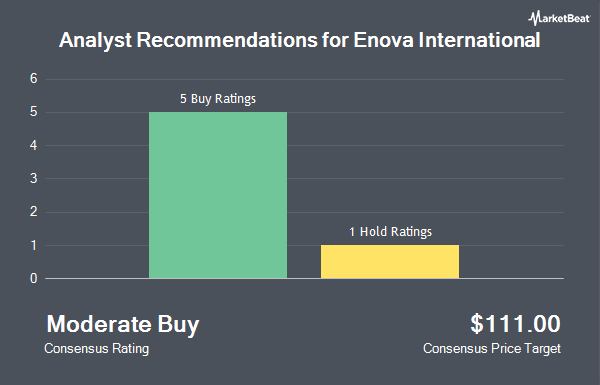

Shares of Enova International, Inc. (NYSE:ENVA - Get Free Report) have received an average rating of "Moderate Buy" from the eight research firms that are presently covering the stock, MarketBeat Ratings reports. Three analysts have rated the stock with a hold rating and five have given a buy rating to the company. The average twelve-month target price among analysts that have covered the stock in the last year is $91.14.

ENVA has been the subject of a number of recent analyst reports. TD Cowen upped their price objective on shares of Enova International from $85.00 to $96.00 and gave the stock a "hold" rating in a research report on Wednesday, October 23rd. StockNews.com raised Enova International from a "hold" rating to a "buy" rating in a research report on Monday, October 21st. BTIG Research lifted their price target on Enova International from $90.00 to $110.00 and gave the stock a "buy" rating in a report on Wednesday, October 23rd. Stephens began coverage on Enova International in a research report on Wednesday, November 13th. They set an "overweight" rating and a $108.00 target price for the company. Finally, Janney Montgomery Scott cut Enova International from a "buy" rating to a "neutral" rating in a research note on Monday, August 26th.

View Our Latest Analysis on Enova International

Insider Activity at Enova International

In related news, CEO David Fisher sold 10,000 shares of the business's stock in a transaction on Tuesday, December 3rd. The stock was sold at an average price of $105.59, for a total transaction of $1,055,900.00. Following the sale, the chief executive officer now directly owns 369,905 shares in the company, valued at approximately $39,058,268.95. The trade was a 2.63 % decrease in their position. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CAO James Joseph Lee sold 615 shares of the firm's stock in a transaction dated Friday, October 25th. The stock was sold at an average price of $89.59, for a total value of $55,097.85. Following the completion of the transaction, the chief accounting officer now owns 20,646 shares of the company's stock, valued at approximately $1,849,675.14. This represents a 2.89 % decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders have sold 90,843 shares of company stock worth $8,552,679. Company insiders own 7.80% of the company's stock.

Institutional Investors Weigh In On Enova International

Institutional investors and hedge funds have recently modified their holdings of the company. Livforsakringsbolaget Skandia Omsesidigt grew its position in Enova International by 1.0% during the third quarter. Livforsakringsbolaget Skandia Omsesidigt now owns 20,250 shares of the credit services provider's stock worth $1,694,000 after buying an additional 200 shares in the last quarter. GAMMA Investing LLC grew its holdings in shares of Enova International by 24.6% during the third quarter. GAMMA Investing LLC now owns 1,065 shares of the credit services provider's stock worth $89,000 after purchasing an additional 210 shares in the last quarter. USA Financial Formulas bought a new position in shares of Enova International in the third quarter worth approximately $76,000. Quantbot Technologies LP raised its stake in Enova International by 10.2% in the third quarter. Quantbot Technologies LP now owns 14,182 shares of the credit services provider's stock valued at $1,188,000 after purchasing an additional 1,311 shares in the last quarter. Finally, Foundry Partners LLC lifted its position in Enova International by 1.1% during the third quarter. Foundry Partners LLC now owns 122,756 shares of the credit services provider's stock valued at $10,286,000 after purchasing an additional 1,328 shares during the last quarter. 89.43% of the stock is owned by hedge funds and other institutional investors.

Enova International Stock Down 2.2 %

Shares of ENVA stock traded down $2.24 during trading hours on Friday, reaching $100.94. The company had a trading volume of 225,165 shares, compared to its average volume of 228,564. The company has a market cap of $2.65 billion, a price-to-earnings ratio of 16.10 and a beta of 1.46. The company has a debt-to-equity ratio of 2.79, a current ratio of 15.82 and a quick ratio of 15.82. Enova International has a 12 month low of $52.77 and a 12 month high of $108.15. The business has a fifty day simple moving average of $96.08 and a 200-day simple moving average of $81.25.

Enova International (NYSE:ENVA - Get Free Report) last issued its quarterly earnings data on Tuesday, October 22nd. The credit services provider reported $2.45 earnings per share for the quarter, beating the consensus estimate of $2.31 by $0.14. Enova International had a return on equity of 18.41% and a net margin of 7.19%. The business had revenue of $689.92 million for the quarter, compared to analysts' expectations of $666.33 million. During the same period last year, the business earned $1.33 EPS. The business's revenue was up 25.1% on a year-over-year basis. On average, research analysts expect that Enova International will post 7.99 earnings per share for the current fiscal year.

About Enova International

(

Get Free ReportEnova International, Inc, a technology and analytics company, provides online financial services in the United States, Brazil, and internationally. The company provides installment loans; line of credit accounts; CSO programs, including arranging loans with independent third-party lenders and assisting in the preparation of loan applications and loan documents; and bank programs, such as marketing services and loan servicing for near-prime unsecured consumer installment loan.

Further Reading

Before you consider Enova International, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enova International wasn't on the list.

While Enova International currently has a "Moderate Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for December 2024. Learn which stocks have the most short interest and how to trade them. Click the link below to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.