Edgestream Partners L.P. trimmed its holdings in shares of Merck & Co., Inc. (NYSE:MRK - Free Report) by 62.4% in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The fund owned 7,895 shares of the company's stock after selling 13,101 shares during the period. Edgestream Partners L.P.'s holdings in Merck & Co., Inc. were worth $785,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

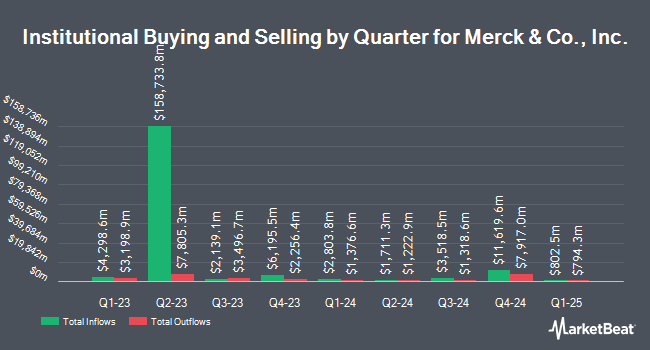

Other institutional investors also recently bought and sold shares of the company. Franklin Resources Inc. lifted its position in shares of Merck & Co., Inc. by 12.9% during the 3rd quarter. Franklin Resources Inc. now owns 16,049,161 shares of the company's stock worth $1,759,800,000 after buying an additional 1,836,505 shares during the last quarter. Janney Montgomery Scott LLC grew its holdings in shares of Merck & Co., Inc. by 1.9% during the fourth quarter. Janney Montgomery Scott LLC now owns 1,902,509 shares of the company's stock worth $189,262,000 after purchasing an additional 35,525 shares during the last quarter. Charles Schwab Investment Management Inc. grew its holdings in shares of Merck & Co., Inc. by 2.8% during the third quarter. Charles Schwab Investment Management Inc. now owns 18,807,293 shares of the company's stock worth $2,135,785,000 after purchasing an additional 514,060 shares during the last quarter. Littlejohn Financial Services Inc. purchased a new stake in shares of Merck & Co., Inc. in the 4th quarter valued at about $2,080,000. Finally, Thrivent Financial for Lutherans lifted its holdings in shares of Merck & Co., Inc. by 3.5% in the 3rd quarter. Thrivent Financial for Lutherans now owns 1,837,354 shares of the company's stock valued at $208,649,000 after purchasing an additional 62,047 shares during the last quarter. 76.07% of the stock is owned by hedge funds and other institutional investors.

Merck & Co., Inc. Trading Down 0.6 %

Shares of Merck & Co., Inc. stock opened at $94.65 on Wednesday. Merck & Co., Inc. has a 12-month low of $81.04 and a 12-month high of $134.63. The company has a current ratio of 1.36, a quick ratio of 1.15 and a debt-to-equity ratio of 0.79. The stock has a market cap of $239.09 billion, a PE ratio of 14.06, a price-to-earnings-growth ratio of 0.77 and a beta of 0.35. The company has a 50-day moving average of $93.87 and a two-hundred day moving average of $102.25.

Merck & Co., Inc. (NYSE:MRK - Get Free Report) last posted its quarterly earnings results on Tuesday, February 4th. The company reported $1.72 EPS for the quarter, missing the consensus estimate of $1.85 by ($0.13). Merck & Co., Inc. had a net margin of 26.67% and a return on equity of 45.35%. The business had revenue of $15.62 billion during the quarter, compared to analysts' expectations of $15.51 billion. During the same quarter last year, the firm earned $0.03 EPS. The firm's quarterly revenue was up 6.8% compared to the same quarter last year. On average, research analysts anticipate that Merck & Co., Inc. will post 9.01 EPS for the current fiscal year.

Merck & Co., Inc. declared that its Board of Directors has approved a share buyback plan on Tuesday, January 28th that allows the company to repurchase $10.00 billion in outstanding shares. This repurchase authorization allows the company to reacquire up to 4.1% of its shares through open market purchases. Shares repurchase plans are often an indication that the company's management believes its stock is undervalued.

Merck & Co., Inc. Dividend Announcement

The business also recently disclosed a quarterly dividend, which will be paid on Monday, April 7th. Stockholders of record on Monday, March 17th will be paid a dividend of $0.81 per share. The ex-dividend date is Monday, March 17th. This represents a $3.24 annualized dividend and a dividend yield of 3.42%. Merck & Co., Inc.'s dividend payout ratio is presently 48.14%.

Insider Buying and Selling

In other news, insider Cristal N. Downing sold 2,361 shares of the business's stock in a transaction dated Thursday, February 6th. The stock was sold at an average price of $88.76, for a total transaction of $209,562.36. Following the completion of the sale, the insider now owns 7,085 shares in the company, valued at approximately $628,864.60. The trade was a 24.99 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which can be accessed through this link. Also, Director Inge G. Thulin purchased 2,833 shares of the business's stock in a transaction that occurred on Thursday, February 6th. The stock was acquired at an average price of $88.25 per share, for a total transaction of $250,012.25. Following the acquisition, the director now directly owns 2,933 shares of the company's stock, valued at $258,837.25. This trade represents a 2,833.00 % increase in their position. The disclosure for this purchase can be found here. Corporate insiders own 0.09% of the company's stock.

Wall Street Analysts Forecast Growth

A number of research analysts recently issued reports on the company. Hsbc Global Res upgraded Merck & Co., Inc. from a "hold" rating to a "strong-buy" rating in a research note on Wednesday, December 4th. Bank of America lowered their target price on shares of Merck & Co., Inc. from $118.00 to $112.00 and set a "buy" rating on the stock in a research report on Wednesday, February 5th. Morgan Stanley decreased their price target on shares of Merck & Co., Inc. from $113.00 to $106.00 and set an "equal weight" rating for the company in a research note on Wednesday, February 5th. UBS Group dropped their price objective on shares of Merck & Co., Inc. from $125.00 to $120.00 and set a "buy" rating on the stock in a research note on Wednesday, January 8th. Finally, TD Securities cut Merck & Co., Inc. from a "buy" rating to a "hold" rating and decreased their price objective for the stock from $121.00 to $100.00 in a research report on Monday, February 10th. Eleven research analysts have rated the stock with a hold rating, nine have issued a buy rating and three have assigned a strong buy rating to the stock. Based on data from MarketBeat.com, Merck & Co., Inc. currently has a consensus rating of "Moderate Buy" and an average price target of $117.12.

Get Our Latest Stock Analysis on Merck & Co., Inc.

About Merck & Co., Inc.

(

Free Report)

Merck & Co, Inc is a health care company, which engages in the provision of health solutions through its prescription medicines, vaccines, biologic therapies, animal health, and consumer care products. It operates through the following segments: Pharmaceutical, Animal Health, and Other. The Pharmaceutical segment includes human health pharmaceutical and vaccine products.

Further Reading

Want to see what other hedge funds are holding MRK? Visit HoldingsChannel.com to get the latest 13F filings and insider trades for Merck & Co., Inc. (NYSE:MRK - Free Report).

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Merck & Co., Inc., you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Merck & Co., Inc. wasn't on the list.

While Merck & Co., Inc. currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report