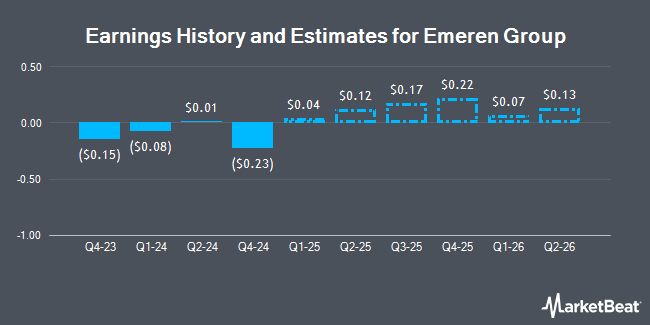

Emeren Group Ltd (NYSE:SOL - Free Report) - Equities researchers at HC Wainwright lifted their FY2025 earnings estimates for Emeren Group in a note issued to investors on Friday, November 15th. HC Wainwright analyst A. Dayal now anticipates that the semiconductor company will earn $0.56 per share for the year, up from their previous estimate of $0.54. HC Wainwright currently has a "Buy" rating and a $7.00 target price on the stock. The consensus estimate for Emeren Group's current full-year earnings is $0.33 per share.

Emeren Group (NYSE:SOL - Get Free Report) last issued its earnings results on Tuesday, August 20th. The semiconductor company reported $0.01 EPS for the quarter, missing analysts' consensus estimates of $0.07 by ($0.06). Emeren Group had a negative return on equity of 2.05% and a negative net margin of 7.14%. The company had revenue of $30.06 million during the quarter, compared to the consensus estimate of $21.10 million. During the same quarter in the prior year, the company earned $0.14 earnings per share.

A number of other research firms have also weighed in on SOL. Roth Mkm restated a "buy" rating and set a $3.00 target price on shares of Emeren Group in a report on Wednesday, August 21st. StockNews.com downgraded Emeren Group from a "hold" rating to a "sell" rating in a research report on Wednesday, November 13th. Three investment analysts have rated the stock with a sell rating and two have given a buy rating to the stock. According to MarketBeat, the stock presently has a consensus rating of "Hold" and an average price target of $3.83.

Read Our Latest Research Report on SOL

Emeren Group Stock Up 5.2 %

Shares of NYSE:SOL traded up $0.10 during trading hours on Monday, hitting $2.01. The company's stock had a trading volume of 191,812 shares, compared to its average volume of 352,409. The company has a debt-to-equity ratio of 0.07, a current ratio of 4.27 and a quick ratio of 4.27. The firm's fifty day moving average price is $2.42 and its 200 day moving average price is $1.98. Emeren Group has a 52 week low of $1.41 and a 52 week high of $3.00. The company has a market capitalization of $103.03 million, a price-to-earnings ratio of -15.46 and a beta of 1.73.

Institutional Investors Weigh In On Emeren Group

Large investors have recently made changes to their positions in the stock. Mercer Global Advisors Inc. ADV boosted its position in Emeren Group by 160.9% in the second quarter. Mercer Global Advisors Inc. ADV now owns 47,809 shares of the semiconductor company's stock valued at $72,000 after buying an additional 29,484 shares during the last quarter. Long Run Wealth Advisors LLC purchased a new position in shares of Emeren Group during the third quarter worth $28,000. Finally, XTX Topco Ltd acquired a new position in Emeren Group during the third quarter valued at $88,000. 44.08% of the stock is owned by hedge funds and other institutional investors.

Insider Transactions at Emeren Group

In related news, Chairman Shah Capital Management bought 26,843 shares of the company's stock in a transaction on Tuesday, September 3rd. The shares were bought at an average price of $1.83 per share, with a total value of $49,122.69. Following the transaction, the chairman now owns 18,655,151 shares in the company, valued at approximately $34,138,926.33. This trade represents a 0.14 % increase in their ownership of the stock. The acquisition was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Insiders own 37.31% of the company's stock.

About Emeren Group

(

Get Free Report)

Emeren Group Ltd, together with its subsidiaries, develops, builds, and sells solar power projects. It owns and operates 3-gigawatt pipeline of projects and independent power producer assets, as well as a 10-gigawatt pipeline of storage pipeline. The company develops community solar gardens; and sells project rights.

Featured Stories

Before you consider Emeren Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Emeren Group wasn't on the list.

While Emeren Group currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering when you'll finally be able to invest in SpaceX, StarLink, or The Boring Company? Click the link below to learn when Elon Musk will let these companies finally IPO.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.