Employees Retirement System of Texas trimmed its holdings in shares of GSK plc (NYSE:GSK - Free Report) by 43.3% in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 95,136 shares of the pharmaceutical company's stock after selling 72,575 shares during the quarter. Employees Retirement System of Texas' holdings in GSK were worth $3,217,000 at the end of the most recent reporting period.

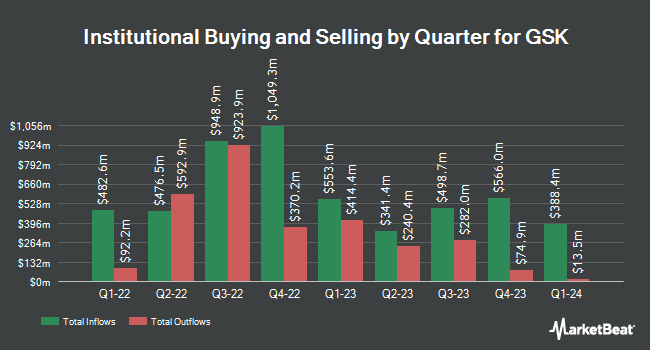

Other institutional investors and hedge funds have also recently bought and sold shares of the company. Dorsey & Whitney Trust CO LLC raised its stake in shares of GSK by 2.5% in the 4th quarter. Dorsey & Whitney Trust CO LLC now owns 11,506 shares of the pharmaceutical company's stock valued at $389,000 after acquiring an additional 278 shares during the period. Sunbelt Securities Inc. increased its holdings in GSK by 73.8% in the 3rd quarter. Sunbelt Securities Inc. now owns 711 shares of the pharmaceutical company's stock valued at $29,000 after purchasing an additional 302 shares during the last quarter. Rehmann Capital Advisory Group raised its position in GSK by 6.3% in the third quarter. Rehmann Capital Advisory Group now owns 5,608 shares of the pharmaceutical company's stock valued at $232,000 after purchasing an additional 332 shares during the period. GC Wealth Management RIA LLC lifted its stake in GSK by 2.6% during the fourth quarter. GC Wealth Management RIA LLC now owns 14,009 shares of the pharmaceutical company's stock worth $474,000 after purchasing an additional 353 shares in the last quarter. Finally, Jacobi Capital Management LLC boosted its position in shares of GSK by 3.9% during the fourth quarter. Jacobi Capital Management LLC now owns 10,403 shares of the pharmaceutical company's stock worth $352,000 after buying an additional 389 shares during the period. 15.74% of the stock is currently owned by hedge funds and other institutional investors.

GSK Stock Up 2.9 %

NYSE GSK traded up $0.98 during trading hours on Friday, hitting $34.58. 9,084,647 shares of the company were exchanged, compared to its average volume of 4,627,785. The company has a 50 day moving average of $37.52 and a two-hundred day moving average of $36.22. The company has a quick ratio of 0.52, a current ratio of 0.78 and a debt-to-equity ratio of 1.12. The firm has a market cap of $71.35 billion, a price-to-earnings ratio of 21.75, a PEG ratio of 1.12 and a beta of 0.56. GSK plc has a 52-week low of $31.72 and a 52-week high of $45.93.

GSK (NYSE:GSK - Get Free Report) last issued its earnings results on Wednesday, February 5th. The pharmaceutical company reported $0.59 earnings per share for the quarter, beating the consensus estimate of $0.44 by $0.15. GSK had a net margin of 8.13% and a return on equity of 48.59%. Equities research analysts anticipate that GSK plc will post 4.14 earnings per share for the current year.

GSK Increases Dividend

The company also recently disclosed a quarterly dividend, which was paid on Thursday, April 10th. Stockholders of record on Friday, February 21st were given a dividend of $0.3932 per share. This is a boost from GSK's previous quarterly dividend of $0.39. This represents a $1.57 annualized dividend and a dividend yield of 4.55%. The ex-dividend date of this dividend was Friday, February 21st. GSK's payout ratio is 100.63%.

Wall Street Analyst Weigh In

Several research firms recently issued reports on GSK. Morgan Stanley initiated coverage on GSK in a research note on Wednesday, February 12th. They set an "equal weight" rating on the stock. StockNews.com raised shares of GSK from a "buy" rating to a "strong-buy" rating in a research report on Friday, February 7th. Seven investment analysts have rated the stock with a hold rating and four have assigned a strong buy rating to the company. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $43.25.

View Our Latest Analysis on GSK

About GSK

(

Free Report)

GSK plc, together with its subsidiaries, engages in the research, development, and manufacture of vaccines, and specialty and general medicines to prevent and treat disease in the United Kingdom, the United States, and internationally. It operates through two segments, Commercial Operations and Total R&D.

Featured Articles

Before you consider GSK, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GSK wasn't on the list.

While GSK currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.