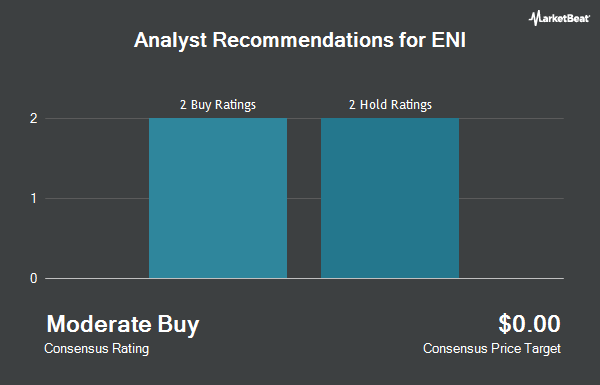

ENI (NYSE:E - Get Free Report) was downgraded by stock analysts at StockNews.com from a "buy" rating to a "hold" rating in a research note issued to investors on Tuesday.

A number of other research firms also recently weighed in on E. Morgan Stanley restated an "equal weight" rating and issued a $31.60 price target (down from $37.50) on shares of ENI in a research note on Tuesday, January 7th. UBS Group downgraded shares of ENI from a "buy" rating to a "neutral" rating in a report on Wednesday, January 8th. Seven equities research analysts have rated the stock with a hold rating and three have given a buy rating to the company's stock. Based on data from MarketBeat, ENI currently has an average rating of "Hold" and an average target price of $31.60.

View Our Latest Report on ENI

ENI Stock Performance

NYSE E traded down $0.31 on Tuesday, reaching $28.90. The stock had a trading volume of 366,036 shares, compared to its average volume of 270,111. The company has a debt-to-equity ratio of 0.41, a quick ratio of 1.07 and a current ratio of 1.27. The stock has a market cap of $48.78 billion, a P/E ratio of 17.31, a price-to-earnings-growth ratio of 1.86 and a beta of 0.92. ENI has a 12-month low of $26.12 and a 12-month high of $33.78. The business's 50-day moving average price is $28.36 and its 200 day moving average price is $29.64.

Hedge Funds Weigh In On ENI

Several institutional investors and hedge funds have recently modified their holdings of E. Creative Planning increased its position in ENI by 21.5% during the third quarter. Creative Planning now owns 56,929 shares of the oil and gas exploration company's stock worth $1,726,000 after purchasing an additional 10,084 shares during the last quarter. Allspring Global Investments Holdings LLC raised its holdings in ENI by 38.9% in the third quarter. Allspring Global Investments Holdings LLC now owns 7,697 shares of the oil and gas exploration company's stock valued at $233,000 after buying an additional 2,155 shares during the period. Private Advisor Group LLC lifted its position in ENI by 14.8% during the third quarter. Private Advisor Group LLC now owns 16,023 shares of the oil and gas exploration company's stock valued at $486,000 after buying an additional 2,065 shares in the last quarter. Wealth Enhancement Advisory Services LLC purchased a new stake in ENI during the third quarter worth approximately $212,000. Finally, First Trust Direct Indexing L.P. increased its position in shares of ENI by 2.8% in the third quarter. First Trust Direct Indexing L.P. now owns 33,473 shares of the oil and gas exploration company's stock worth $1,015,000 after acquiring an additional 917 shares in the last quarter. Hedge funds and other institutional investors own 1.18% of the company's stock.

About ENI

(

Get Free Report)

Eni SpA engages in the exploration, production, refining, and sale of oil, gas, electricity, and chemicals. It operates through the following segments: Exploration and Production, Global Gas and LNG Portfolio, Refining & Marketing and Chemicals, Power & Renewables, and Corporate and Other Activities.

Read More

Before you consider ENI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ENI wasn't on the list.

While ENI currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.