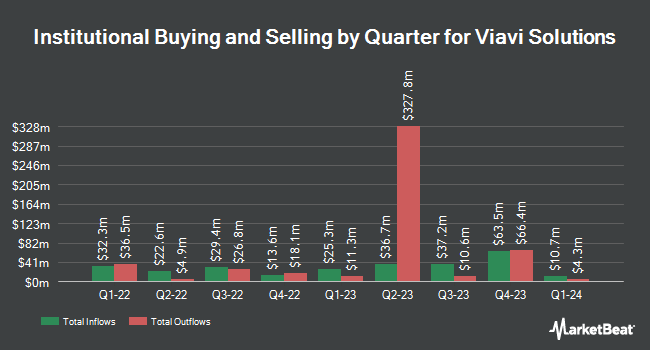

Edgestream Partners L.P. increased its position in shares of Viavi Solutions Inc. (NASDAQ:VIAV - Free Report) by 100.2% in the 3rd quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission. The fund owned 330,313 shares of the communications equipment provider's stock after purchasing an additional 165,339 shares during the period. Edgestream Partners L.P. owned approximately 0.15% of Viavi Solutions worth $2,979,000 as of its most recent filing with the Securities and Exchange Commission.

Other hedge funds have also added to or reduced their stakes in the company. Federated Hermes Inc. raised its holdings in Viavi Solutions by 98,561.6% in the 2nd quarter. Federated Hermes Inc. now owns 187,457 shares of the communications equipment provider's stock valued at $1,288,000 after acquiring an additional 187,267 shares in the last quarter. Louisiana State Employees Retirement System grew its position in shares of Viavi Solutions by 1.9% in the 2nd quarter. Louisiana State Employees Retirement System now owns 112,300 shares of the communications equipment provider's stock valued at $772,000 after buying an additional 2,100 shares during the last quarter. Boston Partners bought a new stake in shares of Viavi Solutions in the 1st quarter valued at about $795,000. Leeward Investments LLC MA lifted its stake in shares of Viavi Solutions by 17.1% in the 3rd quarter. Leeward Investments LLC MA now owns 1,705,653 shares of the communications equipment provider's stock valued at $15,385,000 after purchasing an additional 249,554 shares during the period. Finally, Sequoia Financial Advisors LLC acquired a new position in shares of Viavi Solutions in the 3rd quarter valued at about $105,000. 95.54% of the stock is owned by institutional investors and hedge funds.

Insider Transactions at Viavi Solutions

In other Viavi Solutions news, Director Masood Jabbar sold 15,000 shares of the business's stock in a transaction dated Thursday, November 14th. The shares were sold at an average price of $10.14, for a total value of $152,100.00. Following the transaction, the director now directly owns 225,333 shares in the company, valued at $2,284,876.62. The trade was a 6.24 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which is available through the SEC website. Also, SVP Luke M. Scrivanich sold 3,029 shares of the company's stock in a transaction that occurred on Thursday, September 26th. The stock was sold at an average price of $8.86, for a total transaction of $26,836.94. Following the completion of the transaction, the senior vice president now owns 57,319 shares in the company, valued at approximately $507,846.34. This represents a 5.02 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 53,949 shares of company stock valued at $489,511 over the last 90 days. Corporate insiders own 1.52% of the company's stock.

Viavi Solutions Stock Up 4.3 %

NASDAQ VIAV traded up $0.43 on Monday, hitting $10.37. The stock had a trading volume of 2,144,488 shares, compared to its average volume of 1,779,969. The business's fifty day moving average price is $9.50 and its 200 day moving average price is $8.33. The company has a debt-to-equity ratio of 0.91, a current ratio of 3.71 and a quick ratio of 3.31. Viavi Solutions Inc. has a 52-week low of $6.60 and a 52-week high of $11.32. The stock has a market cap of $2.30 billion, a price-to-earnings ratio of -58.47 and a beta of 0.90.

Viavi Solutions (NASDAQ:VIAV - Get Free Report) last posted its earnings results on Thursday, October 31st. The communications equipment provider reported $0.06 earnings per share (EPS) for the quarter, meeting analysts' consensus estimates of $0.06. Viavi Solutions had a negative net margin of 3.78% and a positive return on equity of 2.22%. The company had revenue of $238.20 million during the quarter, compared to the consensus estimate of $240.09 million. During the same period in the previous year, the firm posted $0.05 earnings per share. The firm's quarterly revenue was down 3.9% on a year-over-year basis. Equities research analysts anticipate that Viavi Solutions Inc. will post 0.19 earnings per share for the current year.

Analysts Set New Price Targets

A number of research analysts recently weighed in on the company. Rosenblatt Securities upped their price target on Viavi Solutions from $8.25 to $10.50 and gave the stock a "neutral" rating in a research note on Friday, November 1st. Stifel Nicolaus reduced their price objective on Viavi Solutions from $13.00 to $10.50 and set a "buy" rating for the company in a report on Tuesday, August 6th. Northland Securities increased their price objective on Viavi Solutions from $11.00 to $13.00 and gave the company an "outperform" rating in a report on Friday, November 1st. B. Riley dropped their target price on Viavi Solutions from $9.00 to $8.50 and set a "neutral" rating on the stock in a research report on Friday, August 9th. Finally, Needham & Company LLC reiterated a "hold" rating on shares of Viavi Solutions in a research report on Friday, November 1st. Seven analysts have rated the stock with a hold rating, two have given a buy rating and one has issued a strong buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and an average target price of $10.44.

Check Out Our Latest Report on Viavi Solutions

Viavi Solutions Profile

(

Free Report)

Viavi Solutions Inc provides network test, monitoring, and assurance solutions for communications service providers, hyperscalers, network equipment manufacturers, original equipment manufacturers, government, and avionics customers in the Americas, the Asia-Pacific, Europe, the Middle East, and Africa.

Read More

Before you consider Viavi Solutions, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Viavi Solutions wasn't on the list.

While Viavi Solutions currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to generate income with your stock portfolio? Use these ten stocks to generate a safe and reliable source of investment income.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.