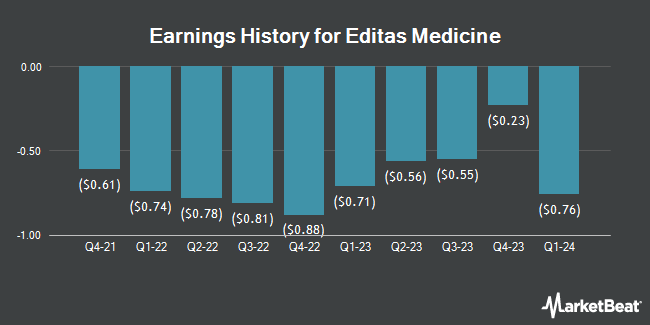

Editas Medicine (NASDAQ:EDIT - Get Free Report) is projected to post its quarterly earnings results before the market opens on Wednesday, February 26th. Analysts expect Editas Medicine to post earnings of ($0.43) per share and revenue of $37.17 million for the quarter.

Editas Medicine Stock Performance

Editas Medicine stock traded down $0.15 during mid-day trading on Friday, reaching $1.92. The stock had a trading volume of 9,432,958 shares, compared to its average volume of 5,416,719. Editas Medicine has a fifty-two week low of $1.12 and a fifty-two week high of $11.58. The stock's 50-day simple moving average is $1.37 and its 200-day simple moving average is $2.57. The firm has a market capitalization of $158.08 million, a PE ratio of -0.75 and a beta of 1.94.

Analysts Set New Price Targets

A number of equities research analysts have commented on the company. Wells Fargo & Company cut Editas Medicine from an "overweight" rating to an "equal weight" rating and reduced their price objective for the company from $7.00 to $4.00 in a research note on Wednesday, December 11th. Chardan Capital reissued a "neutral" rating on shares of Editas Medicine in a research note on Friday, December 13th. Bank of America cut Editas Medicine from a "buy" rating to an "underperform" rating and reduced their price objective for the company from $13.00 to $1.00 in a research note on Monday, November 25th. Barclays cut their target price on Editas Medicine from $5.00 to $3.00 and set an "equal weight" rating on the stock in a research report on Friday, December 13th. Finally, Raymond James cut Editas Medicine from an "outperform" rating to a "market perform" rating in a research report on Monday, November 4th. Three investment analysts have rated the stock with a sell rating, nine have given a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Hold" and a consensus target price of $7.00.

Get Our Latest Research Report on Editas Medicine

About Editas Medicine

(

Get Free Report)

Editas Medicine, Inc, a clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases. It develops a proprietary gene editing platform based on CRISPR technology. The company develops EDIT-101, which is in Phase 1/2 BRILLIANCE trial for Leber Congenital Amaurosis; and reni-cel, a clinical development gene-edited medicine to treat sickle cell disease and transfusion-dependent beta-thalassemia.

Recommended Stories

Before you consider Editas Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Editas Medicine wasn't on the list.

While Editas Medicine currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.