Edgestream Partners L.P. purchased a new stake in Kirby Co. (NYSE:KEX - Free Report) during the 3rd quarter, according to the company in its most recent 13F filing with the SEC. The fund purchased 41,412 shares of the shipping company's stock, valued at approximately $5,070,000. Edgestream Partners L.P. owned 0.07% of Kirby as of its most recent SEC filing.

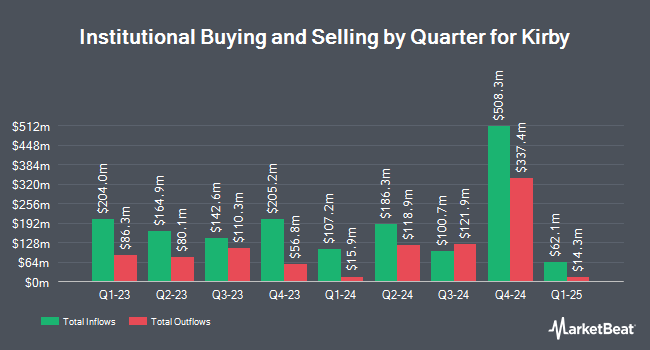

A number of other hedge funds also recently added to or reduced their stakes in KEX. Captrust Financial Advisors raised its position in Kirby by 4.6% during the 3rd quarter. Captrust Financial Advisors now owns 13,644 shares of the shipping company's stock worth $1,670,000 after buying an additional 597 shares during the last quarter. Walleye Capital LLC raised its holdings in Kirby by 54.9% during the third quarter. Walleye Capital LLC now owns 20,836 shares of the shipping company's stock worth $2,551,000 after purchasing an additional 7,381 shares in the last quarter. Bridgewater Associates LP acquired a new stake in Kirby in the third quarter valued at about $6,783,000. Brooklyn Investment Group purchased a new stake in Kirby in the 3rd quarter valued at approximately $42,000. Finally, Advantage Alpha Capital Partners LP boosted its holdings in Kirby by 51.2% in the 3rd quarter. Advantage Alpha Capital Partners LP now owns 48,693 shares of the shipping company's stock valued at $5,961,000 after purchasing an additional 16,497 shares in the last quarter. 96.15% of the stock is owned by institutional investors and hedge funds.

Insiders Place Their Bets

In other Kirby news, COO Christian G. O'neil sold 15,041 shares of the stock in a transaction that occurred on Tuesday, November 12th. The shares were sold at an average price of $130.00, for a total transaction of $1,955,330.00. Following the transaction, the chief operating officer now owns 7,746 shares of the company's stock, valued at $1,006,980. This trade represents a 66.01 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, CEO David W. Grzebinski sold 26,358 shares of the business's stock in a transaction on Monday, September 16th. The shares were sold at an average price of $120.46, for a total transaction of $3,175,084.68. Following the sale, the chief executive officer now directly owns 63,399 shares of the company's stock, valued at $7,637,043.54. This represents a 29.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 68,596 shares of company stock valued at $8,541,440 in the last quarter. 1.50% of the stock is currently owned by company insiders.

Analysts Set New Price Targets

Separately, StockNews.com downgraded Kirby from a "buy" rating to a "hold" rating in a research note on Sunday, September 22nd. One analyst has rated the stock with a hold rating and five have issued a buy rating to the stock. According to MarketBeat, Kirby has an average rating of "Moderate Buy" and an average target price of $123.80.

Read Our Latest Analysis on KEX

Kirby Price Performance

Shares of KEX traded up $0.15 during trading hours on Friday, reaching $126.51. 273,235 shares of the company traded hands, compared to its average volume of 414,119. The stock has a fifty day simple moving average of $124.16 and a 200 day simple moving average of $120.92. Kirby Co. has a fifty-two week low of $72.11 and a fifty-two week high of $132.21. The stock has a market capitalization of $7.26 billion, a PE ratio of 24.28, a price-to-earnings-growth ratio of 0.75 and a beta of 1.17. The company has a quick ratio of 1.05, a current ratio of 1.67 and a debt-to-equity ratio of 0.29.

Kirby (NYSE:KEX - Get Free Report) last posted its quarterly earnings data on Wednesday, October 30th. The shipping company reported $1.55 earnings per share for the quarter, beating analysts' consensus estimates of $1.47 by $0.08. Kirby had a net margin of 9.37% and a return on equity of 9.43%. The business had revenue of $831.10 million during the quarter, compared to analyst estimates of $824.42 million. During the same quarter in the previous year, the business posted $1.05 earnings per share. The company's revenue was up 8.7% on a year-over-year basis. As a group, research analysts predict that Kirby Co. will post 5.45 EPS for the current fiscal year.

About Kirby

(

Free Report)

Kirby Corporation operates domestic tank barges in the United States. Its Marine Transportation segment provides marine transportation service and towing vessel transporting bulk liquid product, as well as operates tank barge throughout the Mississippi River System, on the Gulf Intracoastal Waterway, coastwise along three United States coasts, and in Alaska and Hawaii.

Featured Stories

Before you consider Kirby, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kirby wasn't on the list.

While Kirby currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of the 10 best stocks to own in 2025 and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.