Elastic (NYSE:ESTC - Get Free Report) will be posting its quarterly earnings results after the market closes on Thursday, November 21st. Analysts expect Elastic to post earnings of $0.38 per share for the quarter. Individual interested in participating in the company's earnings conference call can do so using this link.

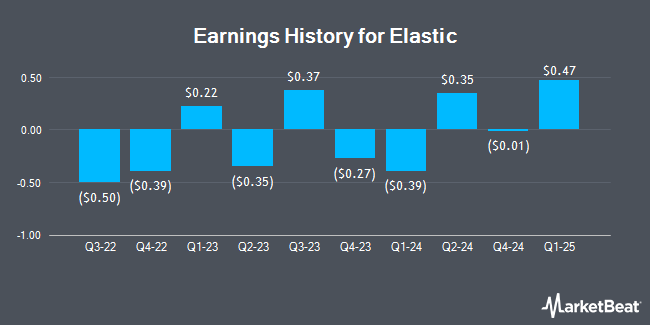

Elastic (NYSE:ESTC - Get Free Report) last released its earnings results on Thursday, August 29th. The company reported $0.35 earnings per share for the quarter, beating the consensus estimate of $0.25 by $0.10. The firm had revenue of $347.42 million for the quarter, compared to analyst estimates of $344.67 million. Elastic had a negative return on equity of 17.54% and a net margin of 4.62%. The company's quarterly revenue was up 18.3% on a year-over-year basis. During the same quarter in the prior year, the firm posted ($0.35) earnings per share. On average, analysts expect Elastic to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Elastic Trading Down 1.0 %

Shares of ESTC stock traded down $0.89 on Thursday, reaching $89.23. The company had a trading volume of 1,412,279 shares, compared to its average volume of 1,272,327. The company has a 50-day moving average of $79.15 and a 200-day moving average of $97.65. Elastic has a 12 month low of $69.00 and a 12 month high of $136.06. The stock has a market cap of $9.17 billion, a PE ratio of 163.85 and a beta of 0.94. The company has a current ratio of 1.91, a quick ratio of 1.91 and a debt-to-equity ratio of 0.75.

Insider Buying and Selling

In related news, Director Paul R. Auvil III purchased 20,000 shares of Elastic stock in a transaction dated Tuesday, September 3rd. The shares were bought at an average cost of $74.25 per share, for a total transaction of $1,485,000.00. Following the purchase, the director now owns 22,627 shares in the company, valued at approximately $1,680,054.75. This trade represents a 761.32 % increase in their position. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through the SEC website. Also, CEO Ashutosh Kulkarni sold 19,649 shares of the company's stock in a transaction that occurred on Monday, September 9th. The stock was sold at an average price of $70.25, for a total transaction of $1,380,342.25. Following the transaction, the chief executive officer now owns 432,648 shares of the company's stock, valued at approximately $30,393,522. This represents a 4.34 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 37,406 shares of company stock valued at $2,627,772 over the last quarter. 15.90% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

Several research analysts have recently weighed in on the stock. Stifel Nicolaus reduced their price target on shares of Elastic from $120.00 to $98.00 and set a "buy" rating for the company in a report on Friday, August 30th. Robert W. Baird downgraded Elastic from an "outperform" rating to a "neutral" rating and decreased their price target for the company from $135.00 to $95.00 in a research note on Friday, August 30th. Guggenheim began coverage on Elastic in a research report on Wednesday, September 11th. They set a "buy" rating and a $100.00 price target on the stock. Piper Sandler cut their price objective on Elastic from $131.00 to $100.00 and set an "overweight" rating for the company in a report on Friday, August 30th. Finally, Truist Financial dropped their target price on shares of Elastic from $140.00 to $105.00 and set a "buy" rating on the stock in a report on Friday, August 30th. Eight investment analysts have rated the stock with a hold rating and sixteen have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and an average price target of $103.71.

View Our Latest Report on Elastic

About Elastic

(

Get Free Report)

Elastic N.V., a data analytics company, delivers solutions designed to run in public or private clouds in multi-cloud environments. It primarily offers Elastic Stack, a set of software products that ingest and store data from various sources and formats, as well as performs search, analysis, and visualization on that data.

See Also

Before you consider Elastic, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Elastic wasn't on the list.

While Elastic currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.