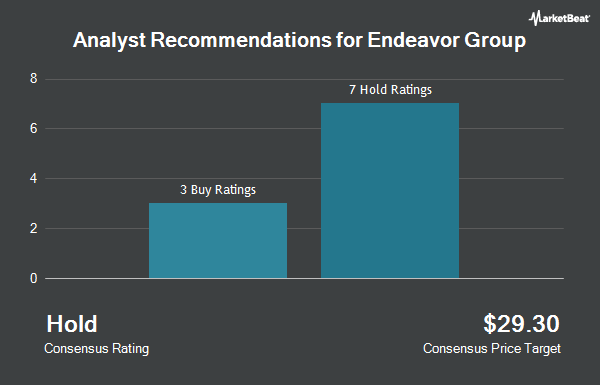

Shares of Endeavor Group Holdings, Inc. (NYSE:EDR - Get Free Report) have been given a consensus recommendation of "Reduce" by the eight ratings firms that are currently covering the firm, MarketBeat.com reports. One investment analyst has rated the stock with a sell recommendation and seven have given a hold recommendation to the company. The average 1 year target price among analysts that have covered the stock in the last year is $27.50.

A number of equities research analysts have recently issued reports on EDR shares. StockNews.com cut shares of Endeavor Group from a "hold" rating to a "sell" rating in a research note on Monday, February 10th. Seaport Res Ptn cut Endeavor Group from a "hold" rating to a "strong sell" rating in a research note on Tuesday, February 11th.

View Our Latest Report on Endeavor Group

Endeavor Group Price Performance

EDR traded up $1.22 during trading on Monday, reaching $30.05. 38,272,387 shares of the company were exchanged, compared to its average volume of 3,138,145. The company has a quick ratio of 0.63, a current ratio of 0.63 and a debt-to-equity ratio of 0.28. The company has a market cap of $20.62 billion, a price-to-earnings ratio of -14.66 and a beta of 0.72. Endeavor Group has a 12-month low of $25.07 and a 12-month high of $35.99. The company's 50-day moving average is $30.72 and its two-hundred day moving average is $29.98.

Endeavor Group Announces Dividend

The firm also recently announced a quarterly dividend, which was paid on Friday, March 14th. Stockholders of record on Friday, February 28th were paid a dividend of $0.06 per share. The ex-dividend date of this dividend was Friday, February 28th. This represents a $0.24 annualized dividend and a dividend yield of 0.80%. Endeavor Group's dividend payout ratio (DPR) is presently -9.02%.

Insider Activity at Endeavor Group

In other news, CFO Jason Lublin sold 50,000 shares of the stock in a transaction on Monday, February 24th. The stock was sold at an average price of $29.98, for a total value of $1,499,000.00. Following the sale, the chief financial officer now directly owns 219,613 shares of the company's stock, valued at approximately $6,583,997.74. This represents a 18.55 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is accessible through this link. Also, insider Canada Pension Plan Investment sold 21,038,712 shares of the stock in a transaction dated Monday, March 24th. The shares were sold at an average price of $27.50, for a total transaction of $578,564,580.00. The disclosure for this sale can be found here. Over the last quarter, insiders acquired 1,212,077 shares of company stock worth $191,824,043 and sold 21,185,617 shares worth $582,983,444. 63.90% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently made changes to their positions in EDR. Kapitalo Investimentos Ltda purchased a new stake in shares of Endeavor Group during the fourth quarter valued at $51,000. Blue Trust Inc. lifted its position in Endeavor Group by 176.1% during the fourth quarter. Blue Trust Inc. now owns 2,303 shares of the company's stock valued at $66,000 after purchasing an additional 1,469 shares during the period. FNY Investment Advisers LLC purchased a new stake in Endeavor Group in the fourth quarter worth approximately $96,000. BNP Paribas Financial Markets bought a new stake in Endeavor Group in the 4th quarter worth approximately $120,000. Finally, FMR LLC raised its stake in Endeavor Group by 67.6% during the 3rd quarter. FMR LLC now owns 5,575 shares of the company's stock valued at $159,000 after buying an additional 2,248 shares during the last quarter. Institutional investors own 74.99% of the company's stock.

Endeavor Group Company Profile

(

Get Free ReportEndeavor Group Holdings, Inc operates as a sports and entertainment company in the United States, the United Kingdom, and internationally. It operates through four segments: Owned Sports Properties; Events, Experiences & Rights; Representation; and Sports Data & Technology. The Owned Sports Properties segment operates a portfolio of sports properties, including Ultimate Fighting Championship, World Wrestling Entertainment, Inc, Professional Bull Rider, and Euroleague.

Featured Articles

Before you consider Endeavor Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Endeavor Group wasn't on the list.

While Endeavor Group currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

With the proliferation of data centers and electric vehicles, the electric grid will only get more strained. Download this report to learn how energy stocks can play a role in your portfolio as the global demand for energy continues to grow.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.