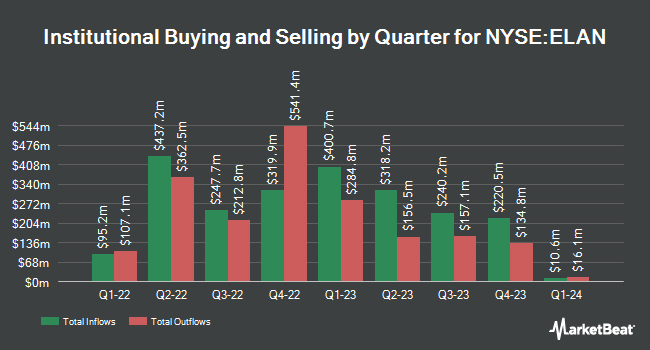

Wellington Management Group LLP increased its holdings in Elanco Animal Health Incorporated (NYSE:ELAN - Free Report) by 19.2% in the 3rd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The institutional investor owned 4,007,805 shares of the company's stock after acquiring an additional 646,522 shares during the quarter. Wellington Management Group LLP owned about 0.81% of Elanco Animal Health worth $58,875,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

A number of other large investors also recently bought and sold shares of ELAN. Benjamin F. Edwards & Company Inc. raised its position in shares of Elanco Animal Health by 337.7% in the 2nd quarter. Benjamin F. Edwards & Company Inc. now owns 1,764 shares of the company's stock worth $26,000 after purchasing an additional 1,361 shares during the last quarter. ORG Wealth Partners LLC bought a new stake in Elanco Animal Health during the 3rd quarter valued at about $29,000. ORG Partners LLC purchased a new position in Elanco Animal Health in the second quarter worth about $31,000. nVerses Capital LLC bought a new position in shares of Elanco Animal Health in the second quarter worth approximately $32,000. Finally, AM Squared Ltd purchased a new stake in shares of Elanco Animal Health during the third quarter valued at approximately $34,000. 97.48% of the stock is owned by hedge funds and other institutional investors.

Elanco Animal Health Stock Performance

Shares of NYSE ELAN traded up $0.11 during midday trading on Wednesday, hitting $12.53. 3,819,879 shares of the company's stock traded hands, compared to its average volume of 4,769,321. The firm has a fifty day moving average of $13.35 and a 200 day moving average of $14.40. Elanco Animal Health Incorporated has a 1 year low of $11.40 and a 1 year high of $18.80. The company has a debt-to-equity ratio of 0.66, a quick ratio of 1.31 and a current ratio of 2.55. The stock has a market capitalization of $6.19 billion, a price-to-earnings ratio of 31.06, a price-to-earnings-growth ratio of 2.02 and a beta of 1.41.

Elanco Animal Health (NYSE:ELAN - Get Free Report) last announced its earnings results on Thursday, November 7th. The company reported $0.13 EPS for the quarter, beating analysts' consensus estimates of $0.12 by $0.01. The business had revenue of $1.03 billion during the quarter, compared to analysts' expectations of $1.04 billion. Elanco Animal Health had a net margin of 4.60% and a return on equity of 6.78%. The firm's revenue was down 3.6% on a year-over-year basis. During the same period in the prior year, the company earned $0.18 earnings per share. On average, analysts forecast that Elanco Animal Health Incorporated will post 0.92 earnings per share for the current year.

Analysts Set New Price Targets

Several research firms recently issued reports on ELAN. Leerink Partners initiated coverage on Elanco Animal Health in a research report on Monday, December 2nd. They issued a "market perform" rating and a $14.00 price objective on the stock. Leerink Partnrs raised Elanco Animal Health to a "hold" rating in a report on Monday, December 2nd. UBS Group started coverage on Elanco Animal Health in a report on Monday. They issued a "buy" rating and a $18.00 price objective for the company. Morgan Stanley lowered Elanco Animal Health from an "overweight" rating to an "equal weight" rating and decreased their target price for the stock from $17.00 to $15.00 in a research report on Thursday, September 19th. Finally, Stifel Nicolaus reaffirmed a "buy" rating and set a $20.00 price target on shares of Elanco Animal Health in a report on Thursday, September 19th. One investment analyst has rated the stock with a sell rating, four have issued a hold rating and four have assigned a buy rating to the company. According to MarketBeat.com, Elanco Animal Health currently has a consensus rating of "Hold" and an average price target of $16.75.

View Our Latest Research Report on ELAN

Elanco Animal Health Profile

(

Free Report)

Elanco Animal Health Incorporated, an animal health company, innovates, develops, manufactures, and markets products for pets and farm animals. It offers pet health disease prevention products, such as parasiticide and vaccine products that protect pets from worms, fleas, and ticks under the Seresto, Advantage, Advantix, and Advocate brands; pet health therapeutics for pain, osteoarthritis, ear infections, cardiovascular, and dermatology indications in canines and felines under the Galliprant and Claro brands; vaccines, antibiotics, parasiticides, and other products for use in poultry and aquaculture production, as well as nutritional health products, including enzymes, probiotics, and prebiotics; and a range of vaccines, antibiotics, implants, parasiticides, and other products used in ruminant and swine production under the Rumensin and Baytril brands.

See Also

Before you consider Elanco Animal Health, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elanco Animal Health wasn't on the list.

While Elanco Animal Health currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.