BMO Capital Markets upgraded shares of Ecolab (NYSE:ECL - Free Report) from a market perform rating to an outperform rating in a report issued on Tuesday, Marketbeat.com reports. The firm currently has $290.00 price objective on the basic materials company's stock, up from their previous price objective of $279.00.

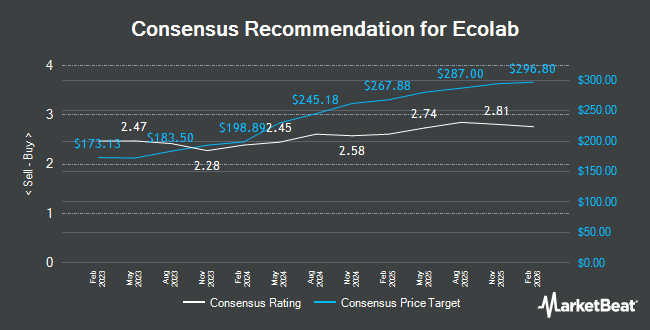

ECL has been the topic of a number of other reports. Morgan Stanley lifted their target price on shares of Ecolab from $240.00 to $263.00 and gave the stock an "equal weight" rating in a research note on Wednesday, October 30th. UBS Group downgraded shares of Ecolab from a "buy" rating to a "neutral" rating and set a $276.00 target price on the stock. in a research note on Monday, November 4th. Robert W. Baird lifted their price target on shares of Ecolab from $271.00 to $279.00 and gave the company a "neutral" rating in a research report on Wednesday, October 30th. Piper Sandler lifted their price objective on shares of Ecolab from $270.00 to $305.00 and gave the company an "overweight" rating in a report on Thursday, September 26th. Finally, Royal Bank of Canada restated an "outperform" rating and set a $306.00 price objective on shares of Ecolab in a research report on Wednesday, October 30th. Seven analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat, Ecolab has an average rating of "Moderate Buy" and an average price target of $280.60.

Read Our Latest Stock Report on Ecolab

Ecolab Stock Performance

ECL stock traded down $1.58 during midday trading on Tuesday, hitting $246.17. 1,792,463 shares of the stock traded hands, compared to its average volume of 1,090,810. The firm has a market cap of $69.71 billion, a P/E ratio of 34.53, a PEG ratio of 2.45 and a beta of 1.13. The company has a debt-to-equity ratio of 0.81, a current ratio of 1.30 and a quick ratio of 0.97. The stock's fifty day simple moving average is $250.33 and its 200-day simple moving average is $246.23. Ecolab has a 1-year low of $193.46 and a 1-year high of $262.61.

Ecolab (NYSE:ECL - Get Free Report) last posted its quarterly earnings data on Tuesday, October 29th. The basic materials company reported $1.83 earnings per share (EPS) for the quarter, beating the consensus estimate of $1.82 by $0.01. The business had revenue of $4 billion for the quarter, compared to the consensus estimate of $4.03 billion. Ecolab had a net margin of 13.05% and a return on equity of 22.12%. The company's revenue was up 1.0% compared to the same quarter last year. During the same period last year, the firm posted $1.54 earnings per share. On average, analysts expect that Ecolab will post 6.65 earnings per share for the current year.

Ecolab Increases Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Wednesday, January 15th. Investors of record on Tuesday, December 17th will be issued a $0.65 dividend. The ex-dividend date is Tuesday, December 17th. This represents a $2.60 annualized dividend and a yield of 1.06%. This is an increase from Ecolab's previous quarterly dividend of $0.57. Ecolab's dividend payout ratio is presently 36.47%.

Insider Buying and Selling at Ecolab

In other news, major shareholder William H. Gates III sold 65,015 shares of the stock in a transaction that occurred on Monday, November 4th. The stock was sold at an average price of $243.80, for a total value of $15,850,657.00. Following the completion of the sale, the insider now directly owns 30,388,741 shares of the company's stock, valued at approximately $7,408,775,055.80. This represents a 0.21 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through this hyperlink. In the last three months, insiders sold 834,566 shares of company stock valued at $205,225,417. 0.50% of the stock is owned by insiders.

Institutional Inflows and Outflows

Several hedge funds have recently bought and sold shares of the stock. Raymond James Financial Services Advisors Inc. boosted its holdings in Ecolab by 1.4% during the second quarter. Raymond James Financial Services Advisors Inc. now owns 73,943 shares of the basic materials company's stock worth $17,598,000 after buying an additional 1,039 shares during the last quarter. First Horizon Advisors Inc. raised its position in Ecolab by 9.0% in the 2nd quarter. First Horizon Advisors Inc. now owns 1,600 shares of the basic materials company's stock valued at $381,000 after buying an additional 132 shares during the last quarter. Atria Wealth Solutions Inc. raised its position in Ecolab by 5.6% in the 2nd quarter. Atria Wealth Solutions Inc. now owns 12,947 shares of the basic materials company's stock valued at $3,086,000 after buying an additional 683 shares during the last quarter. Vicus Capital acquired a new stake in Ecolab in the 2nd quarter valued at approximately $327,000. Finally, PSI Advisors LLC acquired a new stake in Ecolab in the 2nd quarter valued at approximately $27,000. 74.91% of the stock is currently owned by institutional investors and hedge funds.

Ecolab Company Profile

(

Get Free Report)

Ecolab Inc provides water, hygiene, and infection prevention solutions and services in the United States and internationally. The company operates through three segments: Global Industrial; Global Institutional & Specialty; and Global Healthcare & Life Sciences. The Global Industrial segment offers water treatment and process applications, and cleaning and sanitizing solutions to manufacturing, food and beverage processing, transportation, chemical, metals and mining, power generation, pulp and paper, commercial laundry, petroleum, refining, and petrochemical industries.

See Also

Before you consider Ecolab, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ecolab wasn't on the list.

While Ecolab currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Click the link below and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.