Edgestream Partners L.P. reduced its holdings in Nuvalent, Inc. (NASDAQ:NUVL - Free Report) by 82.0% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,829 shares of the company's stock after selling 12,866 shares during the period. Edgestream Partners L.P.'s holdings in Nuvalent were worth $289,000 at the end of the most recent reporting period.

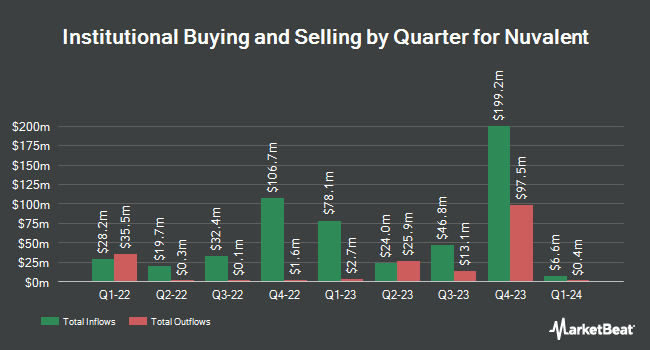

A number of other institutional investors have also recently bought and sold shares of the business. SG Americas Securities LLC boosted its stake in shares of Nuvalent by 108.3% during the 2nd quarter. SG Americas Securities LLC now owns 3,356 shares of the company's stock valued at $255,000 after buying an additional 1,745 shares during the period. Bank of New York Mellon Corp grew its stake in Nuvalent by 23.2% in the second quarter. Bank of New York Mellon Corp now owns 137,883 shares of the company's stock valued at $10,460,000 after purchasing an additional 25,966 shares in the last quarter. Commonwealth Equity Services LLC grew its stake in Nuvalent by 62.0% in the second quarter. Commonwealth Equity Services LLC now owns 4,404 shares of the company's stock valued at $334,000 after purchasing an additional 1,686 shares in the last quarter. Rhumbline Advisers increased its position in Nuvalent by 18.9% in the 2nd quarter. Rhumbline Advisers now owns 46,611 shares of the company's stock worth $3,536,000 after purchasing an additional 7,420 shares during the last quarter. Finally, Arizona State Retirement System raised its stake in shares of Nuvalent by 15.9% during the 2nd quarter. Arizona State Retirement System now owns 8,215 shares of the company's stock worth $623,000 after purchasing an additional 1,127 shares in the last quarter. 97.26% of the stock is currently owned by institutional investors and hedge funds.

Nuvalent Trading Up 0.6 %

NASDAQ:NUVL traded up $0.58 during mid-day trading on Friday, hitting $94.31. 251,875 shares of the company's stock traded hands, compared to its average volume of 332,849. The firm has a 50 day moving average of $96.18 and a two-hundred day moving average of $85.64. The firm has a market capitalization of $6.70 billion, a price-to-earnings ratio of -27.18 and a beta of 1.31. Nuvalent, Inc. has a 12 month low of $61.79 and a 12 month high of $113.51.

Nuvalent (NASDAQ:NUVL - Get Free Report) last posted its quarterly earnings data on Tuesday, November 12th. The company reported ($1.28) earnings per share for the quarter, missing the consensus estimate of ($0.93) by ($0.35). During the same quarter in the prior year, the company earned ($0.59) earnings per share. As a group, equities research analysts expect that Nuvalent, Inc. will post -3.84 earnings per share for the current year.

Wall Street Analysts Forecast Growth

NUVL has been the subject of several recent research reports. Wedbush reissued an "outperform" rating and issued a $115.00 price target on shares of Nuvalent in a research note on Tuesday, November 12th. JPMorgan Chase & Co. boosted their target price on shares of Nuvalent from $100.00 to $125.00 and gave the stock an "overweight" rating in a research report on Friday, October 4th. UBS Group initiated coverage on shares of Nuvalent in a report on Thursday, October 24th. They set a "neutral" rating and a $100.00 price target on the stock. The Goldman Sachs Group raised shares of Nuvalent to a "strong sell" rating in a research note on Monday, September 16th. Finally, BMO Capital Markets increased their target price on shares of Nuvalent from $132.00 to $134.00 and gave the stock an "outperform" rating in a research report on Wednesday, November 13th. One investment analyst has rated the stock with a sell rating, one has assigned a hold rating, ten have assigned a buy rating and one has assigned a strong buy rating to the stock. Based on data from MarketBeat, Nuvalent presently has a consensus rating of "Moderate Buy" and an average price target of $112.60.

Read Our Latest Stock Analysis on Nuvalent

Insider Buying and Selling at Nuvalent

In other news, CFO Alexandra Balcom sold 10,000 shares of the company's stock in a transaction dated Monday, September 30th. The shares were sold at an average price of $101.06, for a total transaction of $1,010,600.00. Following the completion of the transaction, the chief financial officer now owns 33,300 shares of the company's stock, valued at approximately $3,365,298. This represents a 23.09 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. Also, insider Henry E. Pelish sold 32,795 shares of Nuvalent stock in a transaction dated Monday, September 16th. The stock was sold at an average price of $98.92, for a total value of $3,244,081.40. Following the sale, the insider now directly owns 33,300 shares in the company, valued at approximately $3,294,036. This trade represents a 49.62 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 2,093,795 shares of company stock valued at $204,762,781 in the last ninety days. Company insiders own 12.52% of the company's stock.

About Nuvalent

(

Free Report)

Nuvalent, Inc, a clinical stage biopharmaceutical company, engages in the development of therapies for patients with cancer. Its lead product candidates are NVL-520, a novel ROS1-selective inhibitor to address the clinical challenges of emergent treatment resistance, central nervous system (CNS)-related adverse events, and brain metastases that may limit the use of ROS1 tyrosine kinase inhibitors (TKIs) for patients with ROS proto-oncogene 1 (ROS1)-positive non-small cell lung cancer (NSCLC) which is under the phase 2 portion of the ARROS-1 Phase 1/2 clinical trial; NVL-655, a brain-penetrant ALK-selective inhibitor, to address the clinical challenges of emergent treatment resistance, CNS-related adverse events, and brain metastases that might limit the use of first-, second-, and third-generation ALK inhibitors that is under the phase 2 portion of the ALKOVE-1 Phase 1/2 clinical trial; and NVL-330, a brain-penetrant human epidermal growth factor receptor 2 (HER2)-selective inhibitor designed to treat tumors driven by HER2ex20, brain metastases, and avoiding treatment-limiting adverse events including due to off-target inhibition of wild-type EGFR, which is expected to initiate phase 1 trial.

Featured Articles

Before you consider Nuvalent, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Nuvalent wasn't on the list.

While Nuvalent currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

As the AI market heats up, investors who have a vision for artificial intelligence have the potential to see real returns. Learn about the industry as a whole as well as seven companies that are getting work done with the power of AI.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.