Kovitz Investment Group Partners LLC lifted its position in shares of e.l.f. Beauty, Inc. (NYSE:ELF - Free Report) by 63.4% in the 3rd quarter, according to its most recent Form 13F filing with the Securities and Exchange Commission (SEC). The firm owned 9,721 shares of the company's stock after buying an additional 3,773 shares during the period. Kovitz Investment Group Partners LLC's holdings in e.l.f. Beauty were worth $1,052,000 at the end of the most recent quarter.

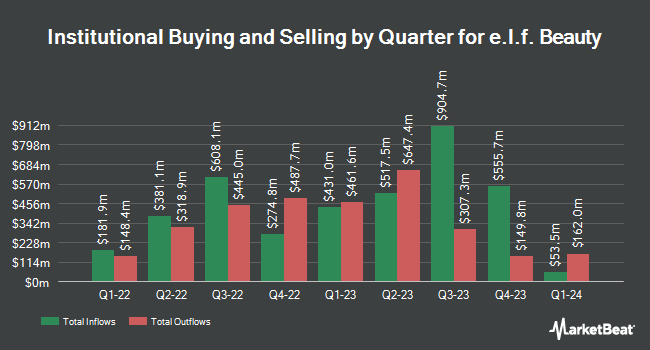

A number of other hedge funds have also modified their holdings of ELF. Texas Capital Bank Wealth Management Services Inc acquired a new position in e.l.f. Beauty during the third quarter worth $546,000. State Street Corp lifted its position in e.l.f. Beauty by 3.7% during the 3rd quarter. State Street Corp now owns 1,665,203 shares of the company's stock worth $181,557,000 after buying an additional 59,248 shares in the last quarter. Stifel Financial Corp boosted its stake in shares of e.l.f. Beauty by 57.7% during the 3rd quarter. Stifel Financial Corp now owns 28,244 shares of the company's stock worth $3,079,000 after buying an additional 10,332 shares during the last quarter. Quantinno Capital Management LP grew its holdings in shares of e.l.f. Beauty by 21.8% in the 3rd quarter. Quantinno Capital Management LP now owns 2,318 shares of the company's stock valued at $253,000 after acquiring an additional 415 shares in the last quarter. Finally, Quarry LP acquired a new stake in shares of e.l.f. Beauty in the third quarter valued at about $62,000. 92.44% of the stock is currently owned by institutional investors.

Insider Transactions at e.l.f. Beauty

In related news, CEO Tarang Amin sold 890 shares of the business's stock in a transaction dated Friday, December 6th. The stock was sold at an average price of $137.60, for a total value of $122,464.00. Following the completion of the transaction, the chief executive officer now owns 99,699 shares of the company's stock, valued at $13,718,582.40. The trade was a 0.88 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through this link. Also, insider Scott Milsten sold 530 shares of the stock in a transaction dated Friday, December 6th. The stock was sold at an average price of $137.60, for a total transaction of $72,928.00. Following the sale, the insider now owns 68,853 shares in the company, valued at $9,474,172.80. The trade was a 0.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last 90 days, insiders sold 2,205 shares of company stock valued at $297,442. 3.50% of the stock is currently owned by corporate insiders.

e.l.f. Beauty Stock Performance

ELF stock traded down $6.47 during mid-day trading on Thursday, hitting $132.00. 1,136,199 shares of the company were exchanged, compared to its average volume of 1,960,969. e.l.f. Beauty, Inc. has a 1-year low of $98.50 and a 1-year high of $221.83. The business has a 50 day simple moving average of $117.75 and a 200-day simple moving average of $149.71. The company has a current ratio of 1.78, a quick ratio of 1.01 and a debt-to-equity ratio of 0.22. The stock has a market capitalization of $7.44 billion, a PE ratio of 74.91, a price-to-earnings-growth ratio of 3.06 and a beta of 1.49.

e.l.f. Beauty (NYSE:ELF - Get Free Report) last released its quarterly earnings results on Wednesday, November 6th. The company reported $0.77 earnings per share for the quarter, topping the consensus estimate of $0.43 by $0.34. e.l.f. Beauty had a return on equity of 19.34% and a net margin of 8.87%. The business had revenue of $301.10 million during the quarter, compared to analysts' expectations of $289.43 million. During the same period last year, the firm posted $0.66 EPS. The firm's revenue for the quarter was up 39.7% compared to the same quarter last year. On average, equities analysts forecast that e.l.f. Beauty, Inc. will post 2.8 earnings per share for the current year.

Wall Street Analysts Forecast Growth

ELF has been the subject of several recent research reports. Truist Financial reduced their price target on e.l.f. Beauty from $210.00 to $130.00 and set a "buy" rating for the company in a research report on Wednesday, October 16th. JPMorgan Chase & Co. cut their price objective on e.l.f. Beauty from $167.00 to $154.00 and set an "overweight" rating for the company in a report on Thursday, November 7th. Bank of America decreased their target price on shares of e.l.f. Beauty from $190.00 to $165.00 and set a "buy" rating for the company in a research note on Tuesday, October 15th. Canaccord Genuity Group dropped their price target on shares of e.l.f. Beauty from $250.00 to $200.00 and set a "buy" rating on the stock in a research report on Thursday, November 7th. Finally, DA Davidson reissued a "buy" rating and issued a $170.00 price objective on shares of e.l.f. Beauty in a research report on Wednesday. One research analyst has rated the stock with a sell rating, three have assigned a hold rating, twelve have given a buy rating and two have issued a strong buy rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average target price of $171.00.

View Our Latest Stock Analysis on e.l.f. Beauty

e.l.f. Beauty Company Profile

(

Free Report)

e.l.f. Beauty, Inc, together with its subsidiaries, provides cosmetic and skin care products under the e.l.f. Cosmetics, e.l.f. Skin, Well People, and Keys Soulcare brand names worldwide. The company offers eye, lip, face, face, paw, and skin care products. It sells its products through national and international retailers and direct-to-consumer channels, which include e-commerce platforms in the United States, and internationally primarily through distributors.

Featured Articles

Before you consider e.l.f. Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and e.l.f. Beauty wasn't on the list.

While e.l.f. Beauty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Click the link to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.