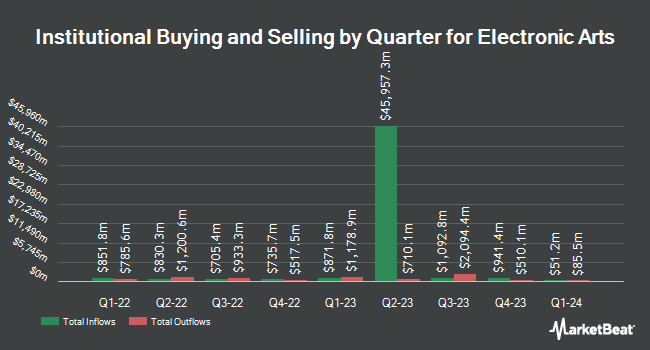

Barclays PLC decreased its stake in Electronic Arts Inc. (NASDAQ:EA - Free Report) by 26.4% during the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission. The firm owned 1,861,139 shares of the game software company's stock after selling 668,046 shares during the quarter. Barclays PLC owned 0.71% of Electronic Arts worth $266,962,000 as of its most recent filing with the Securities and Exchange Commission.

A number of other hedge funds have also modified their holdings of the company. Larson Financial Group LLC increased its holdings in shares of Electronic Arts by 31.8% in the third quarter. Larson Financial Group LLC now owns 290 shares of the game software company's stock worth $42,000 after acquiring an additional 70 shares in the last quarter. Prime Capital Investment Advisors LLC increased its stake in Electronic Arts by 5.1% during the 3rd quarter. Prime Capital Investment Advisors LLC now owns 1,572 shares of the game software company's stock worth $225,000 after purchasing an additional 76 shares in the last quarter. Cullen Frost Bankers Inc. raised its holdings in Electronic Arts by 2.9% during the 2nd quarter. Cullen Frost Bankers Inc. now owns 2,828 shares of the game software company's stock worth $394,000 after buying an additional 79 shares during the period. Shepherd Financial Partners LLC lifted its stake in Electronic Arts by 1.6% in the third quarter. Shepherd Financial Partners LLC now owns 5,690 shares of the game software company's stock valued at $816,000 after buying an additional 88 shares in the last quarter. Finally, Grove Bank & Trust boosted its holdings in shares of Electronic Arts by 23.5% in the second quarter. Grove Bank & Trust now owns 494 shares of the game software company's stock valued at $69,000 after buying an additional 94 shares during the period. 90.23% of the stock is currently owned by institutional investors and hedge funds.

Analyst Upgrades and Downgrades

EA has been the subject of several recent research reports. BNP Paribas upgraded shares of Electronic Arts to a "strong-buy" rating in a report on Wednesday, October 9th. UBS Group upped their target price on Electronic Arts from $155.00 to $160.00 and gave the stock a "neutral" rating in a report on Wednesday, October 30th. JPMorgan Chase & Co. decreased their price target on Electronic Arts from $155.00 to $150.00 and set a "neutral" rating for the company in a research note on Wednesday, October 30th. BMO Capital Markets reiterated an "outperform" rating and set a $160.00 price objective (up previously from $154.00) on shares of Electronic Arts in a research note on Wednesday, October 30th. Finally, Roth Mkm raised their target price on shares of Electronic Arts from $154.00 to $158.00 and gave the company a "neutral" rating in a research note on Wednesday, October 30th. Eight equities research analysts have rated the stock with a hold rating, twelve have given a buy rating and two have issued a strong buy rating to the company. According to data from MarketBeat, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $165.37.

Get Our Latest Analysis on EA

Insider Activity

In related news, insider Vijayanthimala Singh sold 1,000 shares of Electronic Arts stock in a transaction on Monday, December 2nd. The shares were sold at an average price of $164.45, for a total transaction of $164,450.00. Following the completion of the transaction, the insider now owns 30,216 shares of the company's stock, valued at $4,969,021.20. This trade represents a 3.20 % decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO Andrew Wilson sold 2,500 shares of the company's stock in a transaction dated Wednesday, September 25th. The shares were sold at an average price of $141.50, for a total value of $353,750.00. Following the sale, the chief executive officer now owns 54,247 shares in the company, valued at approximately $7,675,950.50. The trade was a 4.41 % decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 20,000 shares of company stock valued at $3,086,270. Insiders own 0.22% of the company's stock.

Electronic Arts Price Performance

Shares of EA traded down $0.31 during trading hours on Tuesday, reaching $165.30. The stock had a trading volume of 1,699,315 shares, compared to its average volume of 2,035,113. The stock has a market capitalization of $43.35 billion, a PE ratio of 42.49, a PEG ratio of 2.18 and a beta of 0.79. Electronic Arts Inc. has a 12 month low of $124.92 and a 12 month high of $168.50. The company has a debt-to-equity ratio of 0.25, a quick ratio of 1.43 and a current ratio of 1.43. The company's 50-day moving average is $154.87 and its two-hundred day moving average is $147.00.

Electronic Arts Dividend Announcement

The firm also recently declared a quarterly dividend, which will be paid on Wednesday, December 18th. Shareholders of record on Wednesday, November 27th will be given a $0.19 dividend. This represents a $0.76 annualized dividend and a yield of 0.46%. The ex-dividend date of this dividend is Wednesday, November 27th. Electronic Arts's dividend payout ratio (DPR) is currently 19.54%.

Electronic Arts Company Profile

(

Free Report)

Electronic Arts Inc develops, markets, publishes, and distributes games, content, and services for game consoles, PCs, mobile phones, and tablets worldwide. It develops and publishes games and services across various genres, such as sports, racing, first-person shooter, action, role-playing, and simulation primarily under the Battlefield, The Sims, Apex Legends, Need for Speed, and license games from others, including FIFA, Madden NFL, UFC, and Star Wars brands.

Recommended Stories

Before you consider Electronic Arts, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Electronic Arts wasn't on the list.

While Electronic Arts currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.