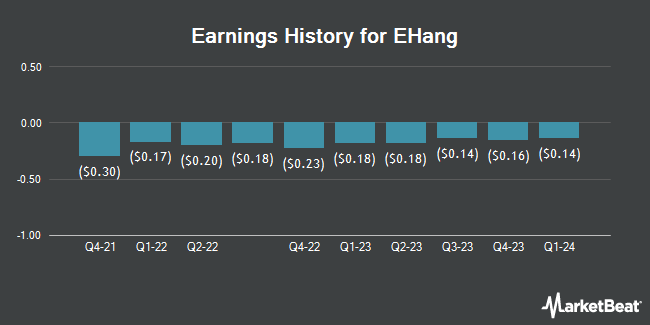

EHang (NASDAQ:EH - Get Free Report) is projected to issue its quarterly earnings data before the market opens on Friday, March 21st. Analysts expect the company to announce earnings of ($0.20) per share and revenue of $190.33 million for the quarter. Investors that wish to register for the company's conference call can do so using this link.

EHang Stock Up 4.5 %

NASDAQ EH traded up $1.08 on Monday, hitting $25.26. 2,726,363 shares of the company were exchanged, compared to its average volume of 1,702,593. The company has a current ratio of 2.39, a quick ratio of 2.25 and a debt-to-equity ratio of 0.01. The company has a market cap of $1.60 billion, a PE ratio of -46.78 and a beta of 0.91. The stock has a fifty day moving average of $19.84 and a 200-day moving average of $16.83. EHang has a 12 month low of $10.40 and a 12 month high of $29.76.

Analysts Set New Price Targets

Separately, CICC Research assumed coverage on EHang in a report on Thursday, January 2nd. They set an "outperform" rating for the company.

View Our Latest Analysis on EHang

About EHang

(

Get Free Report)

EHang Holdings Limited operates as an autonomous aerial vehicle (AAV) technology platform company in the People's Republic of China, East Asia, West Asia, Europe, and internationally. It designs, develops, manufactures, sells, and operates AAVs, as well as their supporting systems and infrastructure for various industries and applications, including passenger transportation, logistics, smart city management, and aerial media solutions.

Further Reading

Before you consider EHang, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EHang wasn't on the list.

While EHang currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.