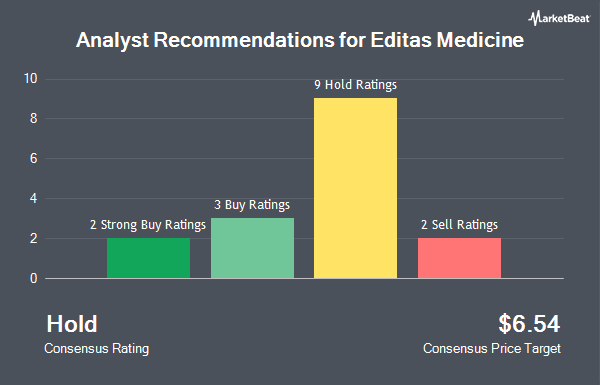

Editas Medicine, Inc. (NASDAQ:EDIT - Get Free Report) has received an average rating of "Moderate Buy" from the thirteen research firms that are currently covering the stock, MarketBeat.com reports. Six research analysts have rated the stock with a hold recommendation and seven have assigned a buy recommendation to the company. The average 1-year price target among brokerages that have covered the stock in the last year is $9.08.

EDIT has been the topic of several research analyst reports. Truist Financial lowered their price target on Editas Medicine from $12.00 to $8.00 and set a "buy" rating on the stock in a report on Tuesday. Chardan Capital reiterated a "buy" rating and set a $12.00 target price on shares of Editas Medicine in a report on Tuesday. Bank of America upgraded shares of Editas Medicine from a "neutral" rating to a "buy" rating and raised their target price for the company from $13.00 to $15.00 in a report on Thursday, August 8th. Wells Fargo & Company reduced their price objective on Editas Medicine from $9.00 to $7.00 and set an "overweight" rating on the stock in a research note on Tuesday. Finally, Evercore ISI upgraded Editas Medicine from an "in-line" rating to an "outperform" rating in a research report on Wednesday.

Get Our Latest Analysis on EDIT

Editas Medicine Price Performance

Shares of NASDAQ EDIT traded down $0.11 during midday trading on Thursday, reaching $3.17. 2,077,651 shares of the company traded hands, compared to its average volume of 1,935,623. Editas Medicine has a 52 week low of $2.70 and a 52 week high of $11.69. The stock has a 50-day moving average price of $3.40 and a 200 day moving average price of $4.49. The company has a market cap of $261.46 million, a price-to-earnings ratio of -1.24 and a beta of 2.01.

Editas Medicine (NASDAQ:EDIT - Get Free Report) last issued its earnings results on Monday, November 4th. The company reported ($0.75) EPS for the quarter, hitting the consensus estimate of ($0.75). The company had revenue of $0.06 million during the quarter, compared to the consensus estimate of $3.93 million. Editas Medicine had a negative return on equity of 72.15% and a negative net margin of 340.96%. The firm's revenue for the quarter was down 98.9% compared to the same quarter last year. During the same period in the previous year, the company posted ($0.55) EPS. As a group, analysts expect that Editas Medicine will post -2.96 EPS for the current year.

Hedge Funds Weigh In On Editas Medicine

A number of institutional investors have recently bought and sold shares of the stock. Integral Health Asset Management LLC boosted its position in shares of Editas Medicine by 50.0% during the 2nd quarter. Integral Health Asset Management LLC now owns 675,000 shares of the company's stock worth $3,152,000 after purchasing an additional 225,000 shares during the period. Millennium Management LLC boosted its holdings in shares of Editas Medicine by 10.0% in the 2nd quarter. Millennium Management LLC now owns 2,459,629 shares of the company's stock valued at $11,486,000 after buying an additional 223,012 shares during the period. Raymond James & Associates raised its position in shares of Editas Medicine by 49.7% during the 2nd quarter. Raymond James & Associates now owns 526,815 shares of the company's stock worth $2,460,000 after buying an additional 174,993 shares in the last quarter. Hennion & Walsh Asset Management Inc. purchased a new position in shares of Editas Medicine in the second quarter worth approximately $786,000. Finally, Kennedy Capital Management LLC acquired a new stake in Editas Medicine in the first quarter valued at approximately $988,000. 71.90% of the stock is owned by institutional investors.

About Editas Medicine

(

Get Free ReportEditas Medicine, Inc, a clinical stage genome editing company, focuses on developing transformative genomic medicines to treat a range of serious diseases. It develops a proprietary gene editing platform based on CRISPR technology. The company develops EDIT-101, which is in Phase 1/2 BRILLIANCE trial for Leber Congenital Amaurosis; and reni-cel, a clinical development gene-edited medicine to treat sickle cell disease and transfusion-dependent beta-thalassemia.

Featured Stories

Before you consider Editas Medicine, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Editas Medicine wasn't on the list.

While Editas Medicine currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Click the link below to learn more about how your portfolio could bloom.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.