Edgestream Partners L.P. lowered its holdings in Vital Energy, Inc. (NYSE:VTLE - Free Report) by 40.2% during the third quarter, according to its most recent disclosure with the Securities and Exchange Commission (SEC). The firm owned 56,696 shares of the company's stock after selling 38,126 shares during the quarter. Edgestream Partners L.P. owned 0.15% of Vital Energy worth $1,525,000 as of its most recent SEC filing.

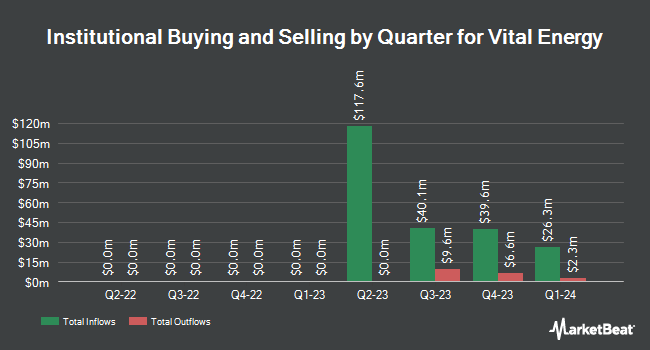

A number of other hedge funds and other institutional investors have also recently made changes to their positions in VTLE. Price T Rowe Associates Inc. MD increased its stake in shares of Vital Energy by 8.4% in the first quarter. Price T Rowe Associates Inc. MD now owns 10,577 shares of the company's stock worth $556,000 after acquiring an additional 816 shares during the period. California State Teachers Retirement System increased its stake in shares of Vital Energy by 5.2% in the first quarter. California State Teachers Retirement System now owns 23,062 shares of the company's stock worth $1,212,000 after acquiring an additional 1,133 shares during the period. Cetera Investment Advisers acquired a new stake in shares of Vital Energy in the first quarter worth $1,669,000. Cetera Advisors LLC grew its position in Vital Energy by 5.6% during the first quarter. Cetera Advisors LLC now owns 18,750 shares of the company's stock valued at $985,000 after buying an additional 989 shares during the period. Finally, CWM LLC grew its position in Vital Energy by 400.9% during the second quarter. CWM LLC now owns 581 shares of the company's stock valued at $26,000 after buying an additional 465 shares during the period. Institutional investors and hedge funds own 86.54% of the company's stock.

Vital Energy Trading Down 6.2 %

VTLE stock traded down $2.06 during trading on Wednesday, reaching $31.01. 756,522 shares of the stock were exchanged, compared to its average volume of 904,430. Vital Energy, Inc. has a 1 year low of $25.85 and a 1 year high of $58.30. The firm has a market capitalization of $1.18 billion, a price-to-earnings ratio of 2.21 and a beta of 3.19. The business has a 50 day moving average price of $29.38 and a 200-day moving average price of $36.44. The company has a current ratio of 0.67, a quick ratio of 0.67 and a debt-to-equity ratio of 0.80.

Vital Energy (NYSE:VTLE - Get Free Report) last announced its quarterly earnings results on Wednesday, November 6th. The company reported $1.61 earnings per share for the quarter, beating analysts' consensus estimates of $1.46 by $0.15. Vital Energy had a net margin of 25.09% and a return on equity of 9.05%. The business had revenue of $459.23 million during the quarter, compared to analysts' expectations of $461.58 million. During the same period last year, the business earned $5.16 earnings per share. The business's revenue for the quarter was up 5.4% on a year-over-year basis. On average, research analysts predict that Vital Energy, Inc. will post 6.9 earnings per share for the current year.

Insider Buying and Selling at Vital Energy

In related news, CFO Bryan Lemmerman sold 10,000 shares of Vital Energy stock in a transaction that occurred on Thursday, October 10th. The shares were sold at an average price of $28.54, for a total value of $285,400.00. Following the completion of the transaction, the chief financial officer now owns 77,516 shares in the company, valued at approximately $2,212,306.64. The trade was a 11.43 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, EVP Mark David Denny sold 5,145 shares of Vital Energy stock in a transaction that occurred on Tuesday, October 8th. The shares were sold at an average price of $30.22, for a total transaction of $155,481.90. Following the completion of the transaction, the executive vice president now owns 26,358 shares of the company's stock, valued at $796,538.76. This trade represents a 16.33 % decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 17,168 shares of company stock worth $502,017 over the last three months. Insiders own 1.20% of the company's stock.

Wall Street Analyst Weigh In

Several analysts recently commented on the stock. KeyCorp lowered shares of Vital Energy from an "overweight" rating to a "sector weight" rating in a research report on Friday, August 16th. BMO Capital Markets dropped their price target on shares of Vital Energy from $48.00 to $40.00 and set a "market perform" rating on the stock in a research report on Friday, October 4th. Piper Sandler dropped their target price on shares of Vital Energy from $37.00 to $35.00 and set a "neutral" rating on the stock in a research report on Monday, November 18th. JPMorgan Chase & Co. dropped their target price on shares of Vital Energy from $45.00 to $31.00 and set an "underweight" rating on the stock in a research report on Thursday, September 12th. Finally, Wells Fargo & Company lifted their target price on shares of Vital Energy from $29.00 to $35.00 and gave the company an "equal weight" rating in a research report on Tuesday, November 19th. Three research analysts have rated the stock with a sell rating, five have given a hold rating and three have assigned a buy rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and an average price target of $47.09.

Check Out Our Latest Stock Report on Vital Energy

Vital Energy Company Profile

(

Free Report)

Vital Energy, Inc, an independent energy company, engages in the acquisition, exploration, and development of oil and natural gas properties in the Permian Basin of West Texas, the United States. The company was formerly known as Laredo Petroleum, Inc and changed its name to Vital Energy, Inc in January 2023.

Read More

Before you consider Vital Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vital Energy wasn't on the list.

While Vital Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.