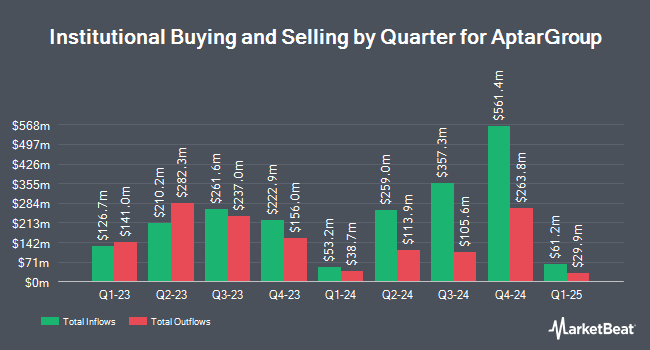

Edgestream Partners L.P. decreased its stake in AptarGroup, Inc. (NYSE:ATR - Free Report) by 61.9% in the 4th quarter, according to the company in its most recent filing with the Securities and Exchange Commission. The institutional investor owned 12,133 shares of the industrial products company's stock after selling 19,729 shares during the period. Edgestream Partners L.P.'s holdings in AptarGroup were worth $1,906,000 at the end of the most recent reporting period.

Other hedge funds have also recently modified their holdings of the company. Inceptionr LLC acquired a new position in shares of AptarGroup in the fourth quarter valued at approximately $739,000. Raymond James Financial Inc. acquired a new position in AptarGroup in the 4th quarter valued at $21,941,000. Arizona State Retirement System raised its position in AptarGroup by 1.0% during the 4th quarter. Arizona State Retirement System now owns 19,267 shares of the industrial products company's stock worth $3,027,000 after buying an additional 187 shares during the last quarter. Proficio Capital Partners LLC purchased a new position in AptarGroup during the 4th quarter worth $3,357,000. Finally, Atria Investments Inc lifted its stake in shares of AptarGroup by 5.8% in the 4th quarter. Atria Investments Inc now owns 4,549 shares of the industrial products company's stock worth $715,000 after acquiring an additional 250 shares during the period. 88.52% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

ATR has been the topic of a number of research analyst reports. StockNews.com downgraded shares of AptarGroup from a "buy" rating to a "hold" rating in a report on Monday, February 10th. Bank of America cut AptarGroup from a "buy" rating to a "neutral" rating and set a $173.00 price target for the company. in a research report on Monday, January 6th. Robert W. Baird decreased their price objective on shares of AptarGroup from $185.00 to $160.00 and set an "outperform" rating on the stock in a research report on Monday, February 10th. Wells Fargo & Company dropped their target price on shares of AptarGroup from $180.00 to $170.00 and set an "overweight" rating for the company in a report on Monday, February 10th. Finally, Raymond James reaffirmed an "outperform" rating and issued a $190.00 price target (down previously from $200.00) on shares of AptarGroup in a report on Monday, February 10th. Two equities research analysts have rated the stock with a hold rating, five have issued a buy rating and one has assigned a strong buy rating to the stock. According to MarketBeat.com, AptarGroup currently has a consensus rating of "Moderate Buy" and a consensus price target of $181.60.

Check Out Our Latest Stock Report on AptarGroup

AptarGroup Price Performance

ATR stock traded down $1.35 during trading on Thursday, hitting $144.69. 238,382 shares of the stock traded hands, compared to its average volume of 382,491. AptarGroup, Inc. has a one year low of $135.96 and a one year high of $178.03. The company has a current ratio of 1.38, a quick ratio of 0.95 and a debt-to-equity ratio of 0.28. The company has a 50 day simple moving average of $151.51 and a 200 day simple moving average of $159.05. The stock has a market cap of $9.62 billion, a price-to-earnings ratio of 26.12, a P/E/G ratio of 3.89 and a beta of 0.56.

AptarGroup (NYSE:ATR - Get Free Report) last announced its earnings results on Thursday, February 6th. The industrial products company reported $1.52 EPS for the quarter, topping the consensus estimate of $1.28 by $0.24. AptarGroup had a net margin of 10.45% and a return on equity of 15.56%. Equities analysts expect that AptarGroup, Inc. will post 5.57 EPS for the current fiscal year.

AptarGroup Announces Dividend

The business also recently declared a quarterly dividend, which was paid on Wednesday, February 26th. Investors of record on Wednesday, February 5th were given a $0.45 dividend. This represents a $1.80 dividend on an annualized basis and a dividend yield of 1.24%. The ex-dividend date of this dividend was Wednesday, February 5th. AptarGroup's payout ratio is currently 32.49%.

About AptarGroup

(

Free Report)

AptarGroup, Inc designs and manufactures a range of drug delivery, consumer product dispensing, and active material science solutions and services for the pharmaceutical, beauty, personal care, home care, and food and beverage markets. The company operates through Aptar Pharma, Aptar Beauty, and Aptar Closures segments.

Featured Articles

Before you consider AptarGroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AptarGroup wasn't on the list.

While AptarGroup currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.