Enovix (NASDAQ:ENVX - Get Free Report) is anticipated to announce its Q4 2024 earnings results after the market closes on Wednesday, February 19th. Analysts expect the company to announce earnings of ($0.18) per share and revenue of $8.77 million for the quarter. Enovix has set its Q1 2025 guidance at -0.210--0.150 EPS.Parties that wish to register for the company's conference call can do so using this link.

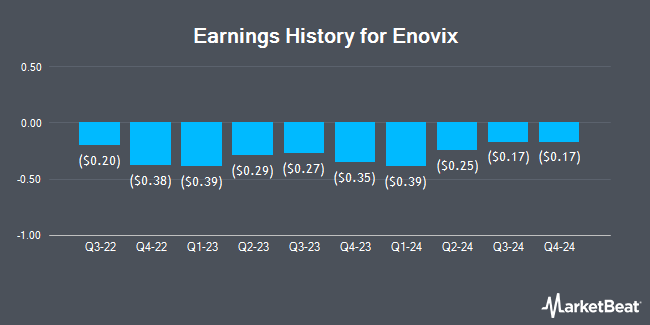

Enovix (NASDAQ:ENVX - Get Free Report) last issued its quarterly earnings data on Wednesday, February 19th. The company reported ($0.17) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.18) by $0.01. Enovix had a negative net margin of 1,180.21% and a negative return on equity of 102.19%. The company had revenue of $9.72 million for the quarter, compared to the consensus estimate of $8.77 million. On average, analysts expect Enovix to post $-1 EPS for the current fiscal year and $-1 EPS for the next fiscal year.

Enovix Stock Performance

Shares of NASDAQ:ENVX traded up $0.28 on Thursday, reaching $11.47. The company's stock had a trading volume of 10,618,860 shares, compared to its average volume of 7,059,146. Enovix has a 52-week low of $5.70 and a 52-week high of $18.68. The stock has a market capitalization of $2.04 billion, a P/E ratio of -7.12 and a beta of 1.87. The stock's 50-day moving average is $11.06 and its two-hundred day moving average is $10.29. The company has a debt-to-equity ratio of 0.99, a current ratio of 3.77 and a quick ratio of 3.61.

Wall Street Analysts Forecast Growth

ENVX has been the subject of several analyst reports. Cantor Fitzgerald reaffirmed an "overweight" rating and set a $30.00 price objective on shares of Enovix in a research note on Thursday. Benchmark restated a "buy" rating and set a $25.00 price target on shares of Enovix in a research note on Wednesday, October 30th. Craig Hallum lowered their price objective on shares of Enovix from $20.00 to $18.00 and set a "buy" rating on the stock in a research report on Thursday. Finally, Janney Montgomery Scott downgraded shares of Enovix from a "buy" rating to a "neutral" rating and set a $10.00 price objective for the company. in a research report on Thursday, October 31st. Two investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company's stock. Based on data from MarketBeat.com, Enovix presently has an average rating of "Moderate Buy" and a consensus price target of $20.30.

Check Out Our Latest Research Report on Enovix

Insiders Place Their Bets

In related news, Director Betsy S. Atkins sold 75,000 shares of Enovix stock in a transaction that occurred on Tuesday, December 3rd. The stock was sold at an average price of $9.73, for a total transaction of $729,750.00. Following the completion of the transaction, the director now directly owns 99,497 shares in the company, valued at $968,105.81. The trade was a 42.98 % decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. 15.70% of the stock is currently owned by company insiders.

About Enovix

(

Get Free Report)

Enovix Corporation designs, develops, and manufactures lithium-ion batteries. It serves wearables and IoT, smartphone, laptops and tablets, industrial and medical, and electric vehicles industries. The company was founded in 2007 and is headquartered in Fremont, California.

Recommended Stories

Before you consider Enovix, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enovix wasn't on the list.

While Enovix currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.