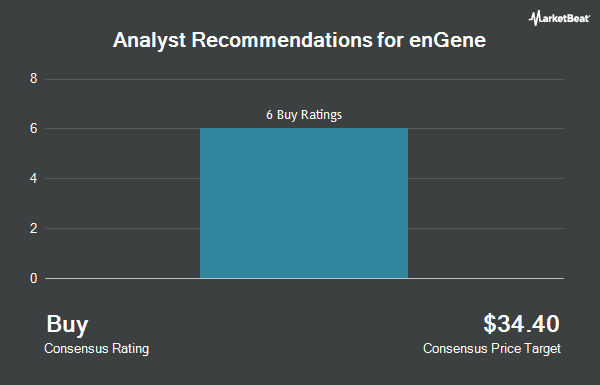

JMP Securities started coverage on shares of enGene (NASDAQ:ENGN - Free Report) in a research note published on Monday, Marketbeat.com reports. The firm issued an outperform rating and a $18.00 target price on the stock.

A number of other analysts have also recently weighed in on the stock. Oppenheimer reaffirmed an "outperform" rating and set a $30.00 price target on shares of enGene in a research report on Tuesday, September 24th. Morgan Stanley reaffirmed an "overweight" rating and set a $40.00 price objective on shares of enGene in a research report on Wednesday, September 11th. Eight analysts have rated the stock with a buy rating, According to MarketBeat.com, the company currently has an average rating of "Buy" and an average target price of $31.43.

Read Our Latest Report on ENGN

enGene Stock Up 0.4 %

ENGN traded up $0.03 on Monday, hitting $7.66. 27,585 shares of the company were exchanged, compared to its average volume of 111,495. The business's fifty day moving average is $7.66 and its 200 day moving average is $8.71. enGene has a fifty-two week low of $4.42 and a fifty-two week high of $18.40. The company has a current ratio of 19.52, a quick ratio of 19.52 and a debt-to-equity ratio of 0.09.

enGene (NASDAQ:ENGN - Get Free Report) last posted its quarterly earnings data on Tuesday, September 10th. The company reported ($0.32) EPS for the quarter, topping analysts' consensus estimates of ($0.37) by $0.05. Equities analysts forecast that enGene will post -1.54 EPS for the current fiscal year.

Insider Activity at enGene

In related news, CEO Ronald Harold Wilfred Cooper purchased 10,000 shares of the firm's stock in a transaction that occurred on Friday, September 27th. The shares were acquired at an average price of $5.70 per share, with a total value of $57,000.00. Following the purchase, the chief executive officer now directly owns 10,000 shares in the company, valued at $57,000. This represents a ∞ increase in their ownership of the stock. The purchase was disclosed in a legal filing with the SEC, which is available through the SEC website. Also, major shareholder Growth Opportunities F. Forbion acquired 11,844 shares of the firm's stock in a transaction on Monday, October 7th. The shares were purchased at an average cost of $6.55 per share, for a total transaction of $77,578.20. Following the completion of the purchase, the insider now directly owns 2,469,833 shares of the company's stock, valued at approximately $16,177,406.15. The trade was a 0.48 % increase in their position. The disclosure for this purchase can be found here. In the last three months, insiders have bought 420,965 shares of company stock worth $2,651,103. 13.70% of the stock is owned by insiders.

Institutional Inflows and Outflows

Several large investors have recently bought and sold shares of the company. Altitude Crest Partners Inc. bought a new position in enGene during the first quarter worth about $2,039,000. Janus Henderson Group PLC acquired a new stake in shares of enGene in the 1st quarter valued at approximately $17,095,000. SR One Capital Management LP acquired a new position in enGene during the second quarter worth approximately $4,715,000. Logos Global Management LP raised its holdings in enGene by 50.0% in the 2nd quarter. Logos Global Management LP now owns 1,200,000 shares of the company's stock valued at $11,316,000 after acquiring an additional 400,000 shares during the period. Finally, Wolverine Asset Management LLC acquired a new stake in enGene in the 3rd quarter worth about $37,000. Institutional investors and hedge funds own 64.16% of the company's stock.

About enGene

(

Get Free Report)

enGene Holdings Inc, through its subsidiary enGene, Inc, operates as a clinical-stage biotechnology company that develops genetic medicines through the delivery of therapeutics to mucosal tissues and other organs. Its lead product candidate is EG-70 (detalimogene voraplasmid), which is a non-viral immunotherapy to treat non-muscle invasive bladder cancer patients with carcinoma-in-situ (Cis), who are unresponsive to treatment with Bacillus Calmette-Guérin.

Read More

Before you consider enGene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and enGene wasn't on the list.

While enGene currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for November 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.