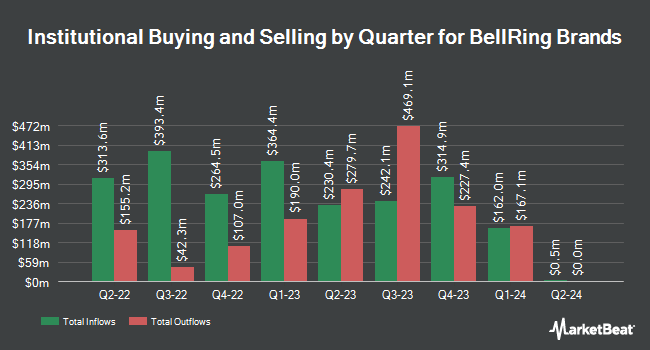

Edgestream Partners L.P. lessened its holdings in BellRing Brands, Inc. (NYSE:BRBR - Free Report) by 70.1% during the 3rd quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The institutional investor owned 50,453 shares of the company's stock after selling 118,257 shares during the period. Edgestream Partners L.P.'s holdings in BellRing Brands were worth $3,064,000 at the end of the most recent reporting period.

Other large investors have also modified their holdings of the company. Braun Stacey Associates Inc. acquired a new position in BellRing Brands in the 3rd quarter valued at about $18,680,000. Dimensional Fund Advisors LP lifted its stake in shares of BellRing Brands by 3.7% during the second quarter. Dimensional Fund Advisors LP now owns 2,423,483 shares of the company's stock valued at $138,482,000 after buying an additional 86,992 shares during the period. WINTON GROUP Ltd boosted its position in BellRing Brands by 186.5% during the second quarter. WINTON GROUP Ltd now owns 44,642 shares of the company's stock worth $2,551,000 after acquiring an additional 29,060 shares during the last quarter. Federated Hermes Inc. grew its stake in BellRing Brands by 28.0% in the 2nd quarter. Federated Hermes Inc. now owns 474,168 shares of the company's stock worth $27,094,000 after acquiring an additional 103,604 shares during the period. Finally, AQR Capital Management LLC raised its holdings in BellRing Brands by 72.3% in the 2nd quarter. AQR Capital Management LLC now owns 532,359 shares of the company's stock valued at $30,419,000 after acquiring an additional 223,430 shares during the last quarter. 94.97% of the stock is currently owned by institutional investors and hedge funds.

BellRing Brands Stock Performance

BellRing Brands stock traded down $0.84 during trading on Monday, reaching $77.62. 1,295,759 shares of the company's stock were exchanged, compared to its average volume of 1,207,761. The company's 50-day moving average is $67.46 and its two-hundred day moving average is $59.99. BellRing Brands, Inc. has a 52-week low of $48.06 and a 52-week high of $79.90. The firm has a market cap of $10.00 billion, a price-to-earnings ratio of 41.51, a PEG ratio of 2.63 and a beta of 0.84.

BellRing Brands (NYSE:BRBR - Get Free Report) last posted its earnings results on Monday, November 18th. The company reported $0.51 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.50 by $0.01. The business had revenue of $555.80 million during the quarter, compared to analyst estimates of $545.00 million. BellRing Brands had a negative return on equity of 103.89% and a net margin of 12.35%. The company's revenue for the quarter was up 17.6% compared to the same quarter last year. During the same quarter last year, the firm earned $0.41 earnings per share. Analysts anticipate that BellRing Brands, Inc. will post 2.16 EPS for the current year.

Wall Street Analysts Forecast Growth

BRBR has been the topic of several analyst reports. Stifel Nicolaus raised their price objective on BellRing Brands from $67.00 to $81.00 and gave the stock a "buy" rating in a report on Wednesday, November 20th. Needham & Company LLC restated a "buy" rating and issued a $66.00 price target on shares of BellRing Brands in a report on Tuesday, August 6th. DA Davidson reaffirmed a "neutral" rating and set a $75.00 price objective on shares of BellRing Brands in a research note on Tuesday, November 19th. JPMorgan Chase & Co. decreased their target price on shares of BellRing Brands from $65.00 to $64.00 and set an "overweight" rating on the stock in a research report on Wednesday, August 7th. Finally, Stephens upped their price target on shares of BellRing Brands from $61.00 to $75.00 and gave the stock an "equal weight" rating in a research report on Monday, November 25th. Three investment analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company. According to MarketBeat, BellRing Brands has an average rating of "Moderate Buy" and a consensus target price of $75.60.

Read Our Latest Stock Report on BellRing Brands

BellRing Brands Company Profile

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

See Also

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.