000 as of its most recent SEC filing.

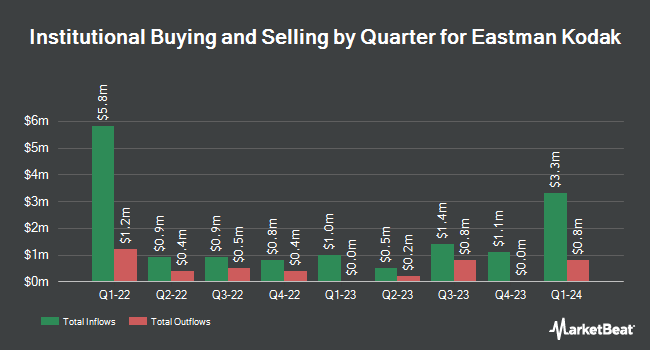

A number of other large investors also recently modified their holdings of the business. First Eagle Investment Management LLC bought a new position in shares of Eastman Kodak during the fourth quarter valued at approximately $2,138,000. JPMorgan Chase & Co. grew its position in shares of Eastman Kodak by 75.3% during the third quarter. JPMorgan Chase & Co. now owns 222,065 shares of the technology company's stock worth $1,048,000 after acquiring an additional 95,402 shares during the last quarter. Vanguard Group Inc. increased its holdings in shares of Eastman Kodak by 2.2% in the 4th quarter. Vanguard Group Inc. now owns 3,997,389 shares of the technology company's stock worth $26,263,000 after acquiring an additional 87,402 shares during the period. Empowered Funds LLC lifted its position in Eastman Kodak by 22.0% in the 4th quarter. Empowered Funds LLC now owns 417,758 shares of the technology company's stock valued at $2,745,000 after purchasing an additional 75,298 shares during the last quarter. Finally, Sanctuary Advisors LLC bought a new stake in shares of Eastman Kodak during the fourth quarter valued at approximately $475,000. 33.65% of the stock is currently owned by institutional investors.

Eastman Kodak Price Performance

KODK stock traded down $0.30 during trading on Wednesday, hitting $6.03. The company had a trading volume of 441,911 shares, compared to its average volume of 1,169,826. The firm has a market capitalization of $486.02 million, a price-to-earnings ratio of 8.61 and a beta of 3.67. The company has a current ratio of 2.41, a quick ratio of 1.51 and a debt-to-equity ratio of 0.47. The business has a 50 day moving average of $6.67 and a 200 day moving average of $6.28. Eastman Kodak has a fifty-two week low of $4.26 and a fifty-two week high of $8.24.

Eastman Kodak (NYSE:KODK - Get Free Report) last issued its quarterly earnings results on Monday, March 17th. The technology company reported $0.23 earnings per share (EPS) for the quarter. Eastman Kodak had a return on equity of 8.47% and a net margin of 7.70%. The company had revenue of $266.00 million for the quarter.

Eastman Kodak Profile

(

Free Report)

Eastman Kodak Company engages in the provision of hardware, software, consumables, and services to customers in the commercial print, packaging, publishing, manufacturing, and entertainment markets worldwide. The company operates through three segments: Print, Advanced Materials and Chemicals, and Brand.

Featured Articles

Before you consider Eastman Kodak, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Eastman Kodak wasn't on the list.

While Eastman Kodak currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.