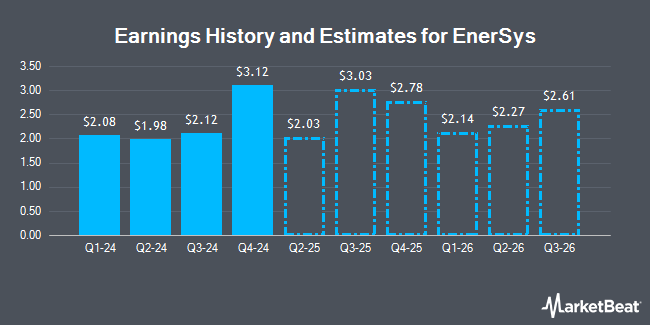

EnerSys (NYSE:ENS - Get Free Report) issued an update on its fourth quarter 2025 earnings guidance on Wednesday morning. The company provided earnings per share guidance of 2.750-2.850 for the period, compared to the consensus earnings per share estimate of 2.600. The company issued revenue guidance of $960.0 million-$1.0 billion, compared to the consensus revenue estimate of $1.0 billion.

EnerSys Trading Up 3.5 %

ENS stock traded up $3.42 during midday trading on Friday, hitting $99.88. The stock had a trading volume of 519,116 shares, compared to its average volume of 274,528. The business has a fifty day moving average price of $94.81 and a two-hundred day moving average price of $97.75. EnerSys has a 1-year low of $86.41 and a 1-year high of $112.53. The company has a current ratio of 3.06, a quick ratio of 1.87 and a debt-to-equity ratio of 0.69. The firm has a market cap of $3.94 billion, a P/E ratio of 12.36, a price-to-earnings-growth ratio of 0.55 and a beta of 1.22.

EnerSys (NYSE:ENS - Get Free Report) last posted its quarterly earnings data on Wednesday, February 5th. The industrial products company reported $3.12 EPS for the quarter, beating the consensus estimate of $2.27 by $0.85. EnerSys had a net margin of 9.23% and a return on equity of 20.78%. On average, sell-side analysts predict that EnerSys will post 9.78 earnings per share for the current fiscal year.

EnerSys Dividend Announcement

The firm also recently disclosed a quarterly dividend, which will be paid on Friday, March 28th. Shareholders of record on Friday, March 14th will be issued a $0.24 dividend. This represents a $0.96 annualized dividend and a yield of 0.96%. The ex-dividend date of this dividend is Friday, March 14th. EnerSys's dividend payout ratio (DPR) is currently 11.88%.

Analysts Set New Price Targets

A number of brokerages have recently commented on ENS. StockNews.com upgraded shares of EnerSys from a "buy" rating to a "strong-buy" rating in a research note on Friday, December 6th. Oppenheimer upgraded EnerSys from a "market perform" rating to an "outperform" rating and set a $115.00 target price on the stock in a research note on Friday, January 17th. One equities research analyst has rated the stock with a hold rating, two have assigned a buy rating and two have issued a strong buy rating to the stock. According to data from MarketBeat.com, EnerSys currently has a consensus rating of "Buy" and a consensus target price of $117.50.

Read Our Latest Report on ENS

Insider Activity

In other EnerSys news, CEO David M. Shaffer sold 20,000 shares of the business's stock in a transaction on Monday, November 25th. The stock was sold at an average price of $100.01, for a total value of $2,000,200.00. Following the completion of the transaction, the chief executive officer now directly owns 206,724 shares in the company, valued at approximately $20,674,467.24. The trade was a 8.82 % decrease in their position. The sale was disclosed in a legal filing with the SEC, which is accessible through this link. Company insiders own 1.61% of the company's stock.

EnerSys Company Profile

(

Get Free Report)

EnerSys engages in the provision of stored energy solutions for industrial applications worldwide. It operates in four segments: Energy Systems, Motive Power, Specialty, and New Ventures. The Energy Systems segment offers uninterruptible power systems (UPS) applications for computer and computer-controlled systems, as well as telecommunications systems; switchgear and electrical control systems used in industrial facilities and electric utilities, large-scale energy storage, and energy pipelines; integrated power solutions and services to broadband, telecom, data center, and renewable and industrial customers; and thermally managed cabinets and enclosures for electronic equipment and batteries.

See Also

Before you consider EnerSys, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EnerSys wasn't on the list.

While EnerSys currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.