Empowered Funds LLC grew its position in BellRing Brands, Inc. (NYSE:BRBR - Free Report) by 6.9% during the fourth quarter, according to its most recent 13F filing with the SEC. The institutional investor owned 74,649 shares of the company's stock after buying an additional 4,805 shares during the period. Empowered Funds LLC owned 0.06% of BellRing Brands worth $5,624,000 at the end of the most recent quarter.

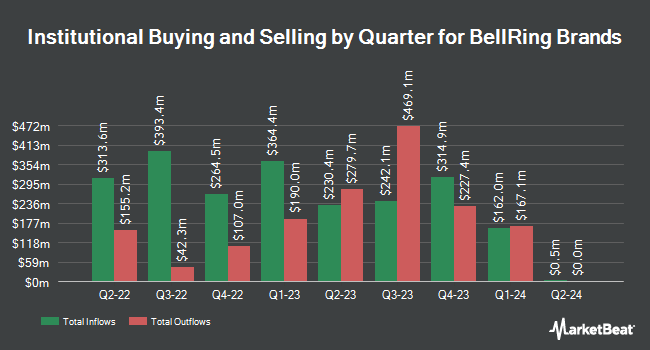

Other large investors have also recently modified their holdings of the company. V Square Quantitative Management LLC purchased a new stake in BellRing Brands during the 3rd quarter worth approximately $31,000. UMB Bank n.a. grew its holdings in shares of BellRing Brands by 69.4% during the fourth quarter. UMB Bank n.a. now owns 571 shares of the company's stock valued at $43,000 after buying an additional 234 shares during the last quarter. Farther Finance Advisors LLC increased its position in shares of BellRing Brands by 243.1% in the 3rd quarter. Farther Finance Advisors LLC now owns 669 shares of the company's stock valued at $41,000 after acquiring an additional 474 shares during the period. E Fund Management Hong Kong Co. Ltd. purchased a new position in BellRing Brands in the 4th quarter worth $52,000. Finally, Truvestments Capital LLC acquired a new stake in BellRing Brands during the 3rd quarter worth about $44,000. Institutional investors own 94.97% of the company's stock.

BellRing Brands Trading Down 1.3 %

BRBR stock traded down $1.00 during mid-day trading on Friday, reaching $76.55. The company's stock had a trading volume of 948,045 shares, compared to its average volume of 1,229,046. The company's 50 day moving average is $75.79 and its two-hundred day moving average is $67.49. BellRing Brands, Inc. has a fifty-two week low of $48.06 and a fifty-two week high of $80.67. The stock has a market cap of $9.86 billion, a PE ratio of 35.94, a P/E/G ratio of 2.34 and a beta of 0.86.

BellRing Brands (NYSE:BRBR - Get Free Report) last posted its quarterly earnings results on Monday, February 3rd. The company reported $0.58 EPS for the quarter, beating the consensus estimate of $0.47 by $0.11. BellRing Brands had a negative return on equity of 130.14% and a net margin of 13.32%. On average, analysts forecast that BellRing Brands, Inc. will post 2.23 earnings per share for the current fiscal year.

Analyst Ratings Changes

BRBR has been the topic of a number of research reports. DA Davidson reissued a "neutral" rating and issued a $75.00 price objective on shares of BellRing Brands in a report on Tuesday, November 19th. Truist Financial raised their price target on shares of BellRing Brands from $60.00 to $75.00 and gave the stock a "hold" rating in a research report on Wednesday, November 20th. Stephens reaffirmed an "equal weight" rating and issued a $75.00 price target on shares of BellRing Brands in a report on Tuesday, February 4th. TD Cowen boosted their price target on BellRing Brands from $83.00 to $86.00 and gave the company a "buy" rating in a report on Wednesday, January 8th. Finally, Citigroup boosted their target price on shares of BellRing Brands from $83.00 to $90.00 and gave the company a "buy" rating in a research note on Wednesday, January 29th. Three analysts have rated the stock with a hold rating and twelve have assigned a buy rating to the company. Based on data from MarketBeat.com, BellRing Brands has an average rating of "Moderate Buy" and a consensus target price of $77.87.

Read Our Latest Stock Analysis on BellRing Brands

Insider Activity

In other news, Director Robert V. Vitale sold 5,100 shares of BellRing Brands stock in a transaction that occurred on Monday, February 10th. The shares were sold at an average price of $75.30, for a total transaction of $384,030.00. Following the sale, the director now owns 1,166,691 shares of the company's stock, valued at approximately $87,851,832.30. The trade was a 0.44 % decrease in their position. The transaction was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Corporate insiders own 1.07% of the company's stock.

About BellRing Brands

(

Free Report)

BellRing Brands, Inc, together with its subsidiaries, provides various nutrition products in the United States. The company offers ready-to-drink (RTD) protein shakes, other RTD beverages, powders, nutrition bars, and other products primarily under the Premier Protein and Dymatize brands. It distributes its products through club, food, drug, mass, eCommerce, specialty, and convenience channels.

See Also

Before you consider BellRing Brands, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BellRing Brands wasn't on the list.

While BellRing Brands currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.