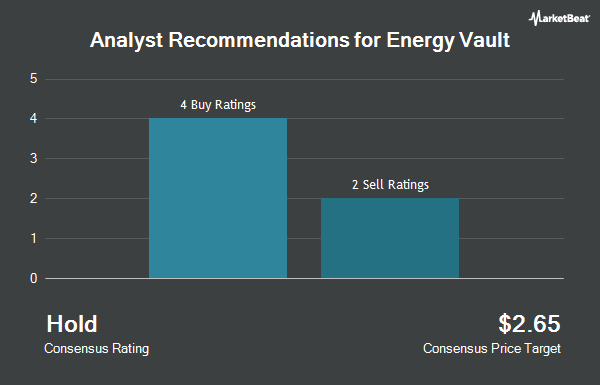

Energy Vault Holdings, Inc. (NYSE:NRGV - Get Free Report) has received an average rating of "Hold" from the six analysts that are currently covering the company, MarketBeat.com reports. Two equities research analysts have rated the stock with a sell recommendation and four have assigned a buy recommendation to the company. The average 12-month target price among brokerages that have issued a report on the stock in the last year is $1.95.

Separately, TD Cowen reiterated a "buy" rating and set a $2.50 price objective on shares of Energy Vault in a research report on Wednesday, November 13th.

Read Our Latest Stock Report on Energy Vault

Insider Activity

In other news, CEO Robert Piconi purchased 150,000 shares of the business's stock in a transaction on Friday, November 22nd. The shares were acquired at an average price of $1.57 per share, with a total value of $235,500.00. Following the acquisition, the chief executive officer now directly owns 17,623,361 shares in the company, valued at approximately $27,668,676.77. The trade was a 0.86 % increase in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is available at the SEC website. Insiders own 19.80% of the company's stock.

Institutional Trading of Energy Vault

Several institutional investors and hedge funds have recently bought and sold shares of the stock. Geode Capital Management LLC lifted its position in Energy Vault by 8.5% in the 3rd quarter. Geode Capital Management LLC now owns 2,273,042 shares of the company's stock valued at $2,182,000 after acquiring an additional 177,214 shares in the last quarter. State Street Corp lifted its holdings in shares of Energy Vault by 1.1% during the 3rd quarter. State Street Corp now owns 1,850,702 shares of the company's stock valued at $1,777,000 after buying an additional 20,915 shares during the period. Vanguard Group Inc. increased its position in shares of Energy Vault by 2.7% during the 1st quarter. Vanguard Group Inc. now owns 1,675,361 shares of the company's stock valued at $2,999,000 after purchasing an additional 43,764 shares during the last quarter. Bank of New York Mellon Corp grew its position in Energy Vault by 21.8% during the second quarter. Bank of New York Mellon Corp now owns 341,909 shares of the company's stock valued at $325,000 after buying an additional 61,135 shares during the period. Finally, XTX Topco Ltd increased its holdings in Energy Vault by 684.0% during the second quarter. XTX Topco Ltd now owns 173,016 shares of the company's stock valued at $164,000 after buying an additional 150,948 shares during the last quarter. 40.03% of the stock is currently owned by hedge funds and other institutional investors.

Energy Vault Stock Up 20.0 %

NYSE:NRGV traded up $0.33 during trading hours on Wednesday, hitting $1.98. 3,039,536 shares of the company's stock traded hands, compared to its average volume of 867,074. The firm has a market cap of $301.20 million, a P/E ratio of -2.85 and a beta of 0.49. The business's fifty day simple moving average is $1.60 and its two-hundred day simple moving average is $1.24. Energy Vault has a 52 week low of $0.78 and a 52 week high of $2.68.

Energy Vault (NYSE:NRGV - Get Free Report) last issued its quarterly earnings data on Tuesday, November 12th. The company reported ($0.18) EPS for the quarter, missing the consensus estimate of ($0.15) by ($0.03). Energy Vault had a negative return on equity of 47.41% and a negative net margin of 73.37%. The business had revenue of $1.20 million for the quarter, compared to analysts' expectations of $4.80 million. During the same period in the previous year, the firm posted ($0.13) EPS. On average, analysts expect that Energy Vault will post -0.64 EPS for the current year.

About Energy Vault

(

Get Free ReportEnergy Vault Holdings, Inc develops and sells energy storage solutions. The company offers B-Vault, an electrochemical battery energy storage systems for shorter-duration energy storage needs; G-Vault, a proprietary gravity energy storage solution, including EVx solution; and H-Vault, a hybrid energy storage systems including systems that integrate green hydrogen.

Further Reading

Before you consider Energy Vault, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Energy Vault wasn't on the list.

While Energy Vault currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.