Edmond DE Rothschild Holding S.A. purchased a new position in Equity Residential (NYSE:EQR - Free Report) during the fourth quarter, according to its most recent disclosure with the Securities & Exchange Commission. The institutional investor purchased 455,187 shares of the real estate investment trust's stock, valued at approximately $32,664,000. Edmond DE Rothschild Holding S.A. owned about 0.12% of Equity Residential at the end of the most recent quarter.

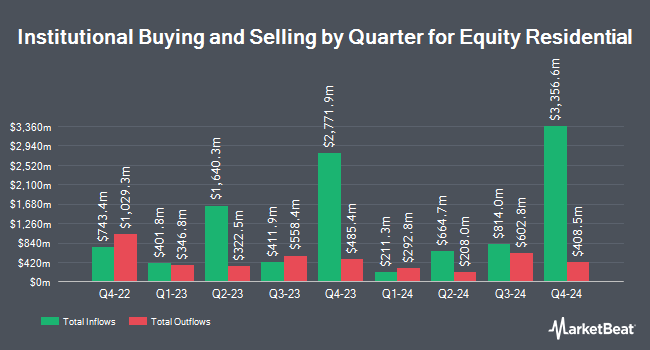

A number of other hedge funds and other institutional investors also recently made changes to their positions in EQR. Norges Bank bought a new position in Equity Residential in the 4th quarter worth approximately $2,493,426,000. Principal Financial Group Inc. raised its position in shares of Equity Residential by 8.3% during the third quarter. Principal Financial Group Inc. now owns 7,745,615 shares of the real estate investment trust's stock valued at $576,737,000 after buying an additional 591,866 shares during the last quarter. Heitman Real Estate Securities LLC raised its holdings in Equity Residential by 2,193.2% in the 3rd quarter. Heitman Real Estate Securities LLC now owns 416,647 shares of the real estate investment trust's stock valued at $31,024,000 after acquiring an additional 398,478 shares in the last quarter. KBC Group NV grew its stake in shares of Equity Residential by 100.9% in the 4th quarter. KBC Group NV now owns 691,061 shares of the real estate investment trust's stock valued at $49,590,000 after purchasing an additional 347,085 shares during the period. Finally, Sumitomo Mitsui Trust Group Inc. lifted its position in shares of Equity Residential by 20.8% during the 4th quarter. Sumitomo Mitsui Trust Group Inc. now owns 2,011,368 shares of the real estate investment trust's stock worth $144,336,000 after buying an additional 345,988 shares during the period. 92.68% of the stock is owned by hedge funds and other institutional investors.

Wall Street Analysts Forecast Growth

Several equities analysts have recently issued reports on the company. Mizuho cut their price target on Equity Residential from $78.00 to $74.00 and set a "neutral" rating on the stock in a research note on Monday, January 6th. Scotiabank increased their target price on Equity Residential from $78.00 to $79.00 and gave the company a "sector perform" rating in a research note on Friday, February 14th. Wells Fargo & Company cut their price target on shares of Equity Residential from $77.00 to $75.00 and set an "equal weight" rating on the stock in a research report on Friday, January 24th. Barclays lowered their target price on shares of Equity Residential from $83.00 to $79.00 and set an "overweight" rating for the company in a research note on Friday, January 24th. Finally, Evercore ISI lifted their price target on shares of Equity Residential from $74.00 to $76.00 and gave the company an "in-line" rating in a research note on Monday, February 10th. Ten equities research analysts have rated the stock with a hold rating and nine have given a buy rating to the company. According to MarketBeat.com, the company has a consensus rating of "Hold" and a consensus price target of $78.51.

Get Our Latest Stock Report on Equity Residential

Equity Residential Price Performance

NYSE EQR traded down $2.76 during trading on Friday, hitting $65.79. 853,562 shares of the company's stock were exchanged, compared to its average volume of 1,648,424. The company has a market cap of $24.98 billion, a PE ratio of 24.19, a P/E/G ratio of 3.99 and a beta of 0.91. The company has a current ratio of 0.36, a quick ratio of 0.36 and a debt-to-equity ratio of 0.72. Equity Residential has a fifty-two week low of $59.48 and a fifty-two week high of $78.83. The stock's 50 day moving average price is $71.08 and its two-hundred day moving average price is $72.34.

Equity Residential Increases Dividend

The company also recently declared a quarterly dividend, which will be paid on Thursday, April 17th. Stockholders of record on Monday, March 31st will be issued a dividend of $0.6925 per share. This is a boost from Equity Residential's previous quarterly dividend of $0.68. This represents a $2.77 annualized dividend and a dividend yield of 4.21%. The ex-dividend date of this dividend is Monday, March 31st. Equity Residential's payout ratio is 101.84%.

Insider Buying and Selling

In other news, CAO Ian Kaufman sold 642 shares of the business's stock in a transaction that occurred on Thursday, February 6th. The shares were sold at an average price of $72.06, for a total value of $46,262.52. Following the transaction, the chief accounting officer now owns 25,539 shares in the company, valued at approximately $1,840,340.34. The trade was a 2.45 % decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, EVP Scott Fenster sold 5,340 shares of the stock in a transaction on Thursday, February 6th. The stock was sold at an average price of $72.06, for a total transaction of $384,800.40. Following the sale, the executive vice president now owns 35,507 shares of the company's stock, valued at approximately $2,558,634.42. This trade represents a 13.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 19,763 shares of company stock worth $1,424,217 in the last ninety days. Company insiders own 1.00% of the company's stock.

About Equity Residential

(

Free Report)

Equity Residential is committed to creating communities where people thrive. The Company, a member of the S&P 500, is focused on the acquisition, development and management of residential properties located in and around dynamic cities that attract affluent long-term renters. Equity Residential owns or has investments in 305 properties consisting of 80,683 apartment units, with an established presence in Boston, New York, Washington, DC, Seattle, San Francisco and Southern California, and an expanding presence in Denver, Atlanta, Dallas/Ft.

Featured Articles

Before you consider Equity Residential, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Equity Residential wasn't on the list.

While Equity Residential currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report