Energizer (NYSE:ENR - Get Free Report) was downgraded by StockNews.com from a "buy" rating to a "hold" rating in a research note issued on Wednesday.

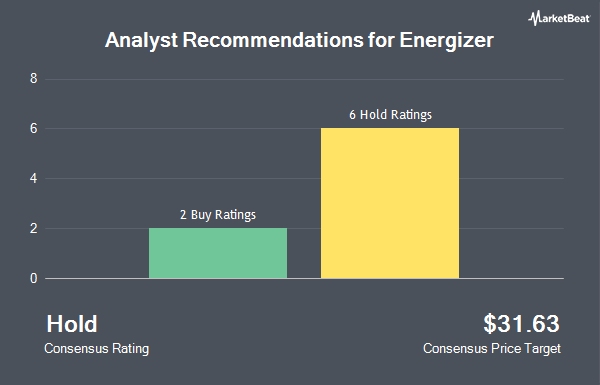

ENR has been the subject of a number of other research reports. Canaccord Genuity Group raised their price objective on Energizer from $32.00 to $36.00 and gave the company a "hold" rating in a research report on Wednesday, November 20th. Evercore ISI cut their target price on Energizer from $42.00 to $40.00 and set an "outperform" rating on the stock in a research note on Wednesday, August 7th. JPMorgan Chase & Co. upgraded Energizer from an "underweight" rating to a "neutral" rating and increased their target price for the company from $32.00 to $39.00 in a research note on Wednesday, November 20th. Royal Bank of Canada reiterated a "sector perform" rating and set a $38.00 target price on shares of Energizer in a research note on Wednesday, August 7th. Finally, Truist Financial raised their price target on Energizer from $40.00 to $45.00 and gave the stock a "buy" rating in a research note on Wednesday, November 20th. Seven investment analysts have rated the stock with a hold rating and two have issued a buy rating to the company. According to data from MarketBeat.com, the stock has a consensus rating of "Hold" and an average price target of $37.63.

View Our Latest Report on Energizer

Energizer Stock Up 0.8 %

Shares of NYSE:ENR traded up $0.32 during trading on Wednesday, hitting $39.04. The stock had a trading volume of 321,818 shares, compared to its average volume of 575,338. Energizer has a 12 month low of $26.92 and a 12 month high of $39.51. The company has a market capitalization of $2.81 billion, a PE ratio of 74.46 and a beta of 1.06. The firm's fifty day moving average is $33.66 and its 200 day moving average is $31.11. The company has a quick ratio of 1.00, a current ratio of 1.80 and a debt-to-equity ratio of 23.51.

Insider Transactions at Energizer

In other Energizer news, EVP Robin Vauth sold 1,978 shares of the business's stock in a transaction that occurred on Tuesday, November 19th. The stock was sold at an average price of $35.97, for a total transaction of $71,148.66. Following the sale, the executive vice president now directly owns 5,758 shares of the company's stock, valued at $207,115.26. The trade was a 25.57 % decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available through this link. Also, VP Sara B. Hampton sold 2,812 shares of the business's stock in a transaction that occurred on Friday, November 22nd. The stock was sold at an average price of $38.49, for a total value of $108,233.88. Following the sale, the vice president now directly owns 4,635 shares in the company, valued at $178,401.15. The trade was a 37.76 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last three months, insiders have sold 8,860 shares of company stock valued at $334,694. 0.77% of the stock is currently owned by insiders.

Institutional Inflows and Outflows

Several large investors have recently modified their holdings of the business. Clarkston Capital Partners LLC raised its stake in Energizer by 12.6% in the third quarter. Clarkston Capital Partners LLC now owns 4,775,177 shares of the company's stock worth $151,660,000 after buying an additional 533,831 shares in the last quarter. LSV Asset Management raised its stake in Energizer by 2.0% in the second quarter. LSV Asset Management now owns 1,606,488 shares of the company's stock worth $47,456,000 after buying an additional 31,900 shares in the last quarter. Bank of New York Mellon Corp raised its stake in Energizer by 1.6% in the second quarter. Bank of New York Mellon Corp now owns 1,003,767 shares of the company's stock worth $29,651,000 after buying an additional 15,982 shares in the last quarter. Charles Schwab Investment Management Inc. raised its stake in Energizer by 2.2% in the third quarter. Charles Schwab Investment Management Inc. now owns 931,571 shares of the company's stock worth $29,587,000 after buying an additional 19,836 shares in the last quarter. Finally, Dimensional Fund Advisors LP increased its position in shares of Energizer by 38.0% during the second quarter. Dimensional Fund Advisors LP now owns 872,606 shares of the company's stock worth $25,778,000 after purchasing an additional 240,402 shares in the last quarter. Hedge funds and other institutional investors own 93.74% of the company's stock.

Energizer Company Profile

(

Get Free Report)

Energizer Holdings, Inc, together with its subsidiaries, manufactures, markets, and distributes household batteries, specialty batteries, and lighting products worldwide. It offers lithium, alkaline, carbon zinc, nickel metal hydride, zinc air, and silver oxide batteries under the Energizer, Eveready, and Rayovac brands; primary, rechargeable, specialty, and hearing aid batteries; and handheld, headlights, lanterns, and area lights, as well as flashlights under the Hard Case, Dolphin, and WeatherReady brands.

Featured Articles

Before you consider Energizer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energizer wasn't on the list.

While Energizer currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Click the link below and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.