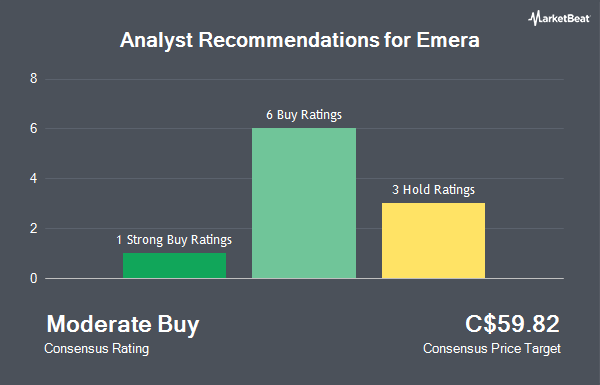

Emera Incorporated (TSE:EMA - Get Free Report) has earned an average rating of "Hold" from the ten research firms that are currently covering the company, MarketBeat.com reports. One equities research analyst has rated the stock with a sell recommendation, four have assigned a hold recommendation and five have given a buy recommendation to the company. The average 12-month price target among brokers that have issued a report on the stock in the last year is C$52.10.

EMA has been the subject of a number of analyst reports. JPMorgan Chase & Co. raised their target price on shares of Emera from C$45.00 to C$46.00 in a research report on Thursday, July 25th. National Bankshares lifted their price objective on Emera from C$49.00 to C$54.00 and gave the stock a "sector perform" rating in a research report on Friday, August 23rd. CIBC decreased their target price on shares of Emera from C$51.00 to C$50.00 and set a "neutral" rating for the company in a research report on Monday, July 22nd. Royal Bank of Canada upped their price objective on shares of Emera from C$57.00 to C$60.00 and gave the company an "outperform" rating in a report on Thursday, October 3rd. Finally, Raymond James lifted their price objective on Emera from C$54.00 to C$57.00 and gave the company an "outperform" rating in a research note on Monday, August 12th.

View Our Latest Stock Report on EMA

Emera Stock Up 0.3 %

Shares of EMA traded up C$0.15 during mid-day trading on Friday, hitting C$50.60. 114,911 shares of the company's stock were exchanged, compared to its average volume of 1,257,195. Emera has a twelve month low of C$44.13 and a twelve month high of C$54.19. The company has a quick ratio of 0.23, a current ratio of 0.79 and a debt-to-equity ratio of 155.62. The firm has a fifty day moving average of C$51.96 and a two-hundred day moving average of C$49.29. The stock has a market cap of C$14.59 billion, a price-to-earnings ratio of 19.63, a P/E/G ratio of 6.20 and a beta of 0.35.

Emera Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, November 15th. Investors of record on Friday, November 15th will be issued a dividend of $0.725 per share. This represents a $2.90 dividend on an annualized basis and a yield of 5.73%. The ex-dividend date is Friday, November 1st. Emera's payout ratio is 112.84%.

About Emera

(

Get Free ReportEmera Incorporated, through its subsidiaries, engages in the generation, transmission, and distribution of electricity to various customers. The company operates through Florida Electric Utility, Canadian Electric Utilities, Other Electric Utilities, Gas Utilities and Infrastructure, and Other segments.

Featured Articles

Before you consider Emera, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emera wasn't on the list.

While Emera currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.