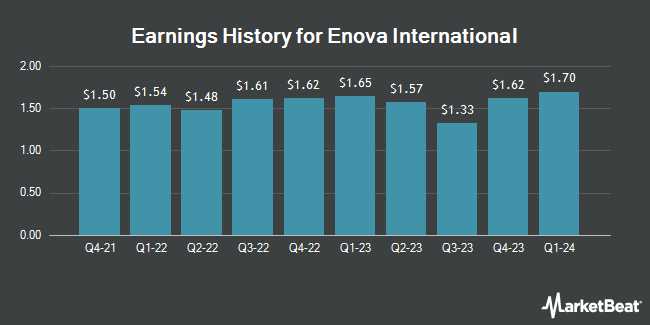

Enova International (NYSE:ENVA - Get Free Report) will likely be releasing its earnings data after the market closes on Tuesday, February 4th. Analysts expect Enova International to post earnings of $2.29 per share and revenue of $731.05 million for the quarter. Individual interested in listening to the company's earnings conference call can do so using this link.

Enova International Stock Performance

Enova International stock traded up $3.04 during midday trading on Tuesday, reaching $112.80. 238,024 shares of the company traded hands, compared to its average volume of 191,978. The company has a debt-to-equity ratio of 2.79, a current ratio of 15.82 and a quick ratio of 15.82. Enova International has a 12 month low of $53.17 and a 12 month high of $113.29. The firm has a market capitalization of $2.96 billion, a price-to-earnings ratio of 17.99 and a beta of 1.48. The business has a 50 day moving average of $102.19 and a two-hundred day moving average of $90.21.

Insider Buying and Selling at Enova International

In other news, CFO Steven E. Cunningham sold 2,455 shares of the company's stock in a transaction that occurred on Wednesday, October 30th. The stock was sold at an average price of $89.75, for a total transaction of $220,336.25. Following the sale, the chief financial officer now directly owns 127,900 shares of the company's stock, valued at $11,479,025. This represents a 1.88 % decrease in their position. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available at the SEC website. Also, CEO David Fisher sold 13,314 shares of the firm's stock in a transaction on Wednesday, November 6th. The shares were sold at an average price of $101.74, for a total transaction of $1,354,566.36. Following the completion of the transaction, the chief executive officer now directly owns 399,925 shares of the company's stock, valued at approximately $40,688,369.50. This trade represents a 3.22 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 35,769 shares of company stock valued at $3,685,503 in the last 90 days. Insiders own 7.80% of the company's stock.

Analyst Upgrades and Downgrades

A number of research analysts have weighed in on ENVA shares. StockNews.com raised Enova International from a "hold" rating to a "buy" rating in a report on Monday, October 21st. BTIG Research increased their price objective on shares of Enova International from $90.00 to $110.00 and gave the stock a "buy" rating in a research note on Wednesday, October 23rd. JMP Securities increased their price target on shares of Enova International from $103.00 to $109.00 and gave the stock a "market outperform" rating in a research report on Wednesday, October 23rd. TD Cowen lifted their price target on shares of Enova International from $85.00 to $96.00 and gave the stock a "hold" rating in a research note on Wednesday, October 23rd. Finally, Stephens assumed coverage on Enova International in a research note on Wednesday, November 13th. They issued an "overweight" rating and a $108.00 price objective for the company. Three investment analysts have rated the stock with a hold rating and six have given a buy rating to the stock. Based on data from MarketBeat.com, Enova International has a consensus rating of "Moderate Buy" and an average target price of $91.14.

Get Our Latest Research Report on ENVA

Enova International Company Profile

(

Get Free Report)

Enova International, Inc, a technology and analytics company, provides online financial services in the United States, Brazil, and internationally. The company provides installment loans; line of credit accounts; CSO programs, including arranging loans with independent third-party lenders and assisting in the preparation of loan applications and loan documents; and bank programs, such as marketing services and loan servicing for near-prime unsecured consumer installment loan.

Featured Articles

Before you consider Enova International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enova International wasn't on the list.

While Enova International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.