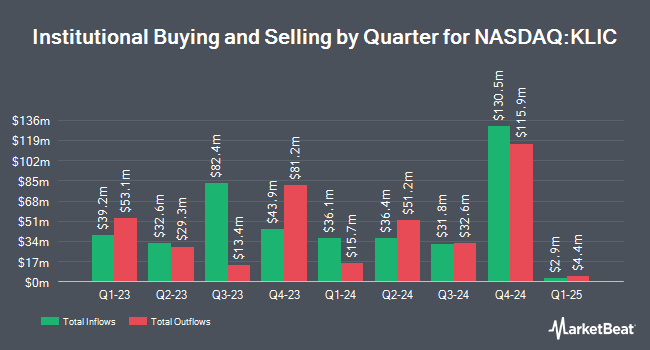

Edgestream Partners L.P. trimmed its stake in Kulicke and Soffa Industries, Inc. (NASDAQ:KLIC - Free Report) by 46.9% in the 3rd quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 79,189 shares of the semiconductor company's stock after selling 70,055 shares during the period. Edgestream Partners L.P. owned 0.15% of Kulicke and Soffa Industries worth $3,574,000 at the end of the most recent reporting period.

Other institutional investors and hedge funds also recently bought and sold shares of the company. Advisors Asset Management Inc. boosted its position in shares of Kulicke and Soffa Industries by 137.5% in the third quarter. Advisors Asset Management Inc. now owns 715 shares of the semiconductor company's stock worth $32,000 after purchasing an additional 414 shares during the period. Signaturefd LLC increased its stake in Kulicke and Soffa Industries by 226.3% in the 3rd quarter. Signaturefd LLC now owns 783 shares of the semiconductor company's stock worth $35,000 after buying an additional 543 shares in the last quarter. Blue Trust Inc. raised its holdings in Kulicke and Soffa Industries by 17,075.0% during the second quarter. Blue Trust Inc. now owns 1,374 shares of the semiconductor company's stock valued at $69,000 after acquiring an additional 1,366 shares during the period. Innealta Capital LLC purchased a new position in shares of Kulicke and Soffa Industries in the second quarter valued at about $73,000. Finally, CWM LLC boosted its stake in shares of Kulicke and Soffa Industries by 101.8% in the third quarter. CWM LLC now owns 1,923 shares of the semiconductor company's stock worth $87,000 after acquiring an additional 970 shares during the period. 98.22% of the stock is currently owned by hedge funds and other institutional investors.

Analyst Ratings Changes

KLIC has been the topic of a number of research analyst reports. StockNews.com cut Kulicke and Soffa Industries from a "hold" rating to a "sell" rating in a report on Wednesday, November 20th. Craig Hallum dropped their target price on shares of Kulicke and Soffa Industries from $55.00 to $50.00 and set a "buy" rating for the company in a research report on Thursday, August 8th. TD Cowen raised their target price on shares of Kulicke and Soffa Industries from $45.00 to $50.00 and gave the company a "hold" rating in a research note on Friday, November 15th. Needham & Company LLC upgraded shares of Kulicke and Soffa Industries from a "hold" rating to a "buy" rating and set a $55.00 price target on the stock in a research note on Friday, November 15th. Finally, DA Davidson dropped their price target on Kulicke and Soffa Industries from $65.00 to $60.00 and set a "buy" rating for the company in a research note on Friday, November 15th. One investment analyst has rated the stock with a sell rating, two have issued a hold rating and three have issued a buy rating to the stock. Based on data from MarketBeat, the company presently has an average rating of "Hold" and a consensus target price of $52.40.

Get Our Latest Report on Kulicke and Soffa Industries

Insider Buying and Selling

In related news, CFO Lester A. Wong sold 60,000 shares of the firm's stock in a transaction dated Wednesday, November 20th. The shares were sold at an average price of $46.37, for a total value of $2,782,200.00. Following the transaction, the chief financial officer now owns 79,636 shares of the company's stock, valued at $3,692,721.32. This trade represents a 42.97 % decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Also, SVP Nelson Munpun Wong sold 30,000 shares of the company's stock in a transaction dated Thursday, November 21st. The stock was sold at an average price of $47.56, for a total transaction of $1,426,800.00. Following the completion of the transaction, the senior vice president now owns 177,533 shares in the company, valued at $8,443,469.48. This represents a 14.46 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last ninety days, insiders sold 99,730 shares of company stock valued at $4,657,261. Company insiders own 0.03% of the company's stock.

Kulicke and Soffa Industries Stock Up 4.4 %

NASDAQ KLIC traded up $2.12 during trading hours on Monday, hitting $50.54. 623,253 shares of the company were exchanged, compared to its average volume of 504,985. Kulicke and Soffa Industries, Inc. has a 52 week low of $38.20 and a 52 week high of $56.71. The stock has a 50-day moving average price of $45.95 and a 200 day moving average price of $45.39. The stock has a market cap of $2.72 billion, a PE ratio of -41.09 and a beta of 1.38.

Kulicke and Soffa Industries (NASDAQ:KLIC - Get Free Report) last released its earnings results on Wednesday, November 13th. The semiconductor company reported $0.34 earnings per share for the quarter, missing the consensus estimate of $0.35 by ($0.01). The company had revenue of $181.30 million for the quarter, compared to the consensus estimate of $180.03 million. Kulicke and Soffa Industries had a negative net margin of 9.77% and a negative return on equity of 0.92%. The business's revenue for the quarter was down 10.4% compared to the same quarter last year. During the same period in the prior year, the firm posted $0.51 EPS. As a group, sell-side analysts anticipate that Kulicke and Soffa Industries, Inc. will post 1.29 earnings per share for the current year.

Kulicke and Soffa Industries Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Thursday, December 19th. Stockholders of record on Tuesday, January 7th will be issued a $0.205 dividend. This represents a $0.82 annualized dividend and a dividend yield of 1.62%. The ex-dividend date is Thursday, December 19th. This is a positive change from Kulicke and Soffa Industries's previous quarterly dividend of $0.20. Kulicke and Soffa Industries's dividend payout ratio (DPR) is -65.04%.

Kulicke and Soffa Industries declared that its Board of Directors has initiated a stock repurchase program on Wednesday, November 13th that permits the company to repurchase $300.00 million in outstanding shares. This repurchase authorization permits the semiconductor company to buy up to 11.7% of its shares through open market purchases. Shares repurchase programs are typically an indication that the company's leadership believes its shares are undervalued.

Kulicke and Soffa Industries Profile

(

Free Report)

Kulicke and Soffa Industries, Inc designs, manufactures, and sells capital equipment and tools used to assemble semiconductor devices. It operates through four segments: Ball Bonding Equipment, Wedge Bonding Equipment, Advanced Solutions, and Aftermarket Products and Services (APS). The company offers ball bonding equipment, wafer level bonding equipment, wedge bonding equipment; and advanced display, die-attach, and thermocompression systems and solutions, as well as tools, spares and services for equipment.

Featured Articles

Before you consider Kulicke and Soffa Industries, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Kulicke and Soffa Industries wasn't on the list.

While Kulicke and Soffa Industries currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.