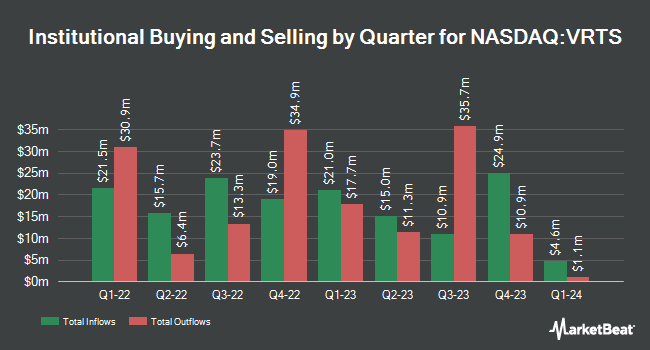

Edgestream Partners L.P. acquired a new stake in shares of Virtus Investment Partners, Inc. (NASDAQ:VRTS - Free Report) in the 3rd quarter, according to its most recent 13F filing with the SEC. The fund acquired 5,428 shares of the closed-end fund's stock, valued at approximately $1,137,000. Edgestream Partners L.P. owned 0.08% of Virtus Investment Partners at the end of the most recent quarter.

Other large investors have also made changes to their positions in the company. Tidal Investments LLC raised its stake in shares of Virtus Investment Partners by 9.4% during the 1st quarter. Tidal Investments LLC now owns 1,048 shares of the closed-end fund's stock valued at $260,000 after buying an additional 90 shares during the last quarter. Cetera Advisors LLC acquired a new position in Virtus Investment Partners in the 1st quarter worth about $657,000. CWM LLC increased its holdings in Virtus Investment Partners by 334.1% in the 2nd quarter. CWM LLC now owns 382 shares of the closed-end fund's stock worth $86,000 after acquiring an additional 294 shares in the last quarter. SG Americas Securities LLC purchased a new stake in Virtus Investment Partners in the 2nd quarter worth $2,553,000. Finally, Blue Trust Inc. lifted its holdings in Virtus Investment Partners by 6,550.0% during the second quarter. Blue Trust Inc. now owns 133 shares of the closed-end fund's stock valued at $33,000 after purchasing an additional 131 shares in the last quarter. 80.52% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

A number of analysts have recently commented on the stock. StockNews.com cut shares of Virtus Investment Partners from a "buy" rating to a "hold" rating in a research note on Monday, November 25th. Piper Sandler increased their target price on Virtus Investment Partners from $264.00 to $274.00 and gave the company an "overweight" rating in a report on Wednesday, November 27th. Barclays started coverage on Virtus Investment Partners in a research report on Tuesday, August 27th. They set an "underweight" rating and a $206.00 price target for the company. Finally, Morgan Stanley raised their price objective on Virtus Investment Partners from $208.00 to $217.00 and gave the company an "underweight" rating in a report on Friday, October 18th. Two investment analysts have rated the stock with a sell rating, two have assigned a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, Virtus Investment Partners currently has a consensus rating of "Hold" and an average price target of $236.00.

View Our Latest Stock Analysis on VRTS

Virtus Investment Partners Trading Down 0.8 %

Shares of VRTS traded down $2.10 during mid-day trading on Thursday, reaching $248.79. The stock had a trading volume of 25,383 shares, compared to its average volume of 42,329. The company has a debt-to-equity ratio of 0.27, a current ratio of 11.86 and a quick ratio of 11.86. The business's fifty day moving average is $225.48 and its 200 day moving average is $220.42. Virtus Investment Partners, Inc. has a 52-week low of $190.42 and a 52-week high of $263.39. The firm has a market cap of $1.75 billion, a price-to-earnings ratio of 9.87 and a beta of 1.46.

Virtus Investment Partners Profile

(

Free Report)

Virtus Investment Partners, Inc is a publicly owned investment manager. The firm primarily provides its services to individual and institutional clients. It launches separate client focused equity and fixed income portfolios. The firm launches equity, fixed income, and balanced mutual funds for its clients.

Featured Articles

Before you consider Virtus Investment Partners, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Virtus Investment Partners wasn't on the list.

While Virtus Investment Partners currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.