Eldred Rock Partners LLC lessened its stake in shares of Novo Nordisk A/S (NYSE:NVO - Free Report) by 16.8% during the fourth quarter, according to the company in its most recent 13F filing with the Securities & Exchange Commission. The fund owned 75,851 shares of the company's stock after selling 15,323 shares during the quarter. Novo Nordisk A/S comprises about 2.3% of Eldred Rock Partners LLC's investment portfolio, making the stock its 24th biggest holding. Eldred Rock Partners LLC's holdings in Novo Nordisk A/S were worth $6,865,000 as of its most recent filing with the Securities & Exchange Commission.

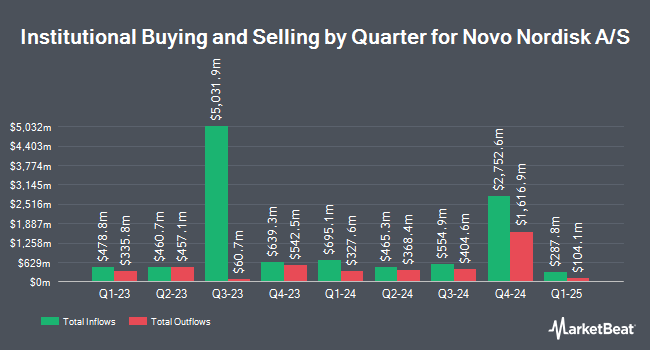

Several other hedge funds have also recently made changes to their positions in the stock. International Assets Investment Management LLC increased its position in shares of Novo Nordisk A/S by 10,608.4% during the 3rd quarter. International Assets Investment Management LLC now owns 1,813,571 shares of the company's stock valued at $215,942,000 after purchasing an additional 1,796,635 shares during the last quarter. DSM Capital Partners LLC raised its position in Novo Nordisk A/S by 257,816.0% in the second quarter. DSM Capital Partners LLC now owns 1,593,921 shares of the company's stock worth $227,516,000 after acquiring an additional 1,593,303 shares during the period. Mediolanum International Funds Ltd bought a new stake in shares of Novo Nordisk A/S during the 3rd quarter valued at $98,765,000. Marshall Wace LLP increased its stake in shares of Novo Nordisk A/S by 34,472.1% in the 2nd quarter. Marshall Wace LLP now owns 691,441 shares of the company's stock worth $98,696,000 after purchasing an additional 689,441 shares in the last quarter. Finally, Wellington Management Group LLP bought a new position in Novo Nordisk A/S in the 3rd quarter worth $42,017,000. 11.54% of the stock is owned by hedge funds and other institutional investors.

Novo Nordisk A/S Price Performance

Shares of NVO stock traded down $4.33 during trading hours on Monday, hitting $78.74. The stock had a trading volume of 21,239,835 shares, compared to its average volume of 8,206,201. The stock's 50-day moving average price is $97.76 and its two-hundred day moving average price is $116.89. Novo Nordisk A/S has a one year low of $78.17 and a one year high of $148.15. The stock has a market capitalization of $353.33 billion, a price-to-earnings ratio of 25.48, a PEG ratio of 0.92 and a beta of 0.45. The company has a debt-to-equity ratio of 0.43, a current ratio of 0.94 and a quick ratio of 0.75.

Analyst Ratings Changes

A number of research firms have recently weighed in on NVO. UBS Group raised Novo Nordisk A/S from a "sell" rating to a "buy" rating in a research report on Wednesday, January 8th. Sanford C. Bernstein raised shares of Novo Nordisk A/S from an "underperform" rating to a "market perform" rating in a research note on Monday, January 6th. StockNews.com cut shares of Novo Nordisk A/S from a "strong-buy" rating to a "buy" rating in a research note on Sunday, December 29th. Cantor Fitzgerald reiterated an "overweight" rating and issued a $160.00 price target on shares of Novo Nordisk A/S in a research note on Wednesday, November 6th. Finally, BNP Paribas upgraded Novo Nordisk A/S to a "strong-buy" rating in a research report on Monday, December 2nd. One analyst has rated the stock with a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company. Based on data from MarketBeat, the stock presently has a consensus rating of "Buy" and a consensus price target of $140.20.

View Our Latest Analysis on NVO

Novo Nordisk A/S Profile

(

Free Report)

Novo Nordisk A/S, together with its subsidiaries, engages in the research and development, manufacture, and distribution of pharmaceutical products in Europe, the Middle East, Africa, Mainland China, Hong Kong, Taiwan, North America, and internationally. It operates in two segments, Diabetes and Obesity Care, and Rare Disease.

See Also

Before you consider Novo Nordisk A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Novo Nordisk A/S wasn't on the list.

While Novo Nordisk A/S currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock your free copy of MarketBeat's comprehensive guide to pot stock investing and discover which cannabis companies are poised for growth. Plus, you'll get exclusive access to our daily newsletter with expert stock recommendations from Wall Street's top analysts.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.