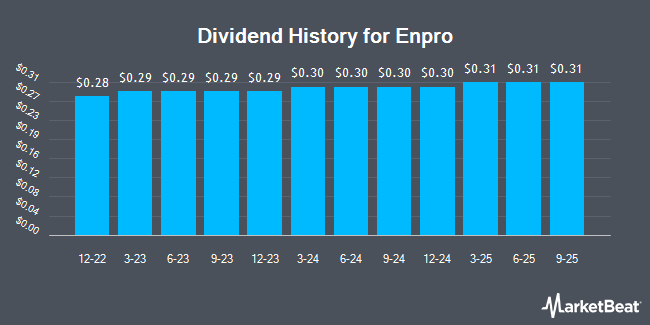

Enpro Inc. (NYSE:NPO - Get Free Report) declared a quarterly dividend on Thursday, February 13th,RTT News reports. Investors of record on Wednesday, March 5th will be given a dividend of 0.31 per share by the industrial products company on Wednesday, March 19th. This represents a $1.24 dividend on an annualized basis and a dividend yield of 0.64%. The ex-dividend date of this dividend is Wednesday, March 5th. This is a boost from Enpro's previous quarterly dividend of $0.30.

Enpro has raised its dividend payment by an average of 3.6% per year over the last three years. Enpro has a payout ratio of 14.4% indicating that its dividend is sufficiently covered by earnings. Analysts expect Enpro to earn $7.42 per share next year, which means the company should continue to be able to cover its $1.24 annual dividend with an expected future payout ratio of 16.7%.

Enpro Trading Up 1.2 %

Shares of Enpro stock traded up $2.30 during midday trading on Monday, reaching $192.73. The company had a trading volume of 67,805 shares, compared to its average volume of 94,570. The stock has a fifty day moving average price of $178.85 and a 200 day moving average price of $167.06. The company has a debt-to-equity ratio of 0.43, a current ratio of 2.76 and a quick ratio of 2.00. The firm has a market cap of $4.05 billion, a PE ratio of 74.99 and a beta of 1.49. Enpro has a fifty-two week low of $136.68 and a fifty-two week high of $197.94.

Analyst Upgrades and Downgrades

A number of research firms recently commented on NPO. StockNews.com lowered Enpro from a "buy" rating to a "hold" rating in a research note on Wednesday, December 18th. KeyCorp lifted their price objective on Enpro from $180.00 to $220.00 and gave the stock an "overweight" rating in a research note on Thursday, December 12th. Finally, Oppenheimer lifted their price objective on Enpro from $170.00 to $215.00 and gave the stock an "outperform" rating in a research note on Monday, December 16th.

Check Out Our Latest Stock Report on Enpro

About Enpro

(

Get Free Report)

Enpro Inc design, develops, manufactures, and markets proprietary, value-added products and solutions to safeguard critical environments in the United States, Europe, and internationally. It operates through two segments, Sealing Technologies and Advanced Surface Technologies. The Sealing Technologies segment offers single-use hygienic seals, tubing, components and assemblies; metallic, non-metallic, and composite material gaskets; dynamic seals; compression packing; hydraulic components; expansion joints; and wall penetration products for chemical and petrochemical processing, pulp and paper processing, nuclear energy, hydrogen, natural gas, food and biopharmaceutical processing, primary metal manufacturing, mining, water and waste treatment, commercial vehicle, aerospace, medical, filtration, and semiconductor fabrication industries.

Further Reading

Before you consider Enpro, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enpro wasn't on the list.

While Enpro currently has a "Buy" rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.