Enbridge (TSE:ENB - Free Report) NYSE: ENB had its price objective lifted by Raymond James from C$65.00 to C$67.00 in a research note issued to investors on Tuesday morning,BayStreet.CA reports.

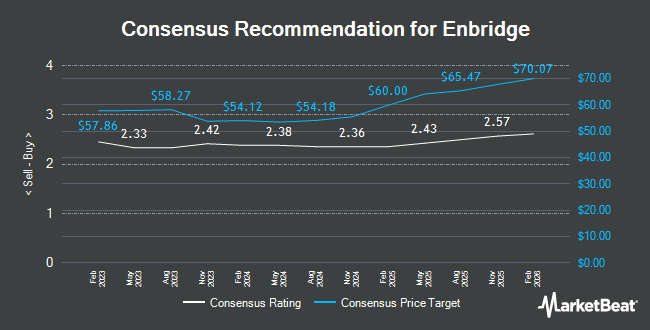

Several other brokerages have also issued reports on ENB. JPMorgan Chase & Co. boosted their target price on Enbridge from C$66.00 to C$69.00 in a research report on Thursday, December 5th. Scotiabank lifted their price target on shares of Enbridge from C$61.00 to C$65.00 and gave the company a "sector perform" rating in a research note on Thursday, February 13th. Wells Fargo & Company lifted their price target on shares of Enbridge from C$57.00 to C$60.00 in a research note on Thursday, December 5th. Royal Bank of Canada lifted their price target on shares of Enbridge from C$63.00 to C$67.00 in a research note on Tuesday. Finally, Barclays lifted their price target on shares of Enbridge from C$59.00 to C$64.00 in a research note on Monday, January 6th. Seven equities research analysts have rated the stock with a hold rating and four have assigned a buy rating to the company's stock. According to MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of C$63.23.

Check Out Our Latest Analysis on Enbridge

Enbridge Trading Down 0.0 %

Shares of TSE:ENB traded down C$0.01 during trading hours on Tuesday, hitting C$59.45. 10,803,839 shares of the company's stock traded hands, compared to its average volume of 10,191,566. Enbridge has a 1 year low of C$45.39 and a 1 year high of C$65.62. The business has a fifty day moving average price of C$62.19 and a 200-day moving average price of C$58.44. The firm has a market capitalization of C$128.84 billion, a P/E ratio of 19.33, a price-to-earnings-growth ratio of 1.72 and a beta of 0.90. The company has a debt-to-equity ratio of 144.86, a current ratio of 0.62 and a quick ratio of 0.44.

Enbridge Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Saturday, March 1st. Investors of record on Saturday, March 1st will be paid a $0.9425 dividend. This is an increase from Enbridge's previous quarterly dividend of $0.92. The ex-dividend date of this dividend is Friday, February 14th. This represents a $3.77 dividend on an annualized basis and a yield of 6.34%. Enbridge's payout ratio is 118.98%.

Insider Buying and Selling

In other news, Senior Officer Cynthia Lynn Hansen sold 1,106 shares of the company's stock in a transaction on Monday, December 23rd. The stock was sold at an average price of C$59.94, for a total transaction of C$66,293.64. 0.10% of the stock is currently owned by insiders.

Enbridge Company Profile

(

Get Free Report)

Enbridge Inc, together with its subsidiaries, operates as an energy infrastructure company. The company operates through five segments: Liquids Pipelines, Gas Transmission and Midstream, Gas Distribution and Storage, Renewable Power Generation, and Energy Services. The Liquids Pipelines segment operates pipelines and related terminals to transport various grades of crude oil and other liquid hydrocarbons in Canada and the United States.

Recommended Stories

Before you consider Enbridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enbridge wasn't on the list.

While Enbridge currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are likely to thrive in today's challenging market? Enter your email address and we'll send you MarketBeat's list of ten stocks that will drive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.