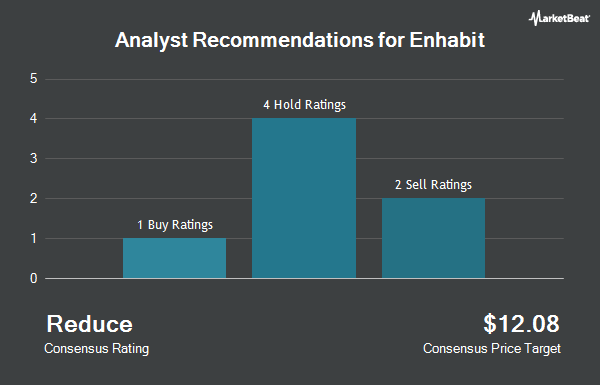

Shares of Enhabit, Inc. (NYSE:EHAB - Get Free Report) have earned a consensus rating of "Hold" from the six ratings firms that are presently covering the company, MarketBeat Ratings reports. One research analyst has rated the stock with a sell recommendation, four have given a hold recommendation and one has given a buy recommendation to the company. The average 12-month target price among brokers that have updated their coverage on the stock in the last year is $8.75.

EHAB has been the topic of several recent analyst reports. Jefferies Financial Group upgraded Enhabit from a "hold" rating to a "buy" rating and increased their target price for the company from $8.25 to $9.50 in a research note on Monday, December 9th. Leerink Partners reiterated a "market perform" rating and issued a $8.00 price objective (down from $8.50) on shares of Enhabit in a report on Tuesday, November 19th.

View Our Latest Analysis on Enhabit

Enhabit Price Performance

Enhabit stock remained flat at $8.52 during mid-day trading on Friday. 207,556 shares of the company were exchanged, compared to its average volume of 571,605. Enhabit has a 52 week low of $6.85 and a 52 week high of $11.74. The company's 50 day moving average price is $7.56 and its 200-day moving average price is $8.31. The firm has a market cap of $428.42 million, a P/E ratio of -3.67 and a beta of 1.89. The company has a debt-to-equity ratio of 0.85, a current ratio of 1.46 and a quick ratio of 1.46.

Enhabit (NYSE:EHAB - Get Free Report) last issued its earnings results on Wednesday, November 6th. The company reported $0.03 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.04 by ($0.01). The firm had revenue of $253.60 million during the quarter, compared to the consensus estimate of $261.69 million. Enhabit had a positive return on equity of 1.67% and a negative net margin of 11.24%. During the same quarter in the prior year, the company posted $0.03 EPS. On average, equities research analysts anticipate that Enhabit will post 0.22 earnings per share for the current fiscal year.

Insider Buying and Selling at Enhabit

In other Enhabit news, Director Jeffrey Bolton acquired 4,000 shares of the stock in a transaction dated Thursday, December 12th. The shares were purchased at an average price of $8.69 per share, for a total transaction of $34,760.00. Following the purchase, the director now directly owns 98,144 shares of the company's stock, valued at approximately $852,871.36. This trade represents a 4.25 % increase in their ownership of the stock. The acquisition was disclosed in a filing with the SEC, which is accessible through this link. Also, Director Stuart M. Mcguigan bought 15,000 shares of the business's stock in a transaction that occurred on Tuesday, December 10th. The shares were acquired at an average price of $8.81 per share, with a total value of $132,150.00. Following the completion of the transaction, the director now directly owns 46,810 shares of the company's stock, valued at $412,396.10. This trade represents a 47.15 % increase in their position. The disclosure for this purchase can be found here. Company insiders own 1.90% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently added to or reduced their stakes in the business. Franklin Resources Inc. increased its position in Enhabit by 19.6% in the third quarter. Franklin Resources Inc. now owns 32,382 shares of the company's stock worth $256,000 after buying an additional 5,317 shares in the last quarter. Geode Capital Management LLC increased its holdings in Enhabit by 0.9% in the 3rd quarter. Geode Capital Management LLC now owns 1,137,458 shares of the company's stock worth $8,987,000 after acquiring an additional 10,538 shares in the last quarter. Y Intercept Hong Kong Ltd purchased a new stake in Enhabit in the 3rd quarter worth approximately $450,000. XTX Topco Ltd bought a new stake in Enhabit during the 3rd quarter worth approximately $123,000. Finally, Zacks Investment Management purchased a new position in Enhabit during the third quarter valued at approximately $107,000.

Enhabit Company Profile

(

Get Free ReportEnhabit, Inc provides home health and hospice services in the United States. Its home health services include patient education, pain management, wound care and dressing changes, cardiac rehabilitation, infusion therapy, pharmaceutical administration, and skilled observation and assessment services; practices to treat chronic diseases and conditions, including diabetes, hypertension, arthritis, Alzheimer's disease, low vision, spinal stenosis, Parkinson's disease, osteoporosis, complex wound care and chronic pain, along with disease-specific plans for patients with diabetes, congestive heart failure, post-orthopedic surgery, or injury and respiratory diseases; and physical, occupational and speech therapists provide therapy services.

See Also

Before you consider Enhabit, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enhabit wasn't on the list.

While Enhabit currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.