Edgestream Partners L.P. lessened its stake in GXO Logistics, Inc. (NYSE:GXO - Free Report) by 94.1% during the third quarter, according to its most recent filing with the Securities and Exchange Commission. The fund owned 7,659 shares of the company's stock after selling 121,461 shares during the period. Edgestream Partners L.P.'s holdings in GXO Logistics were worth $399,000 as of its most recent SEC filing.

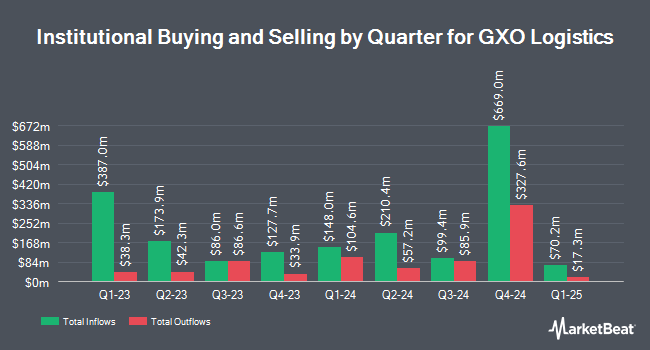

A number of other institutional investors have also recently made changes to their positions in GXO. DekaBank Deutsche Girozentrale bought a new stake in shares of GXO Logistics during the 3rd quarter valued at about $28,000. UMB Bank n.a. grew its holdings in GXO Logistics by 111.4% during the third quarter. UMB Bank n.a. now owns 628 shares of the company's stock valued at $33,000 after purchasing an additional 331 shares during the period. Signaturefd LLC grew its holdings in GXO Logistics by 37.2% during the third quarter. Signaturefd LLC now owns 918 shares of the company's stock valued at $48,000 after purchasing an additional 249 shares during the period. Hara Capital LLC bought a new position in shares of GXO Logistics in the third quarter worth $50,000. Finally, Whittier Trust Co. of Nevada Inc. boosted its holdings in shares of GXO Logistics by 37.6% in the third quarter. Whittier Trust Co. of Nevada Inc. now owns 1,032 shares of the company's stock worth $54,000 after acquiring an additional 282 shares during the period. Institutional investors own 90.67% of the company's stock.

GXO Logistics Price Performance

GXO stock traded down $0.13 during mid-day trading on Friday, hitting $49.71. The company had a trading volume of 997,855 shares, compared to its average volume of 950,780. The company has a market capitalization of $5.94 billion, a price-to-earnings ratio of 55.10, a P/E/G ratio of 1.78 and a beta of 1.52. The company has a 50-day moving average price of $58.24 and a 200 day moving average price of $53.05. The company has a quick ratio of 0.86, a current ratio of 0.86 and a debt-to-equity ratio of 0.81. GXO Logistics, Inc. has a 12-month low of $46.07 and a 12-month high of $63.33.

GXO Logistics (NYSE:GXO - Get Free Report) last released its quarterly earnings data on Monday, November 4th. The company reported $0.79 EPS for the quarter, beating the consensus estimate of $0.78 by $0.01. GXO Logistics had a net margin of 0.97% and a return on equity of 10.03%. The business had revenue of $3.16 billion during the quarter, compared to analyst estimates of $3.01 billion. During the same quarter last year, the business earned $0.69 earnings per share. GXO Logistics's quarterly revenue was up 27.8% compared to the same quarter last year. On average, research analysts anticipate that GXO Logistics, Inc. will post 2.76 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of brokerages recently issued reports on GXO. Citigroup assumed coverage on GXO Logistics in a research report on Wednesday, October 9th. They issued a "buy" rating and a $60.00 price objective on the stock. Oppenheimer upped their price target on shares of GXO Logistics from $63.00 to $67.00 and gave the company an "outperform" rating in a report on Wednesday, November 27th. Susquehanna cut their price target on shares of GXO Logistics from $75.00 to $73.00 and set a "positive" rating on the stock in a report on Thursday, September 26th. UBS Group upped their price objective on shares of GXO Logistics from $66.00 to $72.00 and gave the company a "buy" rating in a research note on Wednesday, November 6th. Finally, Barclays cut their target price on GXO Logistics from $60.00 to $52.00 and set an "equal weight" rating on the stock in a research note on Wednesday. Two analysts have rated the stock with a hold rating and ten have assigned a buy rating to the stock. Based on data from MarketBeat.com, GXO Logistics currently has an average rating of "Moderate Buy" and a consensus price target of $66.33.

Read Our Latest Stock Analysis on GXO Logistics

GXO Logistics Company Profile

(

Free Report)

GXO Logistics, Inc, together with its subsidiaries, provides logistics services worldwide. The company provides warehousing and distribution, order fulfilment, e-commerce, reverse logistics, and other supply chain services. As of December 31, 2023, it operated in approximately 974 facilities. The company serves various customers in the e-commerce, omnichannel retail, technology and consumer electronics, food and beverage, industrial and manufacturing, consumer packaged goods, and others.

Featured Articles

Before you consider GXO Logistics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GXO Logistics wasn't on the list.

While GXO Logistics currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.