Empowered Funds LLC boosted its holdings in Airbnb, Inc. (NASDAQ:ABNB - Free Report) by 1,043.4% during the 3rd quarter, according to the company in its most recent disclosure with the SEC. The fund owned 62,499 shares of the company's stock after buying an additional 57,033 shares during the quarter. Empowered Funds LLC's holdings in Airbnb were worth $7,925,000 as of its most recent SEC filing.

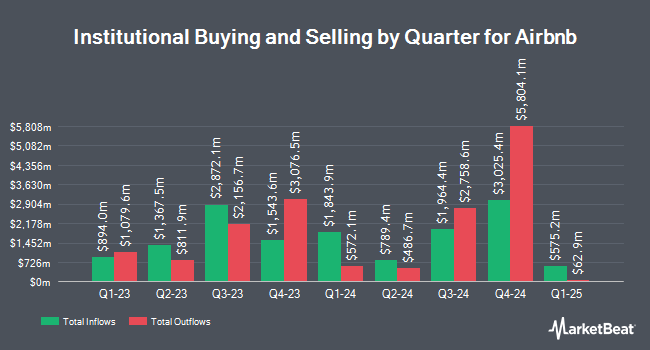

Several other institutional investors also recently modified their holdings of ABNB. Avantax Advisory Services Inc. lifted its stake in Airbnb by 19.9% during the first quarter. Avantax Advisory Services Inc. now owns 4,416 shares of the company's stock valued at $728,000 after buying an additional 732 shares in the last quarter. Koshinski Asset Management Inc. purchased a new position in Airbnb during the 1st quarter worth approximately $235,000. Dorsey & Whitney Trust CO LLC grew its position in Airbnb by 30.2% during the 1st quarter. Dorsey & Whitney Trust CO LLC now owns 1,959 shares of the company's stock worth $323,000 after purchasing an additional 454 shares in the last quarter. Banco Santander S.A. raised its stake in Airbnb by 19.8% during the 1st quarter. Banco Santander S.A. now owns 2,017 shares of the company's stock valued at $333,000 after purchasing an additional 333 shares during the period. Finally, First Foundation Advisors purchased a new stake in shares of Airbnb in the first quarter valued at $151,000. Institutional investors own 80.76% of the company's stock.

Insider Transactions at Airbnb

In other Airbnb news, CFO Elinor Mertz sold 6,250 shares of the firm's stock in a transaction dated Tuesday, September 17th. The shares were sold at an average price of $120.00, for a total transaction of $750,000.00. Following the completion of the transaction, the chief financial officer now owns 537,072 shares in the company, valued at $64,448,640. This trade represents a 1.15 % decrease in their ownership of the stock. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available at this link. Also, CTO Aristotle N. Balogh sold 600 shares of Airbnb stock in a transaction that occurred on Tuesday, August 20th. The shares were sold at an average price of $118.94, for a total value of $71,364.00. Following the sale, the chief technology officer now directly owns 198,244 shares in the company, valued at $23,579,141.36. The trade was a 0.30 % decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last quarter, insiders have sold 417,806 shares of company stock valued at $51,809,831. 27.83% of the stock is owned by corporate insiders.

Analyst Upgrades and Downgrades

Several research analysts recently weighed in on ABNB shares. JPMorgan Chase & Co. upped their price target on Airbnb from $121.00 to $142.00 and gave the company a "neutral" rating in a research report on Friday, November 8th. BMO Capital Markets reduced their price target on shares of Airbnb from $151.00 to $130.00 and set a "market perform" rating for the company in a research report on Wednesday, August 7th. Morgan Stanley boosted their price objective on shares of Airbnb from $120.00 to $130.00 and gave the company an "underweight" rating in a research report on Tuesday, July 23rd. The Goldman Sachs Group cut their target price on shares of Airbnb from $130.00 to $111.00 and set a "sell" rating for the company in a research report on Thursday, August 8th. Finally, Deutsche Bank Aktiengesellschaft lowered their price target on shares of Airbnb from $143.00 to $90.00 and set a "hold" rating on the stock in a report on Wednesday, August 7th. Six equities research analysts have rated the stock with a sell rating, nineteen have assigned a hold rating and eight have issued a buy rating to the company. According to data from MarketBeat.com, the company presently has an average rating of "Hold" and a consensus target price of $139.31.

View Our Latest Research Report on ABNB

Airbnb Stock Performance

ABNB stock traded down $2.06 on Friday, reaching $132.50. 4,798,719 shares of the company were exchanged, compared to its average volume of 4,515,468. The firm has a market capitalization of $85.01 billion, a PE ratio of 46.49, a PEG ratio of 1.87 and a beta of 1.15. Airbnb, Inc. has a 12 month low of $110.38 and a 12 month high of $170.10. The stock's fifty day moving average price is $130.99 and its 200 day moving average price is $136.58. The company has a debt-to-equity ratio of 0.23, a current ratio of 1.62 and a quick ratio of 1.62.

Airbnb (NASDAQ:ABNB - Get Free Report) last posted its quarterly earnings results on Thursday, November 7th. The company reported $2.13 earnings per share (EPS) for the quarter, missing the consensus estimate of $2.17 by ($0.04). The company had revenue of $3.73 billion during the quarter, compared to analyst estimates of $3.72 billion. Airbnb had a return on equity of 32.88% and a net margin of 16.96%. During the same quarter in the prior year, the business earned $2.39 earnings per share. On average, research analysts anticipate that Airbnb, Inc. will post 4.04 EPS for the current fiscal year.

Airbnb Company Profile

(

Free Report)

Airbnb, Inc, together with its subsidiaries, operates a platform that enables hosts to offer stays and experiences to guests worldwide. The company's marketplace connects hosts and guests online or through mobile devices to book spaces and experiences. It primarily offers private rooms, primary homes, and vacation homes.

Further Reading

Before you consider Airbnb, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Airbnb wasn't on the list.

While Airbnb currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.