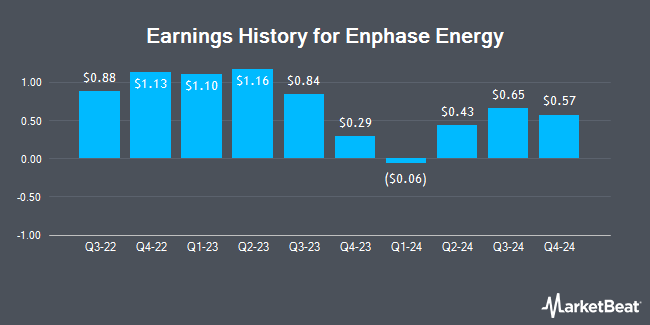

Enphase Energy (NASDAQ:ENPH - Get Free Report) issued its earnings results on Tuesday. The semiconductor company reported $0.29 EPS for the quarter, missing the consensus estimate of $0.70 by ($0.41), Zacks reports. Enphase Energy had a return on equity of 15.62% and a net margin of 7.72%.

Enphase Energy Stock Up 3.5 %

Shares of Enphase Energy stock traded up $1.81 during midday trading on Tuesday, hitting $53.43. The company had a trading volume of 5,910,755 shares, compared to its average volume of 4,068,085. Enphase Energy has a 52-week low of $47.48 and a 52-week high of $141.63. The company has a 50 day moving average of $59.14 and a 200 day moving average of $68.36. The stock has a market capitalization of $7.08 billion, a P/E ratio of 72.20 and a beta of 1.94. The company has a debt-to-equity ratio of 1.44, a quick ratio of 3.28 and a current ratio of 3.53.

Insider Buying and Selling

In related news, Director Thurman J. Rodgers sold 100,000 shares of the stock in a transaction dated Friday, March 7th. The stock was sold at an average price of $61.26, for a total transaction of $6,126,000.00. Following the completion of the sale, the director now owns 1,881,760 shares in the company, valued at approximately $115,276,617.60. This trade represents a 5.05 % decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, CFO Mandy Yang sold 1,319 shares of Enphase Energy stock in a transaction on Monday, March 10th. The shares were sold at an average price of $63.32, for a total transaction of $83,519.08. Following the completion of the sale, the chief financial officer now owns 78,524 shares in the company, valued at approximately $4,972,139.68. This represents a 1.65 % decrease in their ownership of the stock. The disclosure for this sale can be found here. 3.10% of the stock is owned by company insiders.

Analyst Upgrades and Downgrades

Several research firms have commented on ENPH. Truist Financial reiterated a "hold" rating and issued a $65.00 target price (down from $100.00) on shares of Enphase Energy in a research report on Thursday, January 16th. Barclays cut their target price on Enphase Energy from $86.00 to $58.00 and set an "overweight" rating on the stock in a research report on Wednesday, April 16th. Canaccord Genuity Group upgraded shares of Enphase Energy from a "hold" rating to a "buy" rating and upped their price objective for the company from $76.00 to $82.00 in a report on Wednesday, February 5th. Piper Sandler cut their target price on Enphase Energy from $65.00 to $47.00 and set a "neutral" rating on the stock in a report on Thursday, April 17th. Finally, JPMorgan Chase & Co. cut their price target on Enphase Energy from $112.00 to $91.00 and set an "overweight" rating for the company in a research note on Thursday, January 23rd. Four investment analysts have rated the stock with a sell rating, fifteen have given a hold rating and fourteen have assigned a buy rating to the company. Based on data from MarketBeat.com, Enphase Energy has a consensus rating of "Hold" and an average price target of $82.23.

Read Our Latest Stock Analysis on ENPH

Enphase Energy Company Profile

(

Get Free Report)

Enphase Energy, Inc, together with its subsidiaries, designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. The company offers semiconductor-based microinverter, which converts energy at the individual solar module level and combines with its proprietary networking and software technologies to provide energy monitoring and control.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Enphase Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enphase Energy wasn't on the list.

While Enphase Energy currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.