Edgestream Partners L.P. purchased a new stake in shares of Inter Parfums, Inc. (NASDAQ:IPAR - Free Report) during the 3rd quarter, according to the company in its most recent filing with the Securities & Exchange Commission. The fund purchased 5,095 shares of the company's stock, valued at approximately $660,000.

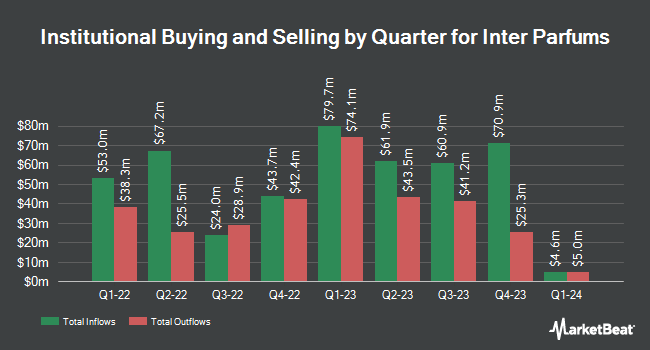

Several other large investors have also bought and sold shares of IPAR. Dimensional Fund Advisors LP lifted its stake in shares of Inter Parfums by 0.7% in the 2nd quarter. Dimensional Fund Advisors LP now owns 735,841 shares of the company's stock valued at $85,384,000 after purchasing an additional 4,862 shares during the period. Royce & Associates LP grew its position in shares of Inter Parfums by 0.7% in the 3rd quarter. Royce & Associates LP now owns 595,175 shares of the company's stock worth $77,063,000 after buying an additional 4,345 shares during the period. Victory Capital Management Inc. increased its stake in shares of Inter Parfums by 5,393.6% in the 3rd quarter. Victory Capital Management Inc. now owns 363,567 shares of the company's stock worth $47,075,000 after acquiring an additional 356,949 shares in the last quarter. American Century Companies Inc. lifted its position in Inter Parfums by 50.1% during the 2nd quarter. American Century Companies Inc. now owns 317,556 shares of the company's stock valued at $36,846,000 after acquiring an additional 106,044 shares during the period. Finally, Bahl & Gaynor Inc. boosted its stake in Inter Parfums by 0.4% during the second quarter. Bahl & Gaynor Inc. now owns 253,443 shares of the company's stock worth $29,407,000 after acquiring an additional 1,023 shares in the last quarter. 55.57% of the stock is owned by institutional investors.

Inter Parfums Stock Up 1.2 %

NASDAQ IPAR traded up $1.58 during mid-day trading on Friday, reaching $138.44. The stock had a trading volume of 29,777 shares, compared to its average volume of 144,574. The stock has a market cap of $4.43 billion, a PE ratio of 29.37 and a beta of 1.20. Inter Parfums, Inc. has a 1 year low of $108.39 and a 1 year high of $156.75. The company has a debt-to-equity ratio of 0.14, a current ratio of 2.82 and a quick ratio of 1.60. The company has a fifty day moving average price of $127.00 and a 200 day moving average price of $123.93.

Inter Parfums (NASDAQ:IPAR - Get Free Report) last posted its quarterly earnings results on Wednesday, November 6th. The company reported $1.93 earnings per share for the quarter, topping the consensus estimate of $1.83 by $0.10. Inter Parfums had a return on equity of 16.34% and a net margin of 10.60%. The firm had revenue of $425.00 million during the quarter, compared to analysts' expectations of $425.00 million. During the same quarter in the previous year, the business earned $1.66 earnings per share. The company's revenue was up 15.5% on a year-over-year basis. On average, research analysts expect that Inter Parfums, Inc. will post 5.15 earnings per share for the current year.

Wall Street Analyst Weigh In

Several research firms have recently issued reports on IPAR. Piper Sandler lifted their target price on shares of Inter Parfums from $155.00 to $164.00 and gave the company an "overweight" rating in a report on Wednesday. DA Davidson reiterated a "buy" rating and set a $163.00 price objective on shares of Inter Parfums in a research note on Tuesday. Finally, BWS Financial reissued a "buy" rating and issued a $172.00 target price on shares of Inter Parfums in a research note on Monday, November 11th. One analyst has rated the stock with a hold rating and four have issued a buy rating to the company. Based on data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average target price of $159.75.

Check Out Our Latest Stock Analysis on Inter Parfums

Insider Buying and Selling at Inter Parfums

In other Inter Parfums news, COO Pelayo Frederic Garcia sold 4,000 shares of the business's stock in a transaction dated Friday, November 22nd. The stock was sold at an average price of $133.04, for a total transaction of $532,160.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Company insiders own 43.90% of the company's stock.

Inter Parfums Company Profile

(

Free Report)

Inter Parfums, Inc, together with its subsidiaries, manufactures, markets, and distributes a range of fragrances and fragrance related products in the United States and internationally. It operates in two segments, European Based Operations and United States Based Operations. The company offers its fragrance and cosmetic products under the Boucheron, Coach, Jimmy Choo, Karl Lagerfeld, Kate Spade, Lanvin, Moncler, Montblanc, Rochas, S.T.

Recommended Stories

Before you consider Inter Parfums, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Inter Parfums wasn't on the list.

While Inter Parfums currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.