Edgestream Partners L.P. trimmed its stake in Ryman Hospitality Properties, Inc. (NYSE:RHP - Free Report) by 68.2% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 32,059 shares of the real estate investment trust's stock after selling 68,637 shares during the period. Edgestream Partners L.P. owned 0.05% of Ryman Hospitality Properties worth $3,438,000 at the end of the most recent quarter.

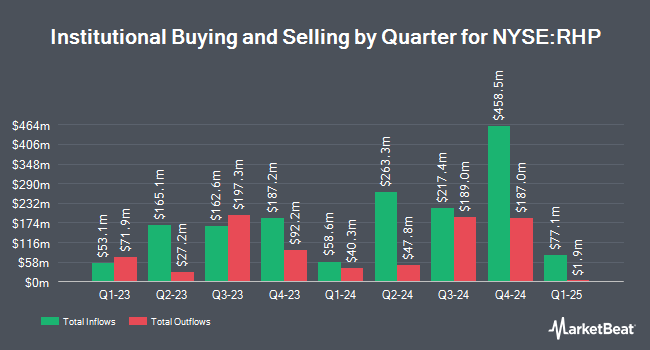

A number of other hedge funds have also recently made changes to their positions in the stock. Principal Financial Group Inc. boosted its stake in Ryman Hospitality Properties by 41.9% in the third quarter. Principal Financial Group Inc. now owns 3,153,360 shares of the real estate investment trust's stock valued at $338,168,000 after acquiring an additional 931,283 shares in the last quarter. American Century Companies Inc. boosted its position in shares of Ryman Hospitality Properties by 0.8% in the 2nd quarter. American Century Companies Inc. now owns 1,586,256 shares of the real estate investment trust's stock worth $158,404,000 after purchasing an additional 12,058 shares in the last quarter. Massachusetts Financial Services Co. MA grew its stake in Ryman Hospitality Properties by 264.2% during the 2nd quarter. Massachusetts Financial Services Co. MA now owns 1,199,392 shares of the real estate investment trust's stock worth $119,771,000 after buying an additional 870,081 shares during the last quarter. Charles Schwab Investment Management Inc. increased its position in Ryman Hospitality Properties by 0.7% during the 3rd quarter. Charles Schwab Investment Management Inc. now owns 964,315 shares of the real estate investment trust's stock valued at $103,413,000 after buying an additional 6,289 shares in the last quarter. Finally, Dimensional Fund Advisors LP raised its stake in Ryman Hospitality Properties by 1.0% in the second quarter. Dimensional Fund Advisors LP now owns 820,639 shares of the real estate investment trust's stock valued at $81,947,000 after buying an additional 8,469 shares during the last quarter. 94.48% of the stock is currently owned by hedge funds and other institutional investors.

Insider Buying and Selling at Ryman Hospitality Properties

In related news, Director Fazal F. Merchant sold 1,269 shares of the company's stock in a transaction dated Wednesday, November 13th. The shares were sold at an average price of $113.98, for a total transaction of $144,640.62. Following the completion of the transaction, the director now owns 4,825 shares in the company, valued at $549,953.50. This represents a 20.82 % decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at the SEC website. Also, Director Alvin L. Bowles, Jr. sold 900 shares of the stock in a transaction that occurred on Thursday, September 19th. The shares were sold at an average price of $107.32, for a total value of $96,588.00. Following the transaction, the director now directly owns 3,148 shares of the company's stock, valued at $337,843.36. The trade was a 22.23 % decrease in their position. The disclosure for this sale can be found here. 3.00% of the stock is owned by corporate insiders.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on RHP shares. StockNews.com upgraded shares of Ryman Hospitality Properties from a "sell" rating to a "hold" rating in a report on Friday, August 9th. Wells Fargo & Company dropped their target price on shares of Ryman Hospitality Properties from $127.00 to $115.00 and set an "overweight" rating on the stock in a research report on Friday, September 13th. Truist Financial raised their price target on shares of Ryman Hospitality Properties from $130.00 to $136.00 and gave the stock a "buy" rating in a report on Monday, November 18th. Finally, Jefferies Financial Group assumed coverage on shares of Ryman Hospitality Properties in a report on Wednesday, November 6th. They set a "buy" rating and a $130.00 price objective on the stock. Two equities research analysts have rated the stock with a hold rating and five have given a buy rating to the company. According to data from MarketBeat.com, Ryman Hospitality Properties has a consensus rating of "Moderate Buy" and an average target price of $126.17.

Read Our Latest Report on Ryman Hospitality Properties

Ryman Hospitality Properties Stock Performance

NYSE RHP traded up $0.35 on Monday, hitting $117.59. 441,508 shares of the company's stock traded hands, compared to its average volume of 452,138. The firm's 50-day moving average price is $111.23 and its two-hundred day moving average price is $104.90. The firm has a market capitalization of $7.04 billion, a PE ratio of 20.89, a P/E/G ratio of 2.96 and a beta of 1.65. The company has a current ratio of 1.73, a quick ratio of 1.73 and a debt-to-equity ratio of 6.07. Ryman Hospitality Properties, Inc. has a 1-year low of $93.76 and a 1-year high of $122.91.

Ryman Hospitality Properties (NYSE:RHP - Get Free Report) last posted its quarterly earnings results on Monday, November 4th. The real estate investment trust reported $0.94 EPS for the quarter, missing the consensus estimate of $1.83 by ($0.89). The business had revenue of $549.90 million during the quarter, compared to analysts' expectations of $545.93 million. Ryman Hospitality Properties had a net margin of 14.84% and a return on equity of 61.94%. Ryman Hospitality Properties's revenue for the quarter was up 4.0% compared to the same quarter last year. During the same period in the previous year, the company posted $1.73 earnings per share. As a group, analysts expect that Ryman Hospitality Properties, Inc. will post 8.44 EPS for the current year.

Ryman Hospitality Properties Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, January 15th. Stockholders of record on Tuesday, December 31st will be issued a dividend of $1.15 per share. This represents a $4.60 annualized dividend and a dividend yield of 3.91%. This is a positive change from Ryman Hospitality Properties's previous quarterly dividend of $1.10. The ex-dividend date of this dividend is Tuesday, December 31st. Ryman Hospitality Properties's payout ratio is 78.15%.

Ryman Hospitality Properties Profile

(

Free Report)

Ryman Hospitality Properties, Inc NYSE: RHP is a leading lodging and hospitality real estate investment trust that specializes in upscale convention center resorts and entertainment experiences. The Company's holdings include Gaylord Opryland Resort & Convention Center; Gaylord Palms Resort & Convention Center; Gaylord Texan Resort & Convention Center; Gaylord National Resort & Convention Center; and Gaylord Rockies Resort & Convention Center, five of the top seven largest non-gaming convention center hotels in the United States based on total indoor meeting space.

Recommended Stories

Before you consider Ryman Hospitality Properties, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ryman Hospitality Properties wasn't on the list.

While Ryman Hospitality Properties currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.