Edgestream Partners L.P. bought a new position in PVH Corp. (NYSE:PVH - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The firm bought 29,665 shares of the textile maker's stock, valued at approximately $2,991,000. Edgestream Partners L.P. owned about 0.05% of PVH at the end of the most recent quarter.

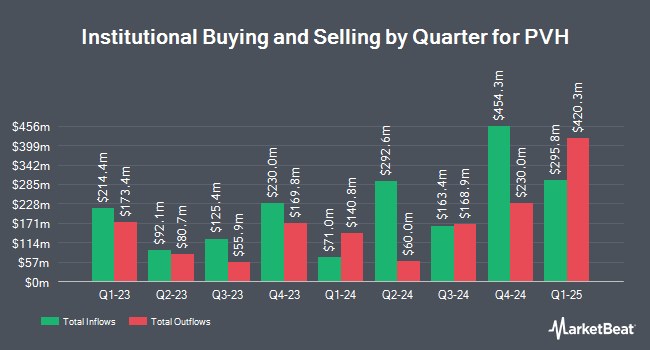

A number of other large investors have also added to or reduced their stakes in PVH. Altshuler Shaham Ltd purchased a new position in shares of PVH in the 2nd quarter worth $25,000. Venturi Wealth Management LLC boosted its position in PVH by 63.9% in the third quarter. Venturi Wealth Management LLC now owns 272 shares of the textile maker's stock worth $27,000 after purchasing an additional 106 shares during the last quarter. Covestor Ltd grew its stake in shares of PVH by 270.6% during the 3rd quarter. Covestor Ltd now owns 404 shares of the textile maker's stock valued at $41,000 after purchasing an additional 295 shares during the period. ORG Partners LLC purchased a new stake in shares of PVH during the 2nd quarter valued at about $42,000. Finally, Allspring Global Investments Holdings LLC lifted its stake in shares of PVH by 116.3% in the 3rd quarter. Allspring Global Investments Holdings LLC now owns 424 shares of the textile maker's stock worth $43,000 after purchasing an additional 228 shares during the period. Institutional investors own 97.25% of the company's stock.

PVH Price Performance

Shares of NYSE:PVH traded up $2.77 during midday trading on Monday, reaching $111.14. 1,130,014 shares of the company were exchanged, compared to its average volume of 833,091. The company has a current ratio of 1.24, a quick ratio of 0.66 and a debt-to-equity ratio of 0.32. The stock has a market cap of $6.20 billion, a PE ratio of 8.78, a price-to-earnings-growth ratio of 0.97 and a beta of 2.11. The business's fifty day moving average is $99.55 and its two-hundred day moving average is $103.09. PVH Corp. has a one year low of $89.56 and a one year high of $141.15.

PVH Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Wednesday, December 18th. Investors of record on Wednesday, November 27th will be given a $0.0375 dividend. The ex-dividend date of this dividend is Wednesday, November 27th. This represents a $0.15 dividend on an annualized basis and a dividend yield of 0.13%. PVH's dividend payout ratio is currently 1.19%.

Analyst Upgrades and Downgrades

Several analysts recently issued reports on PVH shares. BMO Capital Markets cut their target price on shares of PVH from $119.00 to $106.00 and set a "market perform" rating for the company in a research report on Wednesday, August 28th. Telsey Advisory Group restated an "outperform" rating and issued a $130.00 price objective on shares of PVH in a research note on Wednesday, November 27th. Guggenheim lowered their target price on PVH from $120.00 to $105.00 and set a "buy" rating on the stock in a research report on Monday, October 28th. StockNews.com cut PVH from a "strong-buy" rating to a "buy" rating in a research report on Friday, August 16th. Finally, Wells Fargo & Company decreased their price objective on PVH from $145.00 to $130.00 and set an "overweight" rating on the stock in a research note on Wednesday, August 28th. Five research analysts have rated the stock with a hold rating and eleven have issued a buy rating to the stock. According to MarketBeat.com, the company has a consensus rating of "Moderate Buy" and a consensus price target of $126.53.

Check Out Our Latest Research Report on PVH

PVH Company Profile

(

Free Report)

PVH Corp. operates as an apparel company in the United States and internationally. The company operates through Tommy Hilfiger North America, Tommy Hilfiger International, Calvin Klein North America, Calvin Klein International, and Heritage Brands Wholesale segments. It designs and markets men's, women's, and children's branded apparel, footwear and accessories, underwear, sleepwear, outerwear, home furnishings, luggage, dresses, suits and swimwear, activewear, sportswear, socks and accessories, outerwear, golf products, footwear, watches and jewelry, eyeglasses and non-ophthalmic sunglasses, jeans wear, performance apparel, intimate apparel, dress shirts, handbags, fragrance, small leather goods, and other related products; and men's and boy's tailored clothing products, duvets, pillows, mattress pads and toppers, and feather beds.

Read More

Before you consider PVH, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PVH wasn't on the list.

While PVH currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.