Edgestream Partners L.P. boosted its holdings in LegalZoom.com, Inc. (NASDAQ:LZ - Free Report) by 313.2% in the third quarter, according to its most recent filing with the SEC. The institutional investor owned 191,857 shares of the company's stock after buying an additional 145,425 shares during the period. Edgestream Partners L.P. owned 0.11% of LegalZoom.com worth $1,218,000 as of its most recent SEC filing.

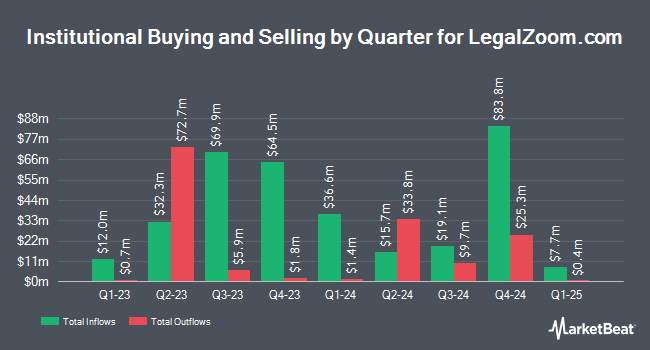

Several other institutional investors and hedge funds also recently added to or reduced their stakes in the business. Westwood Holdings Group Inc. boosted its stake in LegalZoom.com by 15.8% during the second quarter. Westwood Holdings Group Inc. now owns 5,581,315 shares of the company's stock valued at $46,827,000 after buying an additional 762,612 shares during the last quarter. Renaissance Technologies LLC boosted its position in shares of LegalZoom.com by 26.8% during the 2nd quarter. Renaissance Technologies LLC now owns 2,466,933 shares of the company's stock valued at $20,698,000 after acquiring an additional 521,200 shares during the last quarter. Coastal Bridge Advisors LLC grew its holdings in shares of LegalZoom.com by 10.2% in the second quarter. Coastal Bridge Advisors LLC now owns 1,996,558 shares of the company's stock valued at $16,751,000 after purchasing an additional 184,696 shares in the last quarter. Dimensional Fund Advisors LP grew its holdings in shares of LegalZoom.com by 25.6% in the second quarter. Dimensional Fund Advisors LP now owns 1,287,927 shares of the company's stock valued at $10,806,000 after purchasing an additional 262,335 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its stake in LegalZoom.com by 2.8% during the third quarter. Charles Schwab Investment Management Inc. now owns 1,197,833 shares of the company's stock valued at $7,606,000 after purchasing an additional 32,085 shares in the last quarter. Institutional investors own 81.99% of the company's stock.

LegalZoom.com Price Performance

LegalZoom.com stock traded down $0.15 during trading hours on Thursday, hitting $8.05. 661,603 shares of the stock traded hands, compared to its average volume of 1,559,618. LegalZoom.com, Inc. has a 1 year low of $5.33 and a 1 year high of $13.74. The stock has a market capitalization of $1.39 billion, a price-to-earnings ratio of 62.00, a P/E/G ratio of 1.78 and a beta of 1.10. The firm's 50 day moving average price is $7.32 and its 200-day moving average price is $7.23.

LegalZoom.com (NASDAQ:LZ - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported $0.17 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.15 by $0.02. The firm had revenue of $168.60 million during the quarter, compared to analysts' expectations of $167.66 million. LegalZoom.com had a net margin of 3.61% and a return on equity of 32.88%. The firm's revenue was up .8% compared to the same quarter last year. During the same quarter last year, the company posted $0.05 earnings per share. Research analysts forecast that LegalZoom.com, Inc. will post 0.25 earnings per share for the current fiscal year.

Wall Street Analyst Weigh In

Several research firms recently weighed in on LZ. Barclays increased their price target on LegalZoom.com from $7.00 to $8.00 and gave the company an "equal weight" rating in a report on Monday, November 11th. JPMorgan Chase & Co. reissued an "underweight" rating and issued a $8.00 target price on shares of LegalZoom.com in a research note on Friday, November 8th. JMP Securities reiterated a "market perform" rating on shares of LegalZoom.com in a report on Friday, September 13th. William Blair initiated coverage on shares of LegalZoom.com in a research report on Monday, September 16th. They issued a "market perform" rating on the stock. Finally, Citigroup boosted their target price on LegalZoom.com from $7.00 to $8.50 and gave the company a "neutral" rating in a research report on Tuesday, November 26th. Two analysts have rated the stock with a sell rating, five have given a hold rating and one has given a buy rating to the company's stock. Based on data from MarketBeat.com, the company currently has a consensus rating of "Hold" and an average target price of $8.75.

Read Our Latest Analysis on LegalZoom.com

LegalZoom.com Company Profile

(

Free Report)

LegalZoom.com, Inc, together with its subsidiaries, operates an online platform that supports the legal, compliance, and business management needs of small businesses and consumers in the United States. The company's platform offers business formation products, such as limited liability company, incorporation of C and S corporations, nonprofit formations, doing-business-as, corporate changes and filings, business licenses, legal forms, and beneficial ownership information reports; intellectual property products consisting of trademark and patent applications, and copyright registrations; and tax services, including business and personal tax preparations.

Featured Articles

Before you consider LegalZoom.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and LegalZoom.com wasn't on the list.

While LegalZoom.com currently has a "Reduce" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.