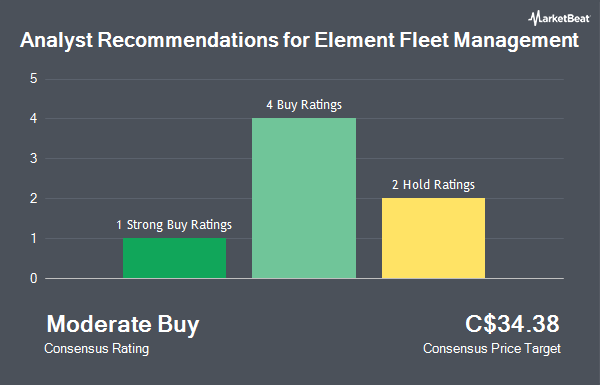

Element Fleet Management Corp. (TSE:EFN - Get Free Report) has earned an average recommendation of "Buy" from the seven research firms that are presently covering the stock, Marketbeat reports. One investment analyst has rated the stock with a hold recommendation, five have given a buy recommendation and one has given a strong buy recommendation to the company. The average twelve-month target price among brokers that have issued a report on the stock in the last year is C$34.00.

EFN has been the topic of a number of recent analyst reports. CIBC lifted their price target on Element Fleet Management from C$33.00 to C$34.00 and gave the stock an "outperform" rating in a report on Thursday, January 30th. Jefferies Financial Group lowered Element Fleet Management from a "buy" rating to a "hold" rating and dropped their price target for the stock from C$32.00 to C$30.00 in a report on Friday, November 15th. Scotiabank dropped their price target on Element Fleet Management from C$33.00 to C$32.00 in a report on Thursday, November 14th. Raymond James lifted their price target on Element Fleet Management from C$34.00 to C$36.00 in a report on Friday, February 28th. Finally, TD Securities lifted their price target on Element Fleet Management from C$32.00 to C$33.00 and gave the stock a "buy" rating in a report on Thursday, November 14th.

Read Our Latest Research Report on EFN

Element Fleet Management Stock Up 0.5 %

Shares of EFN stock traded up C$0.14 during trading hours on Thursday, reaching C$28.18. The company had a trading volume of 552,278 shares, compared to its average volume of 551,700. The business has a fifty day simple moving average of C$28.72 and a 200-day simple moving average of C$28.70. The company has a market cap of C$8.08 billion, a price-to-earnings ratio of 23.39, a price-to-earnings-growth ratio of 2.97 and a beta of 0.91. Element Fleet Management has a 12 month low of C$21.20 and a 12 month high of C$30.49. The company has a debt-to-equity ratio of 303.64, a current ratio of 7.04 and a quick ratio of 5.70.

Insider Activity at Element Fleet Management

In related news, Senior Officer Laura Lee Dottori-Attanasio acquired 10,500 shares of the firm's stock in a transaction that occurred on Friday, December 13th. The shares were bought at an average cost of C$28.70 per share, for a total transaction of C$301,350.00. Also, Senior Officer James Halliday sold 33,664 shares of the business's stock in a transaction on Monday, December 9th. The shares were sold at an average price of C$30.00, for a total value of C$1,009,920.00. In the last three months, insiders have purchased 33,550 shares of company stock worth $945,863. 0.26% of the stock is owned by company insiders.

Element Fleet Management Company Profile

(

Get Free ReportElement Financial separated into two independent public companies in October 2016. The former company now consists of Element Fleet Management, a global fleet management company, and ECN Capital, a commercial finance company. Element Fleet Management provides management services and financing for commercial vehicle and equipment fleets.

Featured Stories

Before you consider Element Fleet Management, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Element Fleet Management wasn't on the list.

While Element Fleet Management currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.