e.l.f. Beauty (NYSE:ELF - Get Free Report)'s stock had its "buy" rating restated by analysts at DA Davidson in a report issued on Wednesday,Benzinga reports. They presently have a $170.00 price objective on the stock. DA Davidson's price objective would indicate a potential upside of 22.67% from the company's previous close.

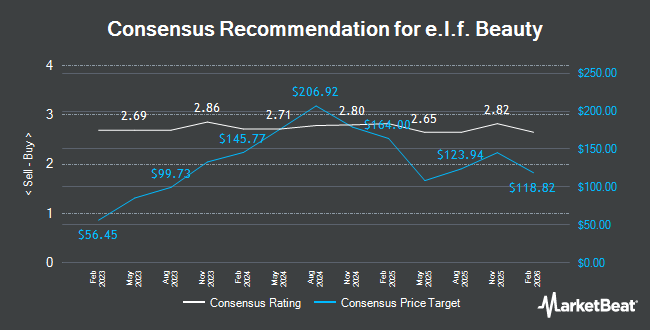

A number of other research analysts have also recently commented on ELF. B. Riley reduced their price objective on e.l.f. Beauty from $175.00 to $150.00 and set a "buy" rating on the stock in a research note on Thursday, November 7th. JPMorgan Chase & Co. decreased their price target on e.l.f. Beauty from $167.00 to $154.00 and set an "overweight" rating for the company in a report on Thursday, November 7th. Canaccord Genuity Group dropped their price objective on shares of e.l.f. Beauty from $250.00 to $200.00 and set a "buy" rating on the stock in a research note on Thursday, November 7th. Truist Financial decreased their target price on shares of e.l.f. Beauty from $210.00 to $130.00 and set a "buy" rating for the company in a research note on Wednesday, October 16th. Finally, Stifel Nicolaus dropped their price target on shares of e.l.f. Beauty from $131.00 to $115.00 and set a "hold" rating on the stock in a research note on Thursday, November 7th. One analyst has rated the stock with a sell rating, two have issued a hold rating, twelve have assigned a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, the stock presently has a consensus rating of "Moderate Buy" and an average target price of $173.53.

Read Our Latest Research Report on e.l.f. Beauty

e.l.f. Beauty Trading Up 0.7 %

ELF traded up $0.98 on Wednesday, reaching $138.58. 1,035,350 shares of the company's stock were exchanged, compared to its average volume of 1,964,551. e.l.f. Beauty has a twelve month low of $98.50 and a twelve month high of $221.83. The company's 50 day moving average is $116.46 and its 200-day moving average is $150.17. The company has a debt-to-equity ratio of 0.22, a quick ratio of 1.01 and a current ratio of 1.78. The company has a market cap of $7.81 billion, a price-to-earnings ratio of 74.27, a PEG ratio of 3.06 and a beta of 1.49.

e.l.f. Beauty (NYSE:ELF - Get Free Report) last released its quarterly earnings data on Wednesday, November 6th. The company reported $0.77 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.43 by $0.34. The company had revenue of $301.10 million during the quarter, compared to analyst estimates of $289.43 million. e.l.f. Beauty had a net margin of 8.87% and a return on equity of 19.34%. The business's quarterly revenue was up 39.7% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.66 earnings per share. Equities analysts predict that e.l.f. Beauty will post 2.8 earnings per share for the current year.

Insider Buying and Selling at e.l.f. Beauty

In other e.l.f. Beauty news, insider Scott Milsten sold 530 shares of the business's stock in a transaction on Friday, December 6th. The shares were sold at an average price of $137.60, for a total transaction of $72,928.00. Following the completion of the sale, the insider now owns 68,853 shares in the company, valued at $9,474,172.80. The trade was a 0.76 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, Director Maureen C. Watson sold 785 shares of the firm's stock in a transaction dated Friday, November 29th. The stock was sold at an average price of $130.00, for a total transaction of $102,050.00. Following the completion of the transaction, the director now owns 1,888 shares in the company, valued at approximately $245,440. The trade was a 29.37 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 2,205 shares of company stock worth $297,442 over the last quarter. 3.50% of the stock is owned by corporate insiders.

Hedge Funds Weigh In On e.l.f. Beauty

Several institutional investors have recently made changes to their positions in the stock. Wealth Enhancement Advisory Services LLC increased its holdings in shares of e.l.f. Beauty by 139.4% in the 2nd quarter. Wealth Enhancement Advisory Services LLC now owns 8,203 shares of the company's stock worth $1,729,000 after acquiring an additional 4,776 shares during the period. Envestnet Portfolio Solutions Inc. increased its stake in shares of e.l.f. Beauty by 44.3% in the second quarter. Envestnet Portfolio Solutions Inc. now owns 6,300 shares of the company's stock valued at $1,328,000 after purchasing an additional 1,935 shares during the period. Baader Bank Aktiengesellschaft bought a new stake in shares of e.l.f. Beauty during the second quarter valued at approximately $211,000. Portside Wealth Group LLC boosted its position in shares of e.l.f. Beauty by 3.2% during the second quarter. Portside Wealth Group LLC now owns 2,982 shares of the company's stock worth $628,000 after buying an additional 93 shares during the period. Finally, Sumitomo Mitsui Trust Holdings Inc. bought a new position in e.l.f. Beauty in the 2nd quarter worth approximately $232,000. 92.44% of the stock is owned by institutional investors.

e.l.f. Beauty Company Profile

(

Get Free Report)

e.l.f. Beauty, Inc, together with its subsidiaries, provides cosmetic and skin care products under the e.l.f. Cosmetics, e.l.f. Skin, Well People, and Keys Soulcare brand names worldwide. The company offers eye, lip, face, face, paw, and skin care products. It sells its products through national and international retailers and direct-to-consumer channels, which include e-commerce platforms in the United States, and internationally primarily through distributors.

Read More

Before you consider e.l.f. Beauty, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and e.l.f. Beauty wasn't on the list.

While e.l.f. Beauty currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.