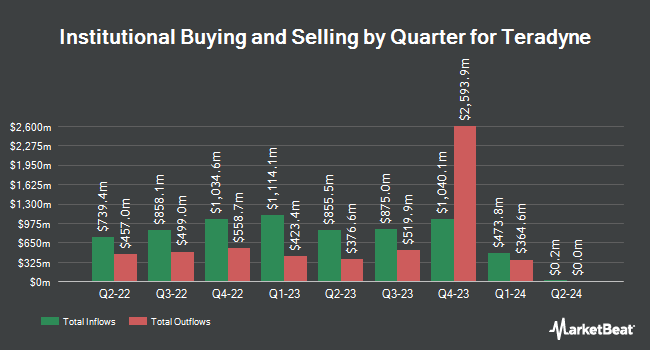

Edgestream Partners L.P. purchased a new position in Teradyne, Inc. (NASDAQ:TER - Free Report) in the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm purchased 36,862 shares of the company's stock, valued at approximately $4,937,000.

Several other hedge funds also recently made changes to their positions in the stock. Ironwood Investment Counsel LLC boosted its position in shares of Teradyne by 1.1% in the third quarter. Ironwood Investment Counsel LLC now owns 44,803 shares of the company's stock valued at $6,001,000 after acquiring an additional 491 shares during the period. Caisse DE Depot ET Placement DU Quebec boosted its holdings in Teradyne by 146.0% in the 3rd quarter. Caisse DE Depot ET Placement DU Quebec now owns 168,476 shares of the company's stock valued at $22,564,000 after purchasing an additional 100,000 shares during the period. Circle Wealth Management LLC grew its position in shares of Teradyne by 127.7% during the 3rd quarter. Circle Wealth Management LLC now owns 6,791 shares of the company's stock valued at $910,000 after purchasing an additional 3,808 shares in the last quarter. Verition Fund Management LLC increased its holdings in shares of Teradyne by 975.5% in the third quarter. Verition Fund Management LLC now owns 76,611 shares of the company's stock worth $10,261,000 after purchasing an additional 69,488 shares during the period. Finally, Alkeon Capital Management LLC raised its position in shares of Teradyne by 189.6% in the third quarter. Alkeon Capital Management LLC now owns 1,144,017 shares of the company's stock worth $153,218,000 after buying an additional 749,003 shares in the last quarter. 99.77% of the stock is currently owned by hedge funds and other institutional investors.

Insider Activity at Teradyne

In related news, Director Mercedes Johnson sold 625 shares of the firm's stock in a transaction on Tuesday, September 3rd. The stock was sold at an average price of $133.49, for a total value of $83,431.25. Following the completion of the sale, the director now owns 16,518 shares of the company's stock, valued at $2,204,987.82. This trade represents a 3.65 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, insider Richard John Burns sold 789 shares of the business's stock in a transaction on Tuesday, October 1st. The shares were sold at an average price of $132.80, for a total transaction of $104,779.20. Following the transaction, the insider now directly owns 21,864 shares in the company, valued at approximately $2,903,539.20. The trade was a 3.48 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 8,199 shares of company stock worth $1,080,634 in the last three months. 0.36% of the stock is owned by insiders.

Wall Street Analysts Forecast Growth

Several equities analysts recently commented on TER shares. Craig Hallum reduced their target price on Teradyne from $124.00 to $111.00 and set a "hold" rating for the company in a research report on Friday, October 25th. Evercore ISI upped their price objective on shares of Teradyne from $130.00 to $145.00 and gave the stock an "overweight" rating in a research report on Wednesday, October 9th. Stifel Nicolaus lowered their target price on shares of Teradyne from $140.00 to $125.00 and set a "hold" rating on the stock in a research note on Friday, October 25th. Robert W. Baird cut their price target on shares of Teradyne from $140.00 to $133.00 and set an "outperform" rating for the company in a research note on Friday, October 25th. Finally, Cantor Fitzgerald raised shares of Teradyne from a "neutral" rating to an "overweight" rating and set a $160.00 price target on the stock in a report on Friday, August 16th. One analyst has rated the stock with a sell rating, six have issued a hold rating and eight have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus price target of $142.62.

Read Our Latest Stock Report on Teradyne

Teradyne Price Performance

NASDAQ TER traded up $1.91 during trading on Friday, hitting $110.00. 1,437,423 shares of the company's stock traded hands, compared to its average volume of 2,024,377. The firm has a market cap of $17.91 billion, a P/E ratio of 34.92, a PEG ratio of 2.38 and a beta of 1.52. The stock has a fifty day moving average of $117.95 and a two-hundred day moving average of $131.12. Teradyne, Inc. has a 12-month low of $90.24 and a 12-month high of $163.21.

Teradyne (NASDAQ:TER - Get Free Report) last issued its earnings results on Wednesday, October 23rd. The company reported $0.90 earnings per share for the quarter, beating the consensus estimate of $0.78 by $0.12. The company had revenue of $737.30 million during the quarter, compared to analysts' expectations of $716.40 million. Teradyne had a return on equity of 18.56% and a net margin of 18.75%. Teradyne's quarterly revenue was up 4.8% compared to the same quarter last year. During the same period in the prior year, the business posted $0.80 EPS. As a group, analysts expect that Teradyne, Inc. will post 3.17 earnings per share for the current fiscal year.

Teradyne declared that its Board of Directors has initiated a stock repurchase plan on Monday, November 11th that authorizes the company to buyback $100.00 million in outstanding shares. This buyback authorization authorizes the company to reacquire up to 0.6% of its stock through open market purchases. Stock buyback plans are typically a sign that the company's board of directors believes its shares are undervalued.

Teradyne Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Monday, November 25th will be paid a $0.12 dividend. This represents a $0.48 annualized dividend and a dividend yield of 0.44%. The ex-dividend date of this dividend is Monday, November 25th. Teradyne's payout ratio is 15.24%.

About Teradyne

(

Free Report)

Teradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

See Also

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report