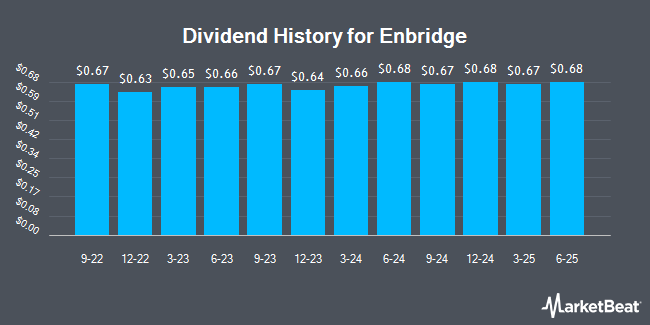

Enbridge Inc. (NYSE:ENB - Get Free Report) TSE: ENB declared a quarterly dividend on Thursday, December 5th,Wall Street Journal reports. Investors of record on Saturday, February 15th will be paid a dividend of 0.67 per share by the pipeline company on Saturday, March 1st. This represents a $2.68 annualized dividend and a yield of 6.10%. The ex-dividend date is Friday, February 14th.

Enbridge has raised its dividend payment by an average of 3.6% annually over the last three years. Enbridge has a dividend payout ratio of 120.4% indicating that the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Analysts expect Enbridge to earn $2.16 per share next year, which means the company may not be able to cover its $2.60 annual dividend with an expected future payout ratio of 120.4%.

Enbridge Price Performance

Shares of ENB stock traded up $0.27 during trading hours on Thursday, hitting $43.91. The company's stock had a trading volume of 5,538,287 shares, compared to its average volume of 4,872,006. The company has a current ratio of 0.62, a quick ratio of 0.54 and a debt-to-equity ratio of 1.41. Enbridge has a twelve month low of $32.85 and a twelve month high of $44.13. The stock has a market cap of $95.64 billion, a price-to-earnings ratio of 20.33, a P/E/G ratio of 4.27 and a beta of 0.94. The business has a fifty day moving average of $41.84 and a 200-day moving average of $39.05.

Enbridge (NYSE:ENB - Get Free Report) TSE: ENB last released its quarterly earnings results on Friday, November 1st. The pipeline company reported $0.55 earnings per share for the quarter, topping the consensus estimate of $0.40 by $0.15. The company had revenue of $10.91 billion during the quarter, compared to the consensus estimate of $4.54 billion. Enbridge had a return on equity of 9.94% and a net margin of 13.54%. During the same quarter last year, the business posted $0.46 earnings per share. As a group, equities research analysts anticipate that Enbridge will post 2.04 EPS for the current year.

Wall Street Analysts Forecast Growth

A number of brokerages have recently commented on ENB. Royal Bank of Canada reiterated an "outperform" rating and set a $63.00 price target (up from $59.00) on shares of Enbridge in a report on Wednesday. Jefferies Financial Group cut Enbridge from a "buy" rating to a "hold" rating in a report on Monday, September 30th. Morgan Stanley started coverage on Enbridge in a research report on Friday, October 25th. They set an "equal weight" rating on the stock. Finally, Wells Fargo & Company upgraded Enbridge from an "underweight" rating to an "equal weight" rating in a report on Wednesday, November 6th. Four research analysts have rated the stock with a hold rating and one has issued a buy rating to the company. Based on data from MarketBeat, the stock has a consensus rating of "Hold" and an average target price of $63.00.

Read Our Latest Report on ENB

Enbridge Company Profile

(

Get Free Report)

Enbridge Inc, together with its subsidiaries, operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services. The Liquids Pipelines segment operates pipelines and related terminals to transport various grades of crude oil and other liquid hydrocarbons in Canada and the United States.

Read More

Before you consider Enbridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enbridge wasn't on the list.

While Enbridge currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.