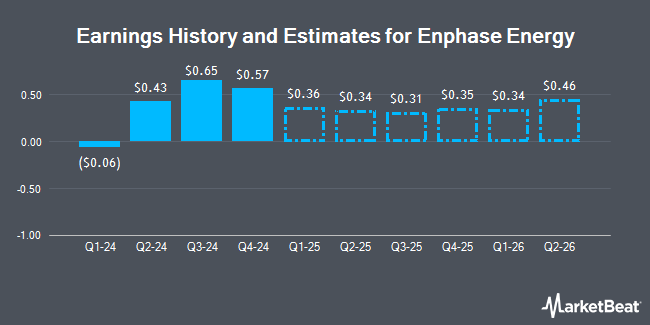

Enphase Energy, Inc. (NASDAQ:ENPH - Free Report) - Equities research analysts at Zacks Research lifted their Q3 2026 earnings estimates for shares of Enphase Energy in a research report issued to clients and investors on Tuesday, December 10th. Zacks Research analyst R. Department now anticipates that the semiconductor company will post earnings per share of $1.16 for the quarter, up from their prior forecast of $1.14. The consensus estimate for Enphase Energy's current full-year earnings is $0.94 per share. Zacks Research also issued estimates for Enphase Energy's FY2026 earnings at $3.13 EPS.

Enphase Energy (NASDAQ:ENPH - Get Free Report) last posted its earnings results on Tuesday, October 22nd. The semiconductor company reported $0.65 earnings per share for the quarter, missing the consensus estimate of $0.77 by ($0.12). The company had revenue of $380.90 million for the quarter, compared to analysts' expectations of $392.51 million. Enphase Energy had a net margin of 4.91% and a return on equity of 10.56%. The business's revenue was down 30.9% on a year-over-year basis. During the same period in the previous year, the business posted $0.84 earnings per share.

Several other brokerages have also recently issued reports on ENPH. Oppenheimer decreased their price objective on Enphase Energy from $134.00 to $101.00 and set an "outperform" rating on the stock in a report on Wednesday, October 23rd. BMO Capital Markets decreased their price target on shares of Enphase Energy from $114.00 to $104.00 and set a "market perform" rating on the stock in a research note on Monday, October 14th. Bank of America lowered their price objective on shares of Enphase Energy from $72.00 to $62.00 and set an "underperform" rating for the company in a research report on Thursday, November 7th. Morgan Stanley reduced their target price on shares of Enphase Energy from $93.00 to $74.00 and set an "equal weight" rating on the stock in a report on Friday, November 15th. Finally, TD Cowen decreased their target price on shares of Enphase Energy from $130.00 to $120.00 and set a "buy" rating on the stock in a research report on Wednesday, October 23rd. Four investment analysts have rated the stock with a sell rating, sixteen have issued a hold rating and fourteen have assigned a buy rating to the stock. According to data from MarketBeat.com, Enphase Energy presently has an average rating of "Hold" and a consensus target price of $101.13.

Get Our Latest Stock Report on Enphase Energy

Enphase Energy Price Performance

Shares of Enphase Energy stock traded down $1.23 during trading on Thursday, reaching $73.00. 1,987,031 shares of the stock traded hands, compared to its average volume of 4,032,737. The company has a debt-to-equity ratio of 1.29, a current ratio of 4.16 and a quick ratio of 3.88. The company has a market capitalization of $9.86 billion, a price-to-earnings ratio of 168.70, a P/E/G ratio of 21.24 and a beta of 1.69. Enphase Energy has a 52-week low of $58.33 and a 52-week high of $141.63. The business has a fifty day simple moving average of $80.07 and a two-hundred day simple moving average of $102.25.

Hedge Funds Weigh In On Enphase Energy

Several institutional investors have recently made changes to their positions in ENPH. Benjamin Edwards Inc. lifted its holdings in Enphase Energy by 2.8% during the second quarter. Benjamin Edwards Inc. now owns 3,361 shares of the semiconductor company's stock worth $335,000 after buying an additional 93 shares during the period. Oregon Public Employees Retirement Fund lifted its stake in shares of Enphase Energy by 0.9% during the 2nd quarter. Oregon Public Employees Retirement Fund now owns 11,681 shares of the semiconductor company's stock worth $1,165,000 after purchasing an additional 100 shares during the last quarter. Green Alpha Advisors LLC boosted its position in Enphase Energy by 1.4% during the third quarter. Green Alpha Advisors LLC now owns 7,148 shares of the semiconductor company's stock valued at $808,000 after purchasing an additional 102 shares in the last quarter. Crossmark Global Holdings Inc. grew its stake in Enphase Energy by 1.9% in the second quarter. Crossmark Global Holdings Inc. now owns 5,591 shares of the semiconductor company's stock valued at $557,000 after purchasing an additional 106 shares during the last quarter. Finally, Centaurus Financial Inc. raised its holdings in Enphase Energy by 10.2% in the second quarter. Centaurus Financial Inc. now owns 1,280 shares of the semiconductor company's stock worth $128,000 after purchasing an additional 118 shares in the last quarter. Hedge funds and other institutional investors own 72.12% of the company's stock.

Enphase Energy Company Profile

(

Get Free Report)

Enphase Energy, Inc, together with its subsidiaries, designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally. The company offers semiconductor-based microinverter, which converts energy at the individual solar module level and combines with its proprietary networking and software technologies to provide energy monitoring and control.

Recommended Stories

Before you consider Enphase Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enphase Energy wasn't on the list.

While Enphase Energy currently has a "Hold" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to avoid the hassle of mudslinging, volatility, and uncertainty? You'd need to be out of the market, which isn’t viable. So where should investors put their money? Find out with this report.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.